A merchant cash advance (MCA) gives your business fast, flexible funding based on future card sales, helping you ease cash flow gaps or invest in growth.

You can typically access up to 1.5 times your average monthly revenue, with repayments automatically adjusting to your sales - keeping cash flow steady.

Instead of an APR, MCAs use a factor rate to determine the cost, and once repaid, renewing is quick and easy, so you can secure more funds when needed.

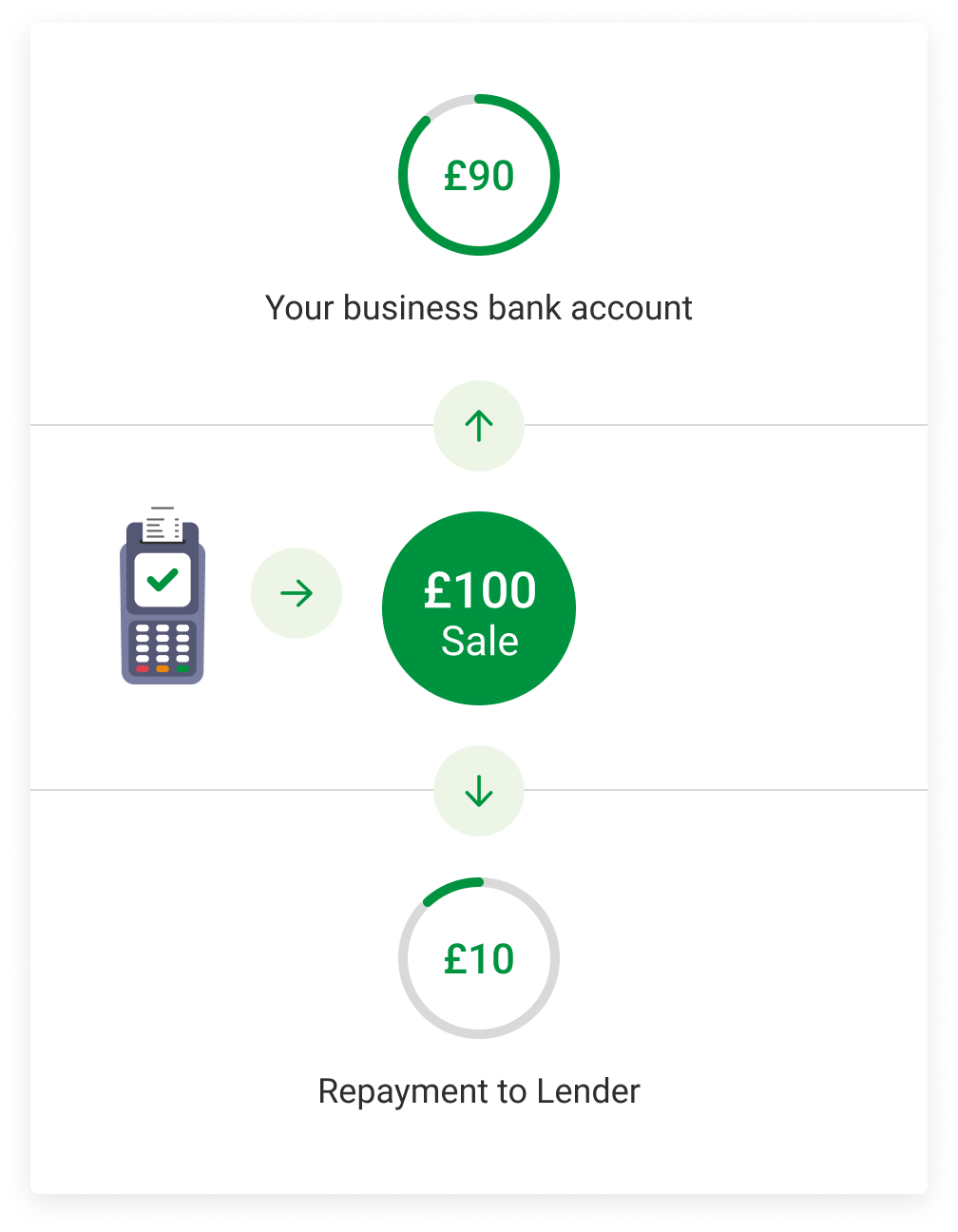

Repayments are based on your daily revenue. This means they adjust with your business’s fluctuating inflows, making it easier to maintain cashflow

A merchant cash advance is fast to secure. With approval based on your card sales rather than credit scores or collateral, the process is simple and requires minimal paperwork. Funds can be in your account within 48 hours.

You can use the funds for anything your business needs, from inventory to marketing.

A merchant cash advance is ideal for businesses that accept card payments, especially those with seasonal revenue fluctuations or those needing quick access to funds to seize new opportunities.

Whether you experience peaks and dips in sales or require fast capital to invest in stock, marketing, or expansion, an MCA offers flexible funding that aligns with your cash flow.

Businesses with seasonal inflows, such as restaurants, takeaways, pubs, bars, clubs, hotels, and garages, can benefit from repayments that adjust to sales cycles.

Meanwhile, businesses needing quick funds to capitalise on opportunities - like coffee shops, retail stores, e-commerce businesses, and hairdressers & salons - can access fast, hassle-free financing when they need it most.

To be eligible for a merchant cash advance, lenders will typically require your business to:

If your business meets these requirements, you can quickly check your eligibility and apply online through Capitalise. You’ll be able to easily compare multiple offers from a marketplace of lenders.

| Advantages | Disadvantages |

|---|---|

| You can access funds quickly, often within 48 hours. | Merchant cash advances tend to have higher fees compared to traditional loans. |

| Repayments are flexible and based on your daily sales, so they adjust with your cash flow. | If sales are slow, it can take longer to repay the loan. |

| No collateral is required, meaning you don't need to offer physical assets as security. | Daily automatic repayments can sometimes put a strain on day-to-day operations. |

Instead of APR or upfront fees, a merchant cash advance uses a factor rate to calculate the loan's cost. This is a flat fee applied as a multiplier to the loan amount.

For example, if you borrow £10,000 and have a factor rate of 1.2, the total repayment would be £12,000.

Factor rates can vary, ranging from 1.10 to 1.35. The factor rate you'll be offered depends on your business's financial health. The merchant cash advance lender will consider factors such as your revenue, profitability, and business credit score in their assessment.

Capitalise is an FCA regulated platform dedicated to UK businesses. Our mission is to help businesses to take control of their financial health. We support business owners by providing easy way to access over 100 lenders and compare their loan products. Our advanced platform makes intelligent matches and ranks lenders, based on their past successes, to help businesses select the best funding solution.

Capitalise also enables businesses to check their own Experian business credit score to better understand their financial health. Plus businesses can check the credit profiles of the companies they work with to reduce risk.

Repayments are taken as a small, pre-agreed percentage of your daily card transactions. The amount you pay will depend on your daily sales, so repayments are flexible and match your cashflow.

As a general rule, you can usually raise up to 150% of your average monthly card takings.

The time it takes to repay depends on the percentage split and your card sales. For example, if you borrow 100% of your monthly turnover and the repayment split is 20%, it will take you around 5 months to repay the loan in full.

A factor rate is a multiplier that determines the cost of your loan. For example, a factor rate of 1.2 on a £10,000 loan means you'll repay £12,000 in total.

You can use a merchant cash advance for a variety of reasons. Merchant cash advance loans could be the right option for your business if you need to: