A strong business credit score is key to better financing and growth opportunities. In this article, we’ll cover simple strategies to help improve your business credit score and strengthen your company’s financial future.

What is a business credit score?

A business credit score reflects your company's financial health and reliability. Lenders, banks, and other companies will, in most cases, review your business credit score before extending credit or offering financing.

There are several credit reference agencies in the UK who all calculate their scores slightly differently, based on their own data intelligence and research. All will take a set of similar factors into considerations around your financial results and credit behaviour. The agencies will obtain details of your company and your financial results which you file at Companies House. They will also receive information directly from banks, lenders and major companies to track your bank and credit balances and payment performance.

Each agency has its own scoring scale. For example, Experian has 7 different credit score bands ranging from 0 to 100: the higher your score, the lower the perceived risk.

Why is it important to improve your business credit score?

Now that you understand what a business credit score is, let’s explore why improving it is critical for your business.

Your business credit score can impact everything from supplier terms to bank loan interest rates. Companies may determine pricing and payment terms based on your credit score, while banks and lenders often set higher interest rates for businesses with lower scores. A strong credit score helps maintain cash flow, enables access to funding, and reduces borrowing costs, all of which can contribute to business growth and profitability.

How to improve your business credit score?

Here are the key steps you can take to improve your business credit score and set your business up for success.

1. Keep your Companies House information up to date and file accounts on time

There is a trend amongst small businesses to limit the financial information which is in the public domain. However, this can make your score lower as the less information the credit references have, the more they have to assume.

Having more information available generally leads to a more accurate and higher score.

2. Make regular payments on time

Paying your suppliers and accounts on time and in full every month is key to a healthy score. It demonstrates that your business can afford the money borrowed. Many large companies send payment performance data to the credit reference agencies. You should prioritise paying these suppliers on time so that your credit behaviour always looks impressive.

Every company will have different suppliers and you should look at the list of those you pay. Focus on large and national companies as a minimum, such as utility companies.

This should also include keeping within credit limits and overdraft facilities for any banks or lenders and making all payments on due dates.

Set up automated payments for regular expenses such as utility bills to avoid missing deadlines.

3. Avoid too many loan applications at once

It can be tempting to apply for finance when you’re thinking about your next business move. In some cases, finance is exactly what you need to expand or grow. However, every time you apply for a loan, it triggers a 'hard inquiry' which can temporarily lower your score. Also, holding too much debt in the business can have a negative impact.

If you are thinking about finance, try checking your business loan eligibility first before you submit an application. Or you can speak to one of our dedicated funding specialists. They will work to find you the right lender, so that you avoid unnecessary applications that could damage your business credit.

4. Open a business bank account and use it regularly

Opening a business bank account enables you to keep your personal and business transactions separate. This means you’ll be able to better track and manage your business’ finances.

Using your business bank account regularly and consistently can prove your business is successfully managing accounts and paying creditors. Banks and lenders often reward businesses who show signs of consistent positive transactions.

If you have any dormant or low activity accounts, consider shutting these down so they don’t worsen your business credit score.

5. Consider using a credit card to improve your business credit score

Credit cards can be a good solution to help improve your business credit. Business credit cards can help you establish a strong credit history. Over a period of time you can showcase that you are regularly and consistently keeping up with payments. However, be mindful that opening a new card will involve a hard credit check.

6. Monitor your business credit profile to spot risks or errors ahead of time

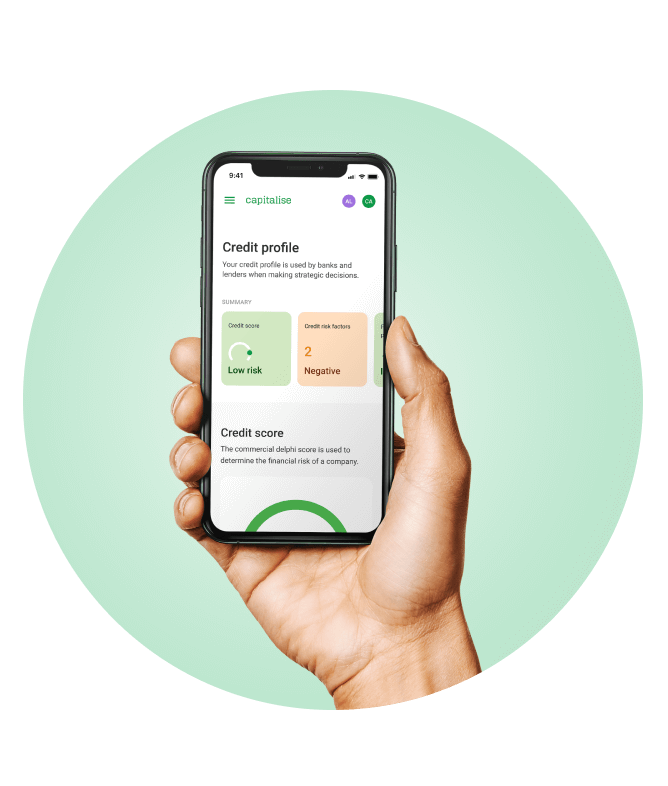

Regular monitoring allows you to correct errors that may otherwise go unnoticed, like incorrect information from suppliers ,or outdated payment records. Being proactive in monitoring your credit can prevent negative surprises and support continuous improvement. With a Capitalise for Business account, you can track your score, identify factors impacting it, and receive real-time alerts about any changes.

7. Avoid any legal notices or County Court Judgement (CCJs)

Protecting your business credit score means staying clear of legal actions and judgments. If you receive a statutory letter or legal notice, it’s critical to act quickly. County Court Judgments (CCJs) can severely damage your credit score, remaining on your record for up to six years—even if the debt is eventually paid. However, if you settle the judgement within one month, it can be removed from your record entirely, sparing your credit from long-term harm.

In more serious cases, if a creditor or HMRC issues a winding-up petition against your company, this will be publicly listed in the “Gazette” as a first Gazette notice for compulsory strike off. Even if the petition doesn’t progress to a court ruling, the notice will still remain visible and negatively affect your credit score.

To avoid these outcomes, never ignore “Red” letters or payment demands. Engage with creditors as soon as you receive any communication about outstanding payments. Creditors are often willing to negotiate payment plans or extensions, which can prevent the situation from escalating into legal action.

8. Build a strong relationship with your suppliers

Good communication with your suppliers is the foundation to building a strong business relationship. You can start by setting clear expectations and maintaining consistent, open dialogue. When you have a strong relationship, issues like delays or misunderstandings can be sorted out faster, and payment transactions feel more transparent.

Trusting relationships with suppliers can also lead to better payment terms, such as more time to pay, or even discounts. This helps keep your cash flow steady and ensures you can meet other financial commitments on time.

By following these eight steps, you’ll not only improve your business credit score but also position your company for long-term financial success. Start today by tracking your score with Capitalise for Business and take control of your financial health.

United Kingdom

United Kingdom  South Africa

South Africa