Invoice finance is a flexible business finance solution. It allows your business to access cash from unpaid invoices, helping to speed up your payment cycle.

Rather than waiting 30, 60, or 90 days for your customers to pay, you can receive a percentage of the invoice upfront. This enables you to bridge the gap between invoicing and receiving payments, ensuring a healthier cash flow for your business.

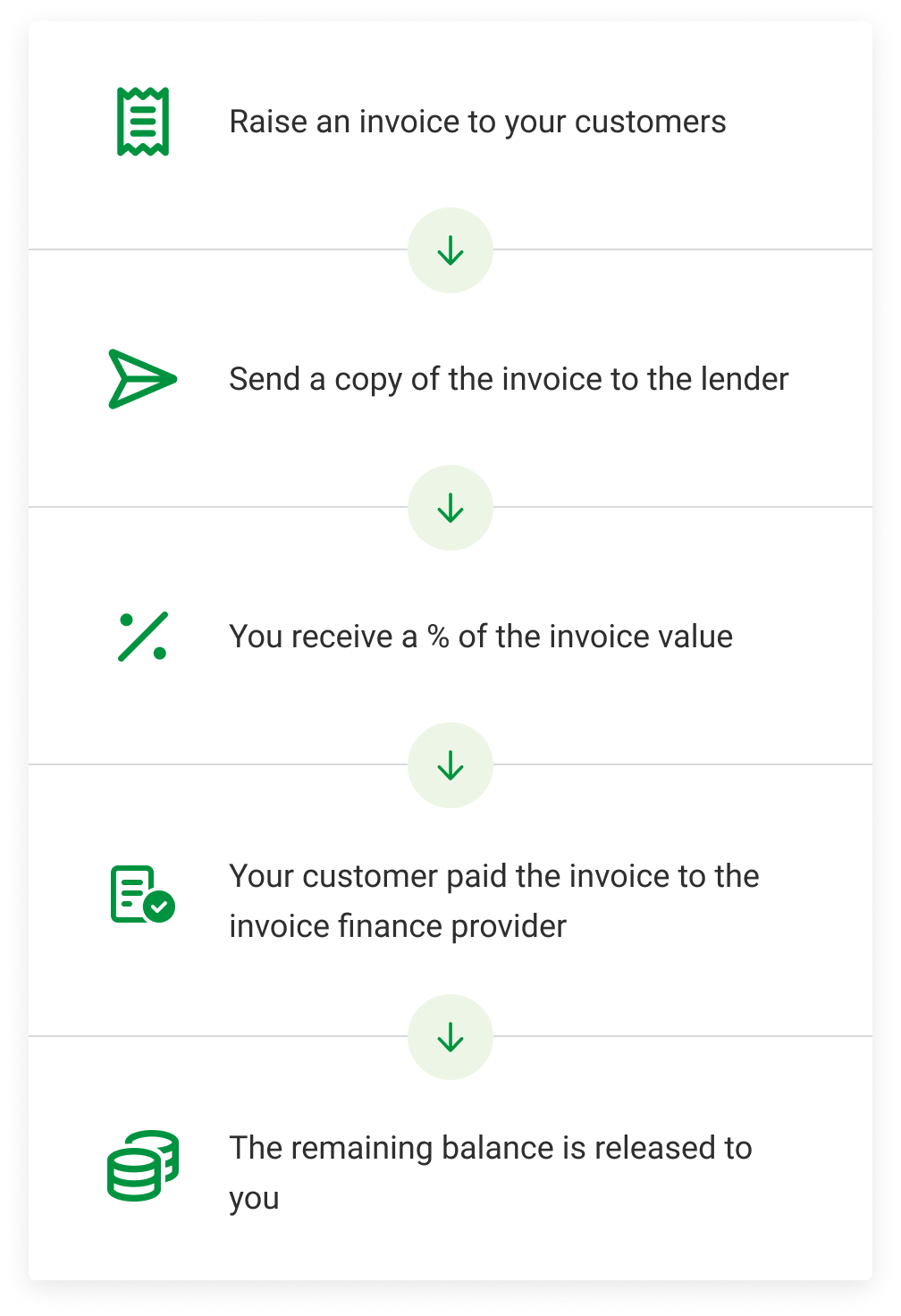

Here’s how invoice finance works:

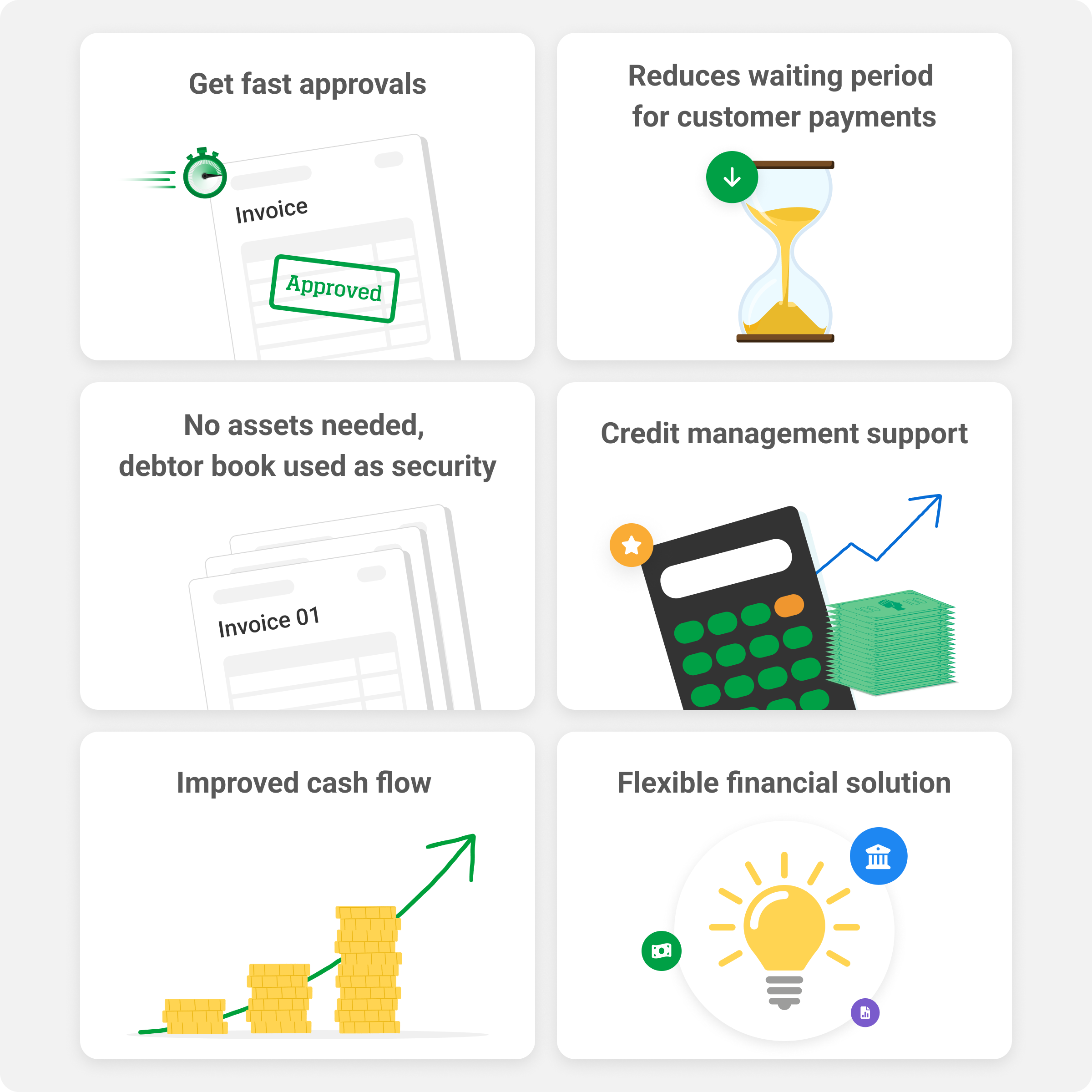

Choosing to use invoice finance can make running your business a lot easier. It’s also a quick solution that doesn’t have as strict eligibility requirements as a traditional bank loan might.

As it gives you fast access to cash, it can help pay for everyday expenses or grow your business without waiting for customers to pay their bills.

There are several types of invoice financing options available, each suited to different business needs and situations.

Invoice factoring allows a business to sell its invoices to a third-party company at a reduced rate. The invoice factoring company then takes on the task of collecting the invoice payments. This arrangement provides the business with immediate cash and transfers the responsibility of credit control to the factoring company, which can reduce the business's administrative workload.

Spot factoring allows businesses to finance individual invoices, instead of their whole debtor book.This is useful for companies needing quick cash without a long-term commitment, providing flexibility and control over which invoices to finance.

Invoice discounting is similar to factoring but with one key difference: the business retains control over the debtor book and invoice collection. This solution is usually confidential, meaning customers are unaware that an invoice financing company is involved.

Selective invoice financing offers businesses the flexibility to choose which invoices to finance. This can be particularly useful for companies with fluctuating cash flow needs. The business will still retain responsibility for their credit control.

Invoice finance companies have varying criteria, but typically your business will need to:

| Advantages of invoice finance | Disadvantages of invoice finance |

|---|---|

| Invoice finance companies immediate access to cash tied up in unpaid invoices, helping businesses manage their cash flow more effectively. | Invoice finance can be more expensive than other types of borrowing, with fees and interest rates potentially higher. |

| With faster access to funds, businesses can take on new projects, stock up on inventory, or expand operations without waiting for customers to pay their invoices. | If using factoring (where the provider takes on debt collection), the interaction between the factor and your customers could affect customer relationships. |

| Your business won’t need assets as collateral, typically the outstanding invoices themselves are used as security. | Not all businesses will qualify for invoice financing. It’s not a suitable option for B2C companies. |

| You can choose whether to retain credit control management. | Some providers may not agree to finance smaller invoices, which can limit the usefulness of the service for some businesses. |

| Unlike traditional loans, the amount of funding can increase with your sales. As your business grows and you invoice more, you can access more finance. | The amount of financing and the terms offered depend heavily on the creditworthiness of your customers. |

| It's often easier and quicker to secure invoice financing than traditional bank loans. | Some invoices, like those tied to contractual disputes or with extended payment terms, may not qualify for financing, limiting the amount of funds that can be accessed. |

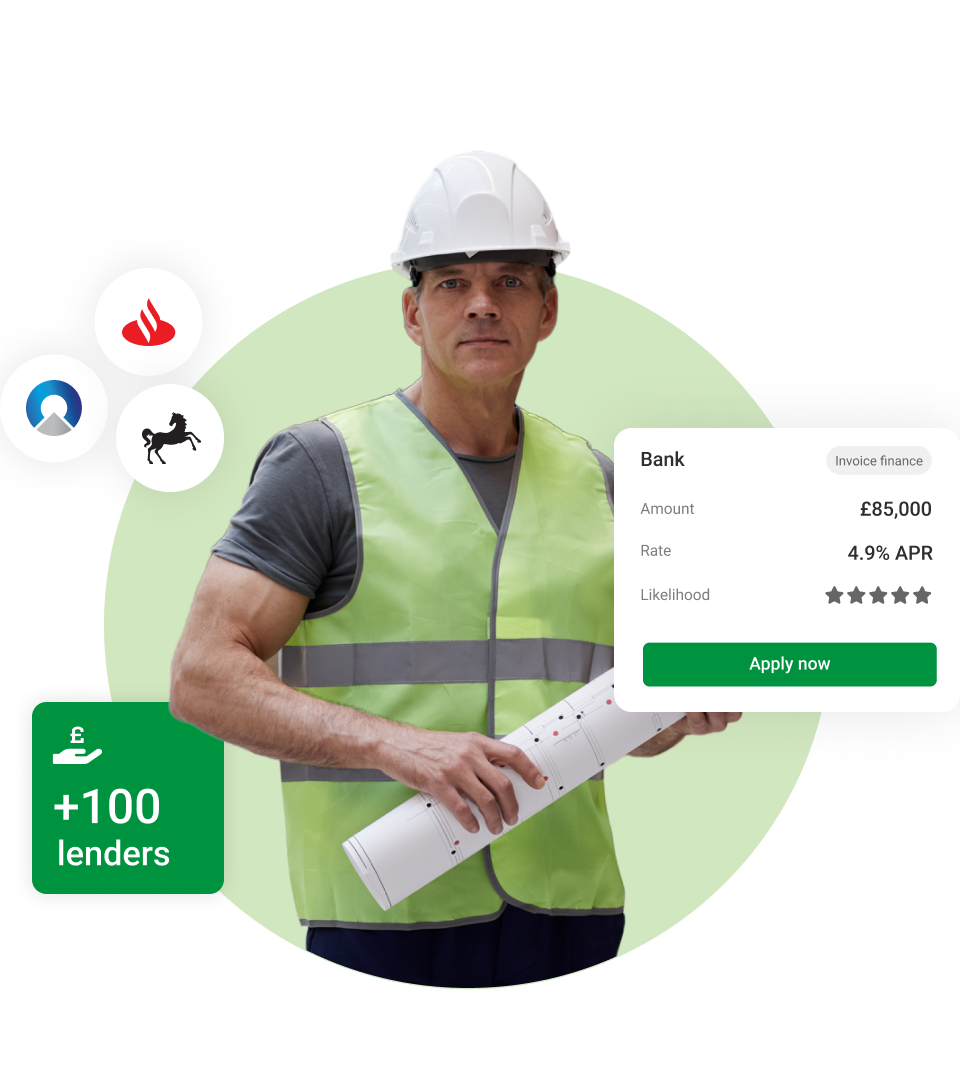

At Capitalise we work with over 100 UK business lenders, many of which are specialist invoice finance companies. Our online platform facilitates a comparison of loan terms and conditions from multiple lenders, ensuring that your business can secure the right finance for your business. Sign up for free and get started today!

If you sell goods or services on credit to other creditworthy businesses and your invoices are for fully-delivered goods and/or services, you meet the basic criteria. With invoice finance, your future growth is more important than an extensive credit history.

Yes, accounts receivable financing and invoice financing refer to the same concept. However, 'accounts receivable financing' usually means you retain control over your customer invoices (debtor book), while 'invoice factoring' means the financing provider takes over credit control and manages collections.

With invoice finance there is a risk of over reliance on your customers. If your customer fails to make a payment, you may still be responsible for repaying the advanced funds.

You will also have to pay short term costs such as initial fees from the invoice finance provider.

Invoice finance helps improve a business’s cash flow by giving fast access to working capital tied up in unpaid invoices. It provides greater financial stability by reducing the impact of late payments, and it offers flexibility, as the available funding can grow in line with your sales and turnover.

No, you don’t have to finance every invoice. You can choose to receive cash advances on just those from specific customers. Invoice finance also gives you the option to keep control of your customer relationships and manage collections yourself.