Capital to grow your retail business

See what funding your retail business could get approved for

Match with lenders you have the best chance of being approved from

We just need a few details to get started for free

We're ready to help.

Match with lenders you have the best chance of being approved from

We just need a few details to get started for free

Giving away equity in your business is the most expensive form of capital. Don't dilute your retail business, match with the right capital to grow your business. At Capitalise, we work with specialist lenders who can not only provide you with the funds you need, but have a proven track record supporting retail businesses.

At Capitalise, we work with a number of institutional lenders, including high street banks, alternative lenders and independent lenders. These lenders offer a variety of products so you're certain to find the most suitable solution for your business.

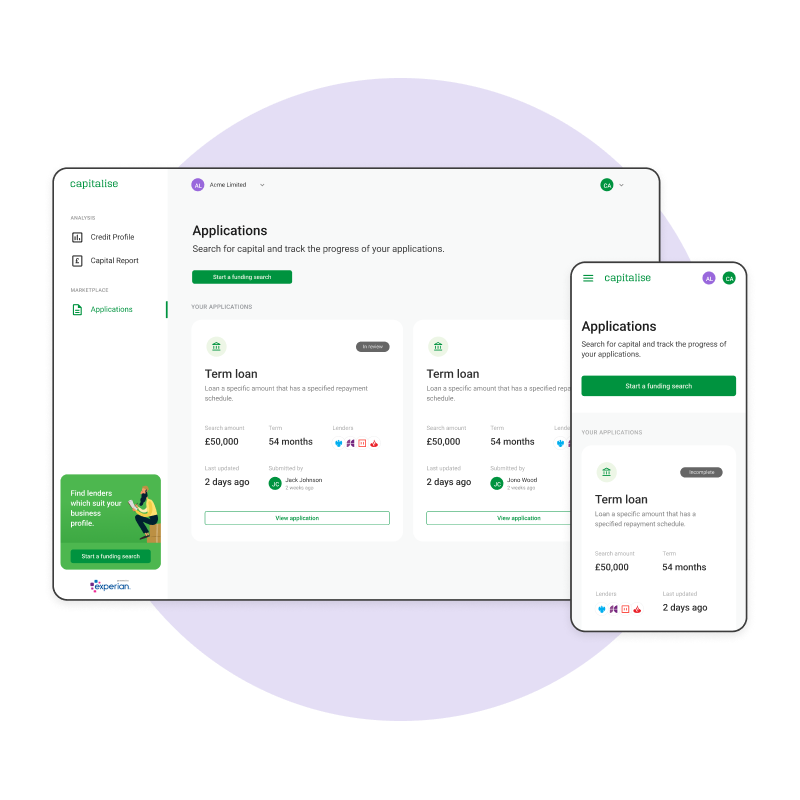

Capitalise makes it easy to find, compare and select lenders who are most likely to give you an offer.

Our lenders offer an extensive range of finance options - so you will find an option that works best for your business.

It can be more difficult to get a loan if you have bad business or personal credit. In extreme cases, it may even be impossible. If a lender does offer you a business loan, they may charge a higher interest rate or insist that you repay the loan over a shorter period of time.

If your business credit score is too low to access funding through Capitalise, we’ll suggest ways for you to improve your score. We might, for example, highlight an outstanding County Court Judgement that needs to be paid or recommend a credit improvement service.

While we can’t offer any direct support to improve your personal credit score, you can use this guide to find out about your options.

When you go beyond getting a quote and actually apply for funding, a lender will do something called a hard search of your business credit profile. Too many of these hard credit searches in a short space of time can have a negative impact on your business credit score. This can happen if you’re not entirely sure what kind of funding is the best fit for your business so you cast a wide net with lots of applications.

When you search for funding through Capitalise, you fill in one application form and we send that on to lenders for you. We keep the number of hard searches to a minimum by making sure we only send your application to the lenders most likely to approve your business for funding. Usually this is between two and four of the carefully selected lenders we work with.

There are different types of business loans, from term loans, merchant cash advances, invoice finance, asset finance, revenue funding to`buy to let, bridging finance, commercial mortgages, development funding.

All of these work slightly differently from each other and address different business needs. They also have varying costs and varying term lengths.

For unsecured funding the average time is anything from 10-20 days. For secured funding it tends to take much longer and depends what funding is required eg Property finance will involve valuations and solicitors so will take months to complete.

How much your business can borrow depends on several factors including the type of funding you’re looking for, your business credit score, turnover and so on. With Capitalise, you get free and instant access to a real-time credit profile that shows you how much funding your business will likely be able to borrow. This profile covers all the information lenders have about your business and what impact various factors are having on your credit score.

How much interest you pay will depend on the type of funding you choose, the lender who provides it and several other factors including your business credit score. You’ll know exactly what you’ll pay upfront so you can make an informed decision about whether to accept any funding that’s offered to your business.

We can match business funding needs for most limited companies with at least one director based in the UK. Generally speaking, if your business has been profitably trading for 2 years with at least £400,000 in annual turnover it could be a good match. That said, we work with over 100 lenders via our platform, so are able to work on a case by case basis

Figuring out which funding is best for your business – and then where to get it from – can be a bit overwhelming. In fact, around 50% of business leaders say they’re not sure what kind of funding they need or which lenders to trust. And 61% say they simply don’t have time for the long and admin-heavy process of applying.

Capitalise does all this legwork for you. You start one search and we find the best funding options from the most suitable lenders. We only work with trusted lenders and we won’t suggest a solution we don’t think your business is likely to be approved for. You can also apply to four different lenders by filling in one application form to get funding faster with a lot less admin.

Capitalise earns a commission if you accept an offer for funding through our platform. But that doesn’t mean we’d ever encourage you to take out funding that wasn’t a good fit. In fact, it’s an extra incentive for us to make sure that any funding offered to you through our platform is matched to your specific needs.

Our Marketplace has over 100 traditional and alternative lenders that specialise in asset and invoice finance, merchant cash advance, property and trade finance as well as working capital. These are broad categories that cover a huge variety of specific products and solutions from overdrafts and loans to management buyouts, VAT funding and the government’s Recovery Loan Scheme. We’ll only match you to the lenders and solutions that are suited to your business and funding needs. You can read more about the options available here.