Tradebridge Trade and Invoice finance offers a diverse selection of funding packages designed to help businesses pay their suppliers, as well as accessing quick capital from raised invoices. Their experienced staff have supported businesses across a variety of sectors including automotive, distribution, haulage, healthcare, recruitment, retail, transportation, manufacturing and much, much more. Through invoice financing, you'll be able to advance a percentage of each invoice that you've raised to your customers. Following approval, this advance will be paid directly into your bank account with the remainder deposited, minus fees, once your client has settled their outstanding balance. Need a hand funding your supplier to take on a new order? Trade finance smoothes out the entire supply chain process by paying your supplier on your behalf. Financing is secured against purchase orders or finished goods, leaving you to focus on delivering the task in hand.

Woodsford Trade and Invoice Finance have no need to crowd source funds or seek backing from banks as they invest their own private funds. As a result, you'll have direct access to decision makers who'll work with you to ensure that they fully understanding the ins and outs of your business. A dedicated Client Manager will work with you every step of the way, helping you to manage your account as your business grows.

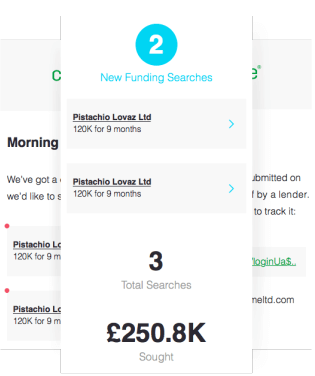

Compare Woodsford Trade and Invoice Finance today by completing your Capitalise profile in just 3 minutes. Our intuitive system will match your business with funding partners who can not only provide you with the finance your business needs, but can advise you based on their experiences lending to similar businesses within your sector.