PRO FEATURE - company finance check

Check a company's finances - know who you're working with.

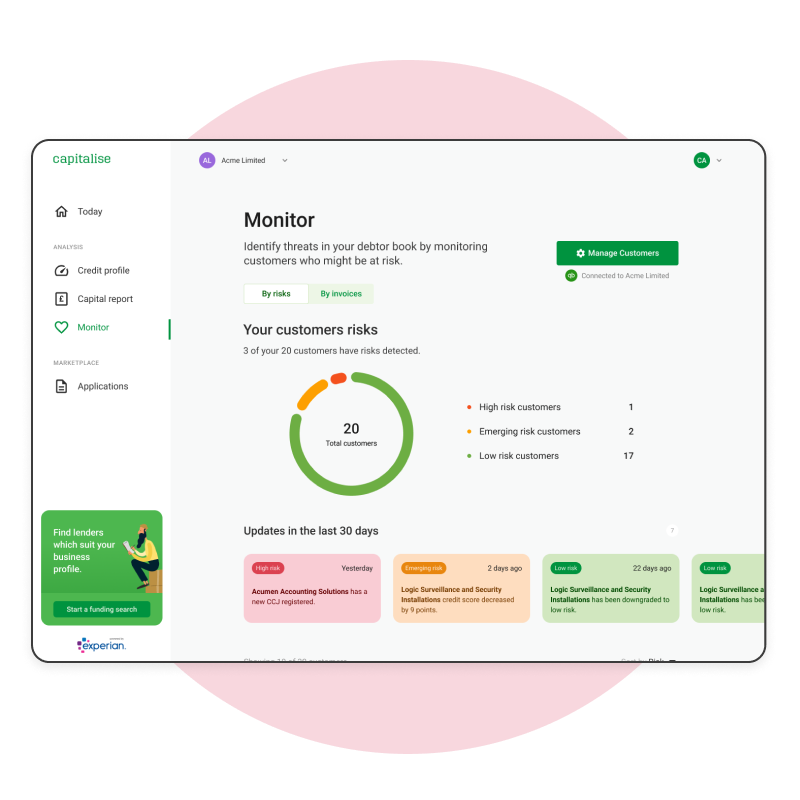

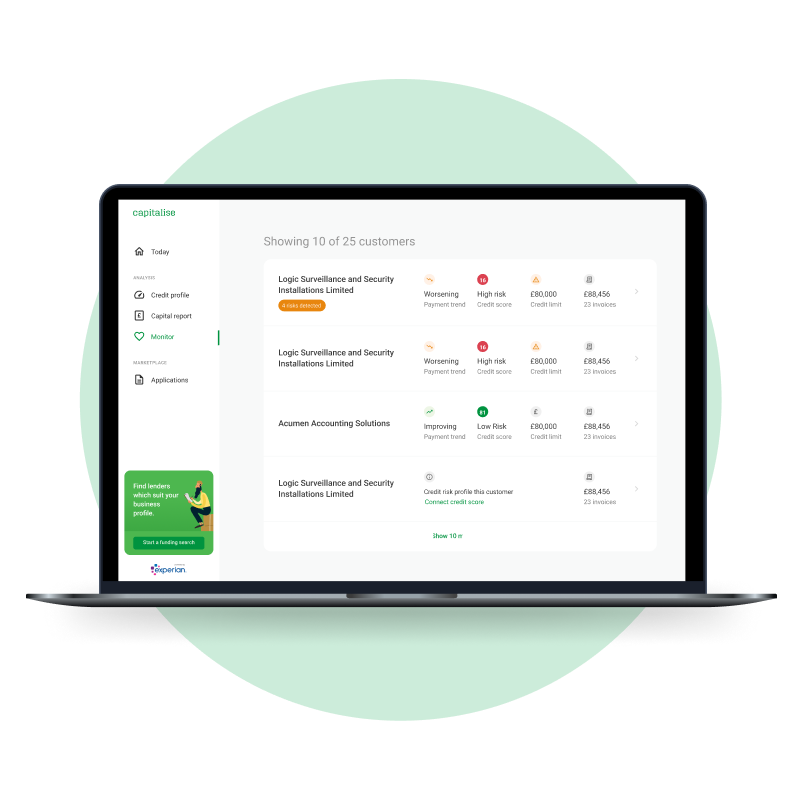

Protect your business and reduce risk in your cashflow by knowing the financial stability of your customers or competitors.

Check a UK company credit score. Get alerts on your customer's credit position and finances, by monitoring their payment performance. Get started by creating your free account