We're seeing costs rising for…well, pretty much all your operational expenses. That might be a macro issue affecting the whole economy, but there is something you can do about it. Fuel, energy, logistics, manufacturing and raw material costs may be steadily increasing in price. But improving your credit score is one way to sidestep this hurdle.

With a better business credit score, you’d have 4x better access to affordable funding for your business. And extra cash in the pot helps you stretch out your cashflow to cover the skyrocketing costs of keeping the lights on in the business.

Here's why being in control of your credit score puts you back in the driving seat.

Why is your credit score so important?

Your business credit score is a fundamental measure of your financial health. We’re used to thinking about our own personal credit score, and how it affects our financial freedom as an individual. But exactly the same thing applies to your business score.

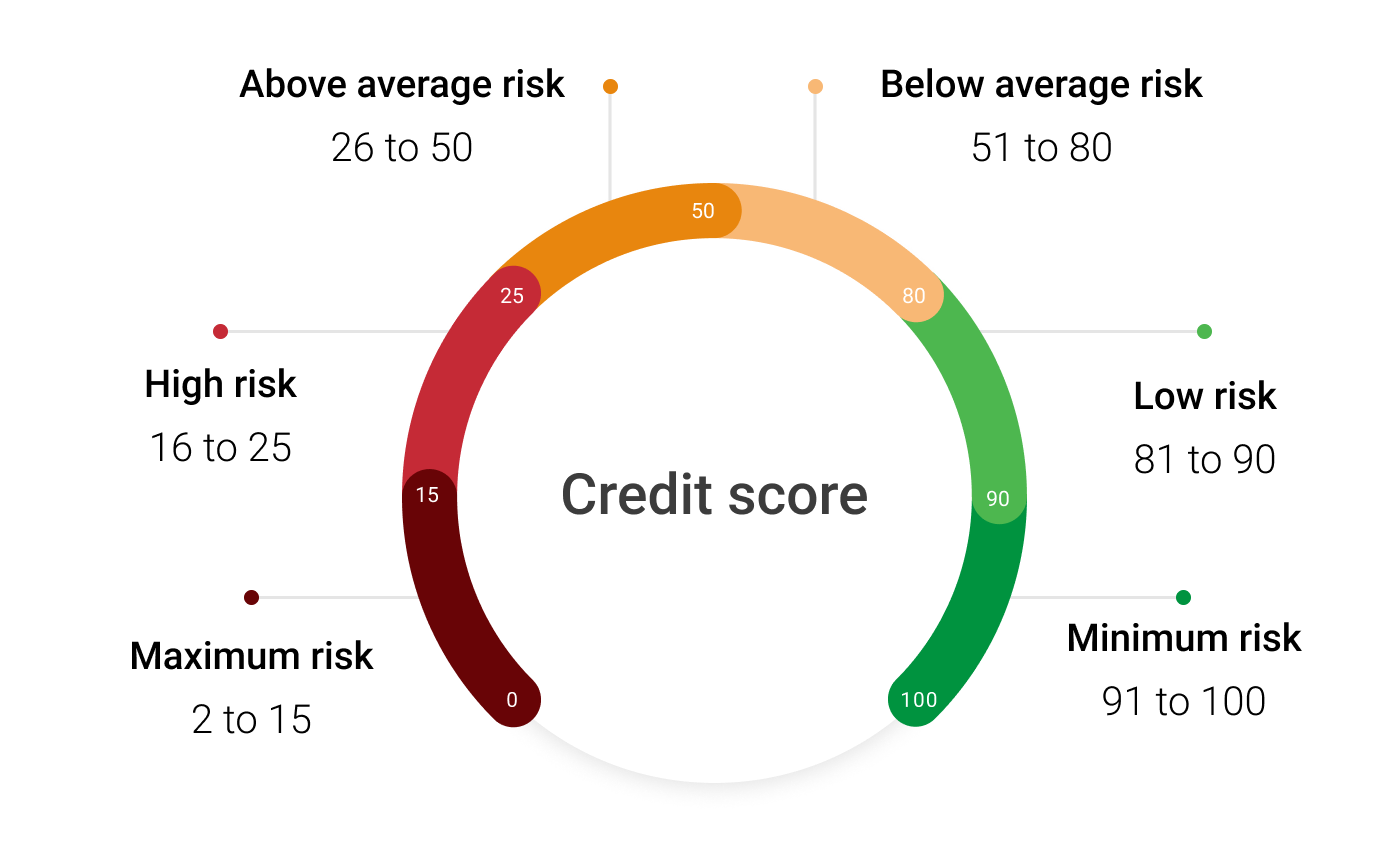

A good credit score is a sign of a fit and healthy business. Different credit agencies use their own scales. For Experian, our credit partner, business credit scores range from 0 to 100. The higher your credit score, the better the perception of your financial position as a business.

For example, a score of:

Getting that low-risk rating is a must-have in the current climate, as we’ll see…

What benefits do you get from a positive credit score?

Improving your credit score isn’t just a tick box exercise. Your score, your risk rating and your perceived creditworthiness all have a very real impact on your business.

When you get proactive about boosting your credit score, this opens up all kinds of opportunities. Some of these are financial benefits that make you a more viable prospect as a business. Others are strategic and tactical advantages that help you meet your growth targets and scale up your customer and supplier bases.

Let's take a look at the biggest advantages:

-

More access to the best funding – lenders want to know that you’re creditworthy – that you can repay any money they lend you. A key measure for this is your credit score. If you’re rated as low risk and have the financial credentials to back this up, you’ll find it much easier to access funding. Whether it’s short-term invoice finance, long-term business loans or property finance, getting funding will be less effort with a credit score of 80 or above. And you’ll pay less for it.

-

Improved working capital to beat rising overheads – As a growing business, you need a steady supply of cash to keep your operations on track. This ‘working capital’ is the lifeblood of the business. With better funding opportunities, you can take out a finance facility to keep your business on track in these challenging times. Extra cash fills the cashflow gaps and allows you to factor these higher overheads into your planning.

-

Better trade credit opportunities – agreeing trade credit terms with your suppliers, helps to ease the pressure of rising prices and bigger supplier bills. If you can agree 60 days terms, that gives you a whole extra month to find the cash. When suppliers check out your credit position, they’re far more likely to agree beneficial terms when you have a good credit score. That low-risk rating is the indication they need that you’re good to pay the bill and don’t have any chronic debt issues.

-

More clients for business-to-business traders – if your customers are other businesses, it’s possible that they’ll run a credit check on you before agreeing to any large-scale contracts. If you can demonstrate a positive credit score, that’s a good indicator that you’re financially fit, viable and able to deliver on a new contract. That leads to more contracts, bigger revenues and improved cashflow.

How does Capitalise for Business Pro boost my score?

Getting your credit score back into shape makes a lot of sense. But what can you do to actually improve your business credit score? The quick and simple answer is to sign up for Capitalise for Business Pro, our one-stop business finance solution.

With Capitalise Pro, you can:

-

Check your current credit score – find out your actual business credit score, as the banks see it. We’re the only platform where you can do this – and it’s a super important piece of intel to know about your business.

-

Track your credit profile in real time – you can monitor your credit score, risk rating and credit history all in one place, in real time. It’s the simplest way to keep in the loop with your credit position, giving you an edge over your competitors.

-

Get instant notifications when your credit score changes – if there’s a change to your credit profile, you get an Instant alert, with in-depth Experian insights. Whether your score moves up or down, you’re notified ASAP and can start taking action.

-

Talk to a credit-score expert – book in a chat with one of our credit specialists to make a personalised game plan for improving your company’s score

-

Get matched with the right lenders – Our funding marketplace offers you over a hundred different lenders and specialist finance providers. Match with funding you’re likely to be approved for and pay much less for it.

Get better funded and give your business an edge

With high inflation and rising costs an ever-present challenge, being well-funded is a no-brainer. With the right funding, you have the flexibility and the financial fluidity to overcome the soaring costs of trading and remaining profitable in 2022.

Turbocharging your credit profile with Capitalise for Business Pro opens the doors to better funding. You get enhanced control over your credit score and more opportunities to borrow the cash you need at better rates – and that’s the good news for the future of your business.

Let's maximise your credit score and open up a whole new world of funding.

United Kingdom

United Kingdom  South Africa

South Africa