This week the UK Government announced that the Recovery Loan Scheme (RLS) will stick around for an extra two years. That’s great news for small businesses as they juggle their post-pandemic ramp up with new pressures like increased costs and rising inflation.

The RLS extension means ongoing access to between £1,000 and £2 million in affordable funding through term loans, overdrafts, asset finance and invoice finance.

Read on for a quick recap on the scheme and more information about the extension. We’ll answer these questions:

- What is the Recovery Loan Scheme?

- What kind of funding is available through the Recovery Loan Scheme?

- How will the Recovery Loan Scheme change after July 2022?

- How do I apply for funding through the Recovery Loan Scheme?

1 What is the Recovery Loan Scheme?

The Recovery Loan Scheme (RLS) was launched in April 2021 to help businesses across the UK recover and grow after the covid-19 pandemic. Businesses that were impacted by pandemic disruptions can access funding through RLS to manage cashflow, invest, expand and more.

RLS funding is available through a wide range of lenders and is easier to access because the scheme is government-backed. While businesses are responsible for paying back any money they borrow, the UK government provides an extra layer of comfort to lenders. That enables them to make more funding available to a greater number and variety of businesses.

Another bonus of RLS is that the APRs (interest rates) are capped by the UK government to ensure that funding through the scheme is affordable. Up until now APRs have been capped at 14.99% but there hasn’t been any mention of whether this will change or stay the same going forward.

2 What kind of funding is available through the Recovery Loan Scheme?

Here’s a quick look at the kind of funding businesses can access through RLS:

- Term loan: these do what they say on the tin by providing a simple cash injection to pay back over time. You might use one to invest in R&D, move to bigger premises or even refinance another loan to get better rates.

- Overdraft: sometimes called a revolving credit facility, this lets you spend beyond your business account balance. This can be useful to bridge temporary cashflow gaps, for example while you wait for outstanding invoices to be settled.

- Invoice finance: this type of funding lets you advance the money owed to you in outstanding invoices, without waiting for your debtors to pay. It’s a flexible way to access funds as and when you need it.

- Asset finance: as the name suggests, this is a great way to upgrade equipment, invest in machinery or buy that great bit of kit that can really change the game for your business.

3 How will the Recovery Loan Scheme change after July 2022?

So far, the UK government hasn’t released much information about changes to RLS after July 2022. Here’s what we do know…

One of the changes mentioned so far is that lenders can ask for a Personal Guarantee, regardless of how much funding they’re providing. Put simply, signing a Personal Guarantee means that you agree to pay back a loan yourself if your business can’t keep up the repayments. Before July 2022, lenders could only take Personal Guarantees for larger RLS funding facilities. Going forward, they can take a Personal Guarantee for a facility of any size.

Something else we know is that the maximum amount of funding available through RLS hasn’t changed. Businesses will still be able to borrow up to £2 million through the extended scheme.

4 How do I apply for the Recovery Loan Scheme?

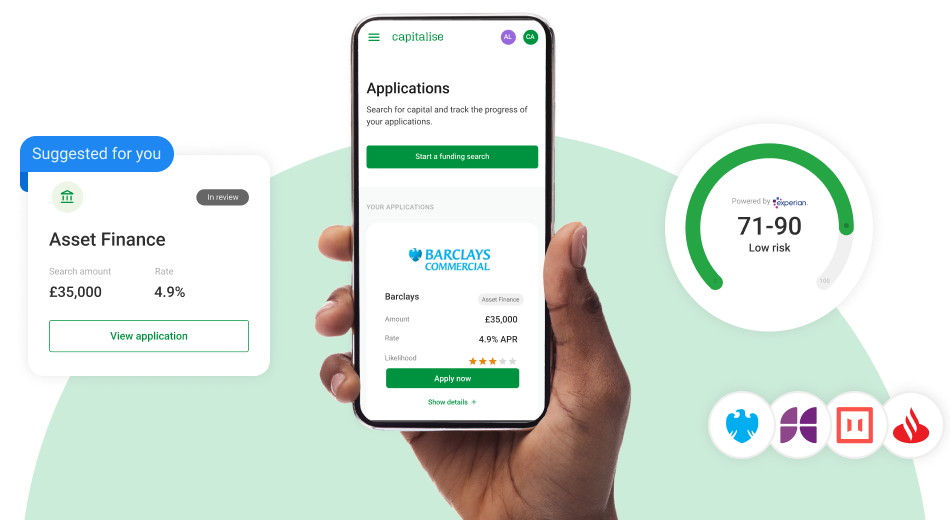

Applications for the extended Recovery Loan Scheme haven’t opened just yet but we’ll update you as soon as we know more. Once RLS applications open, you can simply log in to your Capitalise for Business account and head to Applications to apply.

Don’t have a Capitalise for Business account? Now’s the perfect time to sign up – for free. You’ll unlock insights about your business credit score, how much you might be able to borrow once RLS applications open and more.

United Kingdom

United Kingdom  South Africa

South Africa