✅ Know your business credit score

✅ Understand the factors impacting it

✅ Alerts on risks to your profile

✅ All features from as low as £19/month

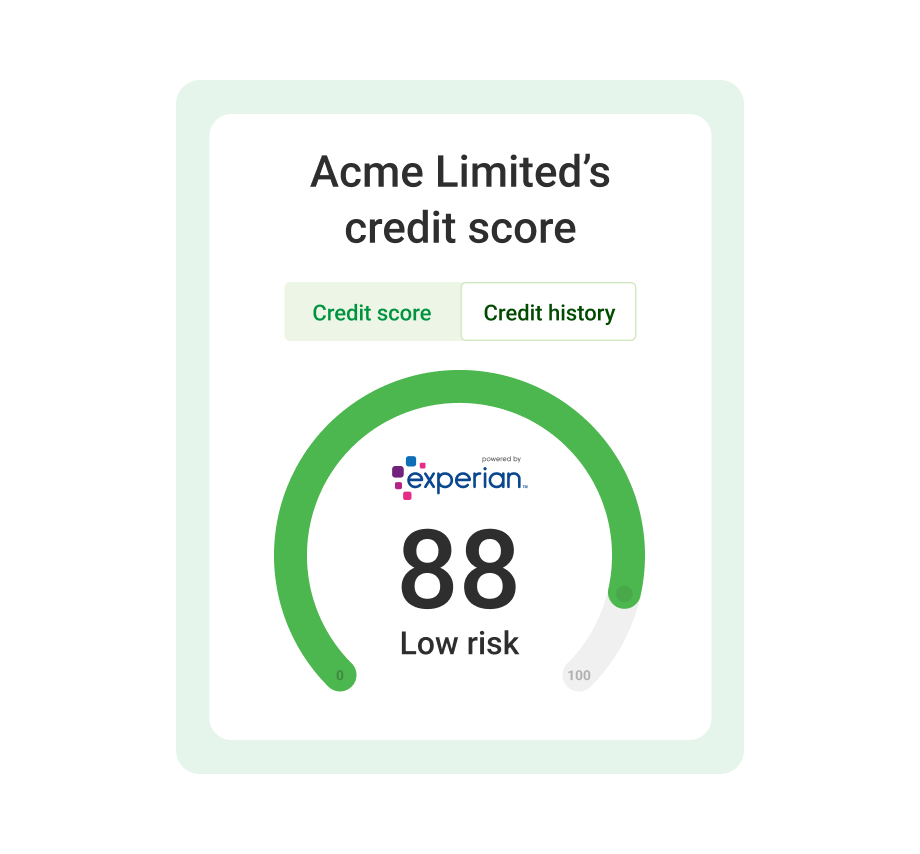

Checking your credit score is easy with Capitalise for Business. Once you sign up, you can view your full business credit profile powered by Experian data, as well as the factors that are impacting it.

Your business credit score is a key indicator of your financial health and reliability. Here's why it's essential to keep tabs on it:

There are places you can go for credit score insights. And places to look for funding. There are places where you’ll pay for advice. And places to track how your business is doing.

Or you can do it all for free, in one place, with Capitalise for Business.

Get full access to information banks and lenders will look at about your business, including your commercial Delphi score and the risk bracket your business is seen as.

Get full access to information banks and lenders will look at about your business, including your commercial Delphi score and the risk bracket your business is seen as.

Understand how likely your business is to get approved for funding.

Understand how likely your business is to get approved for funding.

Understand everything that’s affecting your business credit score - positive and negative.

Understand everything that’s affecting your business credit score - positive and negative.

Spot areas that need attention, and areas looking good, to learn how to improve your score.

Spot areas that need attention, and areas looking good, to learn how to improve your score.

Get alerted as to changes to your credit score, including when a negative event has been registered.

Get alerted as to changes to your credit score, including when a negative event has been registered.

View a summary of information about your business as registered on Companies House. Including, your company’s registered address, list of business directors, accounts and filing history.

View a summary of information about your business as registered on Companies House. Including, your company’s registered address, list of business directors, accounts and filing history.

See if there are any legal notices like CCJs registered. You normally have 30 days to resolve these before they cause significant damage to your credit profile, so you’ll need to act as soon as possible.

See if there are any legal notices like CCJs registered. You normally have 30 days to resolve these before they cause significant damage to your credit profile, so you’ll need to act as soon as possible.

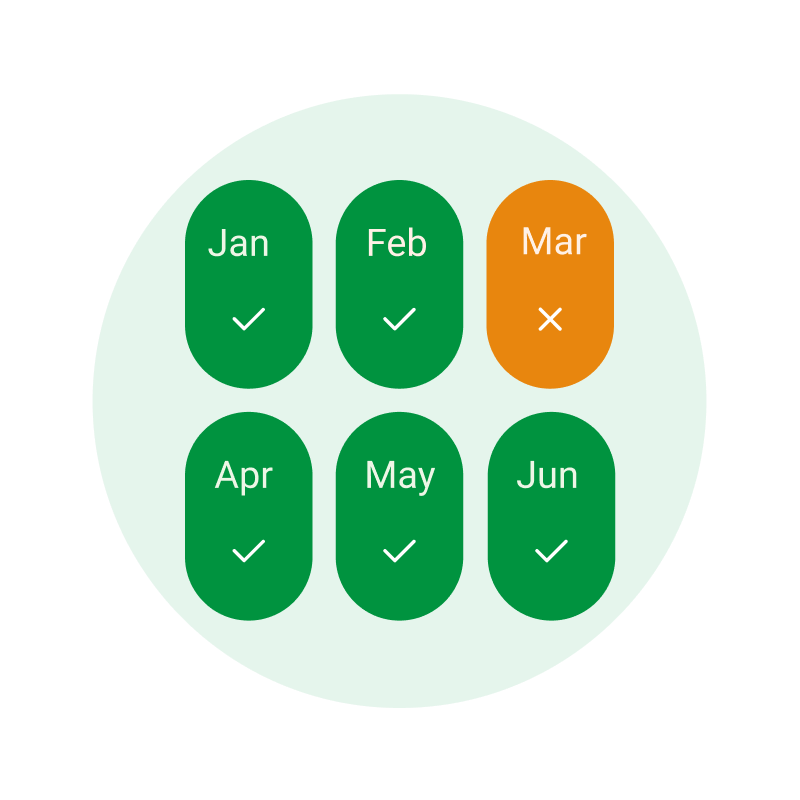

Get insight into how your business performs when making payments to suppliers.

Get insight into how your business performs when making payments to suppliers.

See how you manage cash in the business and how it impacts your business credit score with all your business bank accounts and borrowing data, in one place.

See how you manage cash in the business and how it impacts your business credit score with all your business bank accounts and borrowing data, in one place.

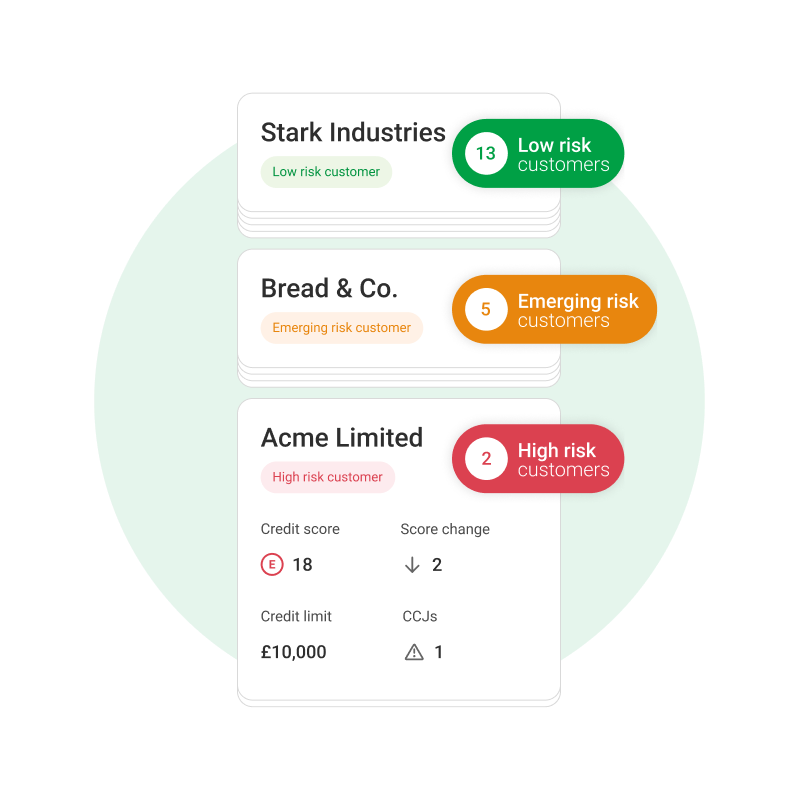

Company credit check up to 100 customers or suppliers.

Company credit check up to 100 customers or suppliers.

Spot risks early and find out if you’re likely to get paid on time.

Spot risks early and find out if you’re likely to get paid on time.

Improve your credit control by knowing which companies to chase and when.

Improve your credit control by knowing which companies to chase and when.

Find funding that’s a better fit from the most suitable lenders.

Find funding that’s a better fit from the most suitable lenders.

Apply to four lenders with one simple form and track all your applications.

Apply to four lenders with one simple form and track all your applications.

Sign up with your company to get instant insights.

UK Limited Companies only. No credit card required.

You can check your business credit score from as little as £19/month.

See our plans and compare features to choose which is right for your business.

Checking your business credit score should be the first step when you’re thinking about applying for a business loan. It will help you to understand if you will meet a lender’s criteria and whether you can access affordable interest rates. Once you’ve checked your business credit score, use your Capitalise for Business account to see how much you could be eligible to borrow. We’ll match your business’ information and needs with up to 4 lenders most likely to approve you for a loan. And when you’re ready, you can apply to multiple lenders in just one simple application.

Whether you’re looking for working capital, a loan to expand your operations, or you want to smooth your cash flow with a line of credit, there’s a range of products that could help fuel your business ambitions.

Get your business credit score professionally reviewed by Experian and see if you can boost it.

Reduce risk to your business by running company credit checks on customers, suppliers and competitors

Get matched with the right lenders for your business with a single search.

A credit score is the measure of how creditworthy your business is. In other words, your score shows a bank or lender how much of a risk it would be to lend your business money. The higher your score, the more likely it is that your business can pay back any debt, for example the repayments on a loan. Credit agencies each have their own scale for calculating your credit score. Our credit agency partner, Experian, uses the Commercial Delphi Score with scores that range from 0 (the highest risk) to 100 (the lowest risk).

Your credit score is important because it’s a measure of the financial health of your business. Not only does it show your financial position today, but it can be the difference between a healthy and unhealthy position in the future. The higher your credit score, the more funding you can get to fuel everyday operations and ambitious next steps. Businesses with higher scores can negotiate better terms with suppliers and are more likely to win contracts with new clients.

Read more about credit scores and why they’re important here.

There are several factors that affect your credit score – both positively and negatively. These include how promptly you pay suppliers and whether or not you have any legal notices against your business. Your Companies House SIC code is also a factor and so is your filing history. Credit agencies will also consider the age, industry and location of your business as well as certain information about its directors.

The exact steps you need to take to improve your credit score will be specific to your business and the factors that are having a negative impact. But here are some general guidelines you can use to get started:

Read more about improving your credit score here.

Your personal credit score measures how creditworthy you are as an individual. In other words, could you personally pay back a debt? If you wanted an overdraft on your personal bank account for example, your bank would look at your score to decide whether you’d be able to make the monthly payments. Your business credit score is a measure of how creditworthy your business is. If you applied for a business loan, the lender would look at your business credit score to decide whether your business would be able to keep up the repayments.

You can check your credit score right now by signing up to Capitalise for Business. If you’re already signed up, you can check your score at any time by simply logging in.

With Capitalise for Business, you can access all your credit score insights starting at £19/month (plus VAT). Every time you log in, you’ll be able to see: