Don't waste time applying to lenders one-by-one who may not accept your application!

As a business owner, we know that time is tight. If you’re worried about not being able to meet an upcoming payment due to tight cashflow, you won’t want to be spending precious hours trailing business loan sites.

With so many options, it can be daunting and difficult to know where to start, or even what type of loan will be the best fit for you.

Say you land that big client you’ve been chasing. But, you don’t have the resources to hire enough staff to deliver the project because you're waiting for payment from your last customer. Are you confident you could deliver your best work?

Maybe it’s your business’s busy season, but you don’t have enough stock to fulfil the volume of orders coming in. Could you still make your numbers missing periods of demand like this?

Perhaps you use a fleet of vehicles, or rely on machinery, but your older assets are costing you time and money through running inefficiently. Wouldn’t it be better in the long run to update the tools you rely on day in and day out, rather than just making it work?

If any of this sounds familiar, it could be time to know what your business loan options are. Search over 100+ UK lenders in minutes to quickly match with affordable finance without affecting your credit score. Get a business loan to help your company grow, or be protected from cashflow risks:

Finding the right type of business funding is essential, so that you can have peace of mind that you have the most suitable and affordable business loan. We work with over 100 traditional banks and alternative lenders to offer a range of products that all help a specific need.

With Capitalise for Business, you can speak to one of our specialists to find out your options and what could be the best fit.

With extra funds, you could help your business to:

Let us know what your business does and why exactly you need the funds

Let us know what your business does and why exactly you need the funds

Our specialists will narrow down which lenders and what product suits your needs

Our specialists will narrow down which lenders and what product suits your needs

A clear purpose for the business loan also helps to show the lender that you have a plan.

A clear purpose for the business loan also helps to show the lender that you have a plan.

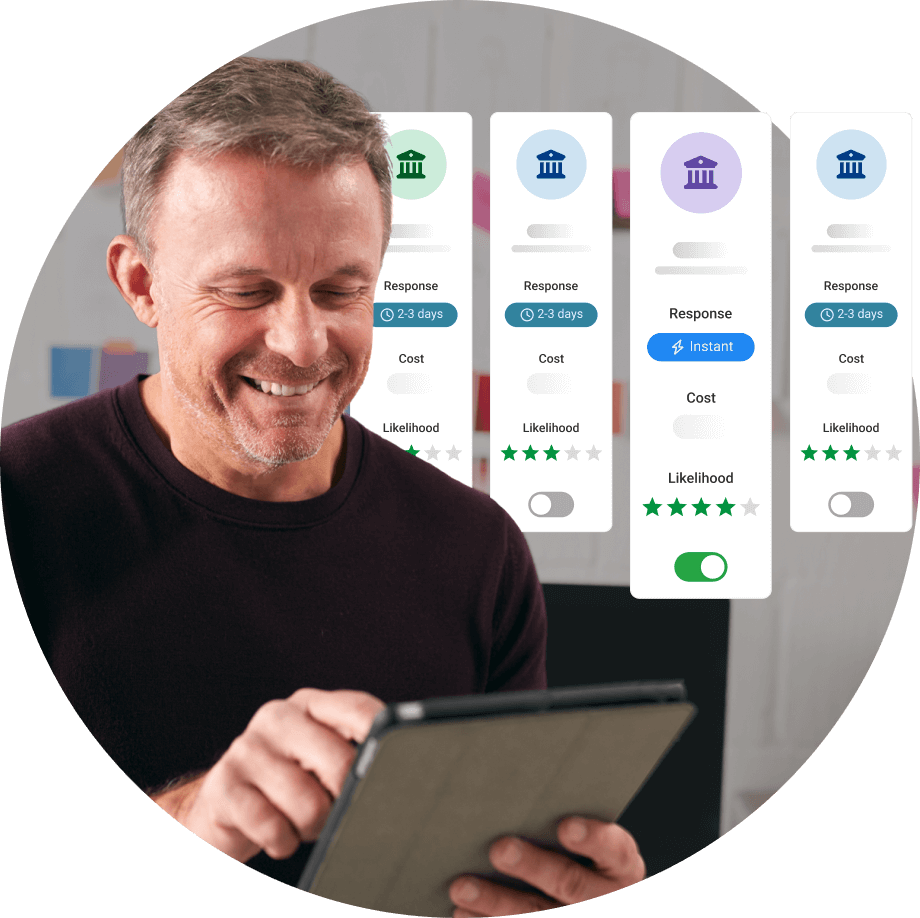

Find your funding match from our pool of over 100 lenders

Find your funding match from our pool of over 100 lenders

A funding specialist will talk you through which lenders will suit your business needs.

A funding specialist will talk you through which lenders will suit your business needs.

Save time and ensure your business doesn't have unnecessary credit checks

Save time and ensure your business doesn't have unnecessary credit checks

With your Capitalise for Business account, you can upload all your documents to one application.

With your Capitalise for Business account, you can upload all your documents to one application.

A funding specialist will help put together the finishing touches, and send it to the selected lenders.

A funding specialist will help put together the finishing touches, and send it to the selected lenders.

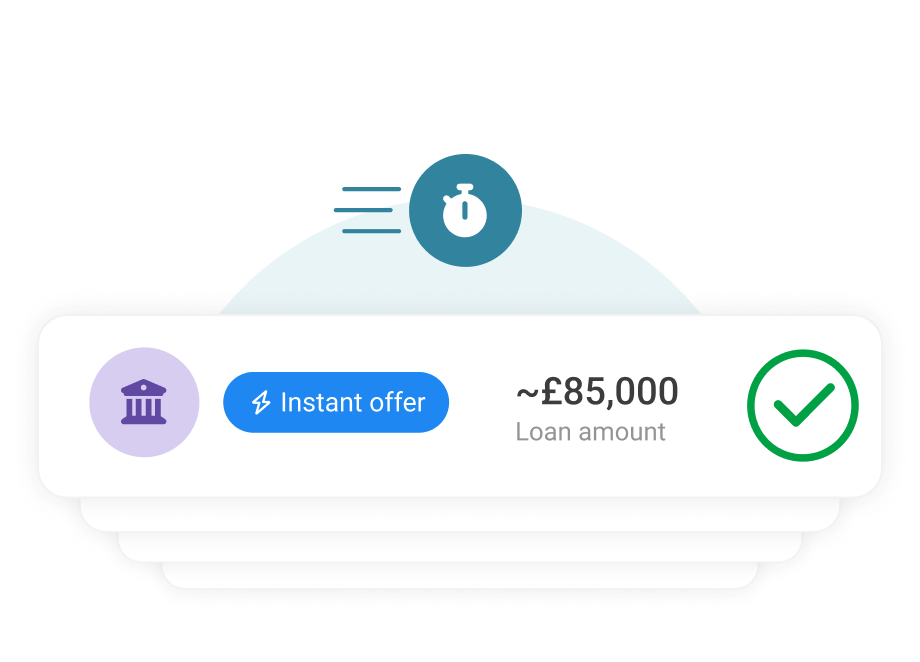

Track responses from lenders on your Capitalise for Business Account.

Track responses from lenders on your Capitalise for Business Account.

With an approval, you could receive funds in as quick as 48 hours from release.

With an approval, you could receive funds in as quick as 48 hours from release.

A funding specialist will guide you through the process from start to finish

A funding specialist will guide you through the process from start to finish

Feel confident you have the right choice with on hand support from an expert

Feel confident you have the right choice with on hand support from an expert

To streamline the process, you only need one application to apply to multiple lenders. You can speed the process up even further by having a few documents ready if something looks like a good match for your business.

Our lenders offer an extensive range of finance options - so you will find an option that works best for your business.

Once you have your documents ready, you could receive funds in your bank account in just 48 hours for an unsecured business loan.

For secured funding, such as Property Finance, this can take much longer as the process will involve valuations and solicitors.

We can match business funding needs for most limited companies with at least one director based in the UK. Generally speaking, if your business has been profitably trading for 2 years with at least £100,000 in annual turnover, there are more options we can match you with. That said, we work with over 100 lenders via our platform, so are able to work on a case by case basis. If you are unsure, just speak to one of our team.

It’s best practice to speak to a specialist as early on as you can. This will mean you will have more time to explore the market and find the best loan for your business. If your business credit score is low, this will also mean you have the time spare to improve your credit score to access cheaper interest rates.

Your business credit score is a key indicator to a lender on whether you can make payments based on your history. A good credit score means you will have more options and access to the best interest rates. There are some lenders that could help with a bad credit score, but these tend to be more expensive.

The best thing to do for your business could be to try and improve your business credit score, to save money on interest rates in the future.

For limited companies, approved funding will need to be deposited in a business bank account. A business bank account is not a requirement to get a business loan if you are a sole trader. Lenders will just need to see the documents for the personal bank account the business uses.

If you want to see if you could be eligible for a business loan, you can use our business funding calculator when you create your Capitalise for Business account. This will give you a personalised estimate of how much you could borrow.

The majority of lenders need some trading history (typically 1 year) to lend to a business. However some lenders will look at applications with as little as 3 months trading history. Decisions are generally made on a case by case basis. You can talk to one of our funding specialists to see your options.

For a start up business loan, the British Business Bank can also help.