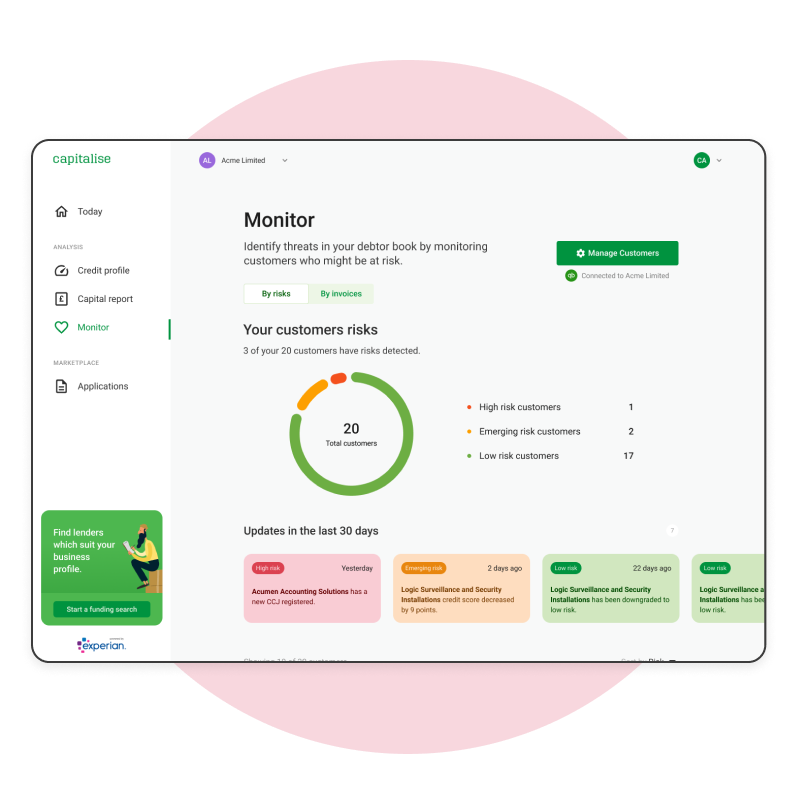

company credit check your customers

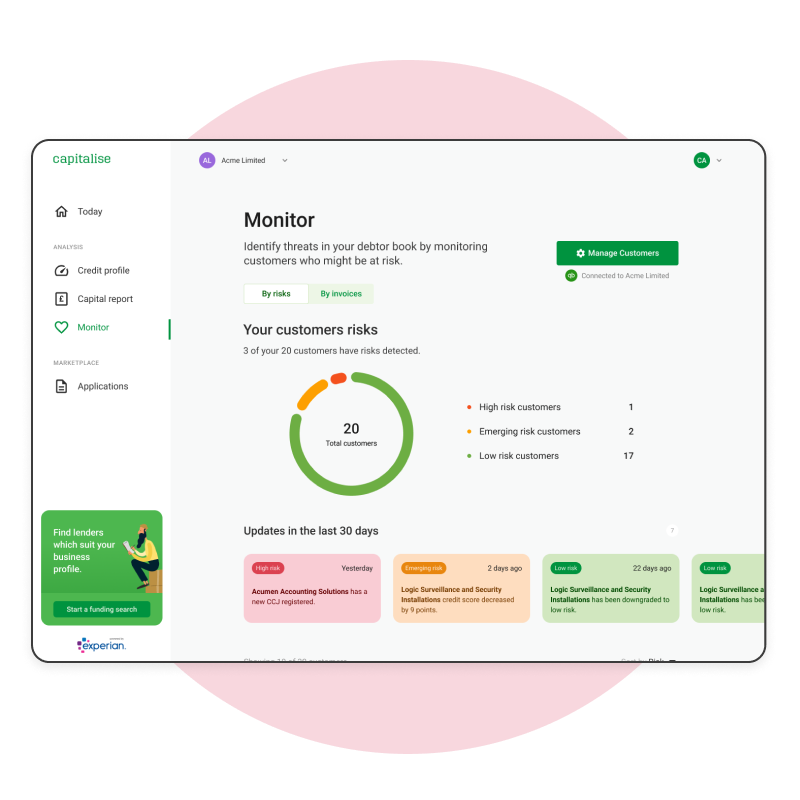

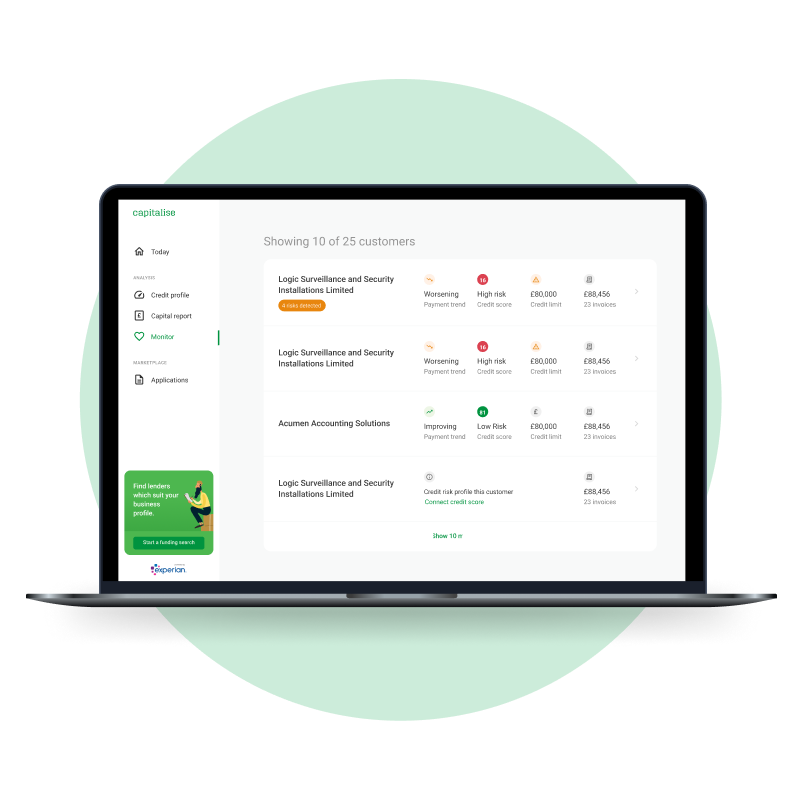

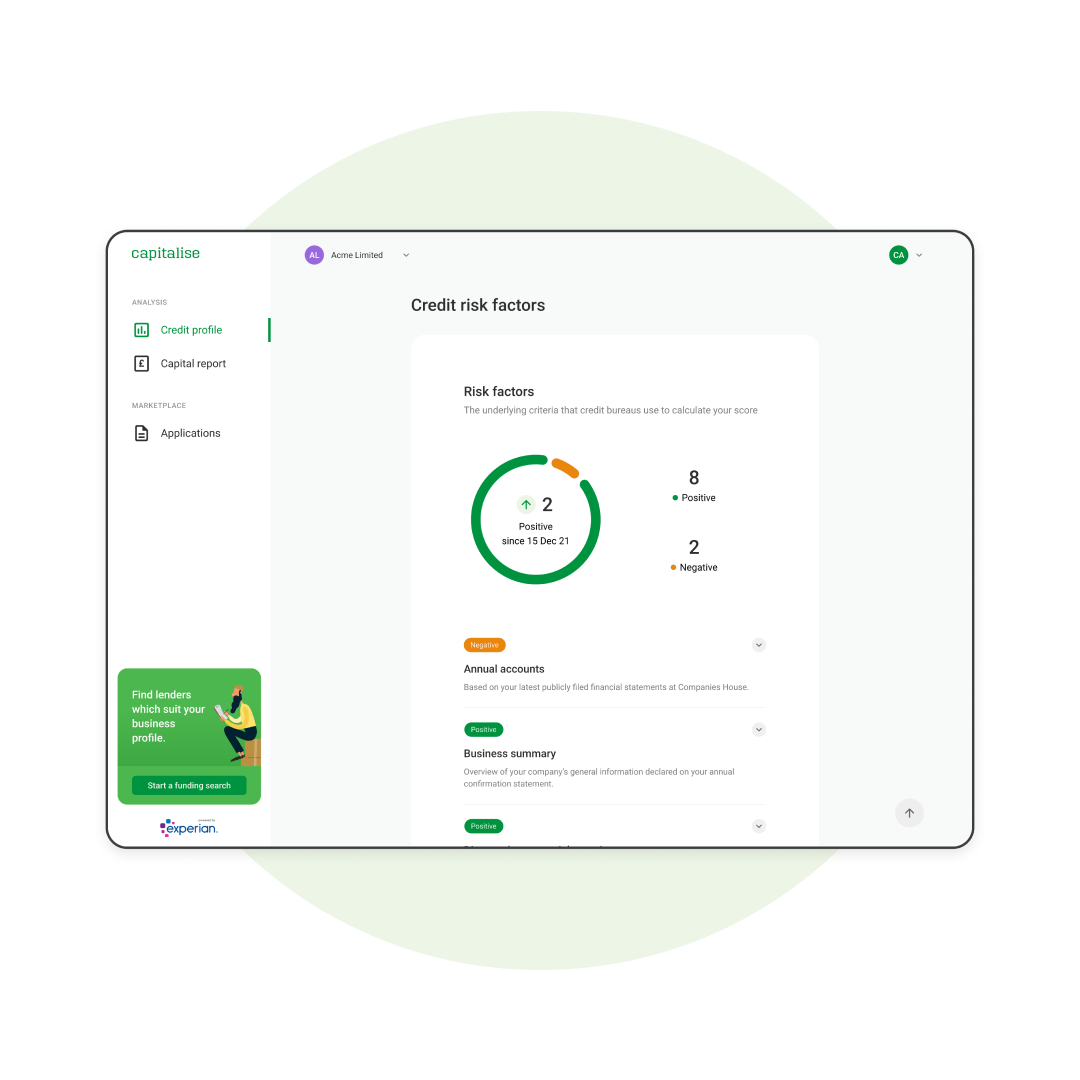

Reduce risk - check your customer's credit score

Protect your business and reduce risk in your cashflow by knowing the financial stability of your customers.

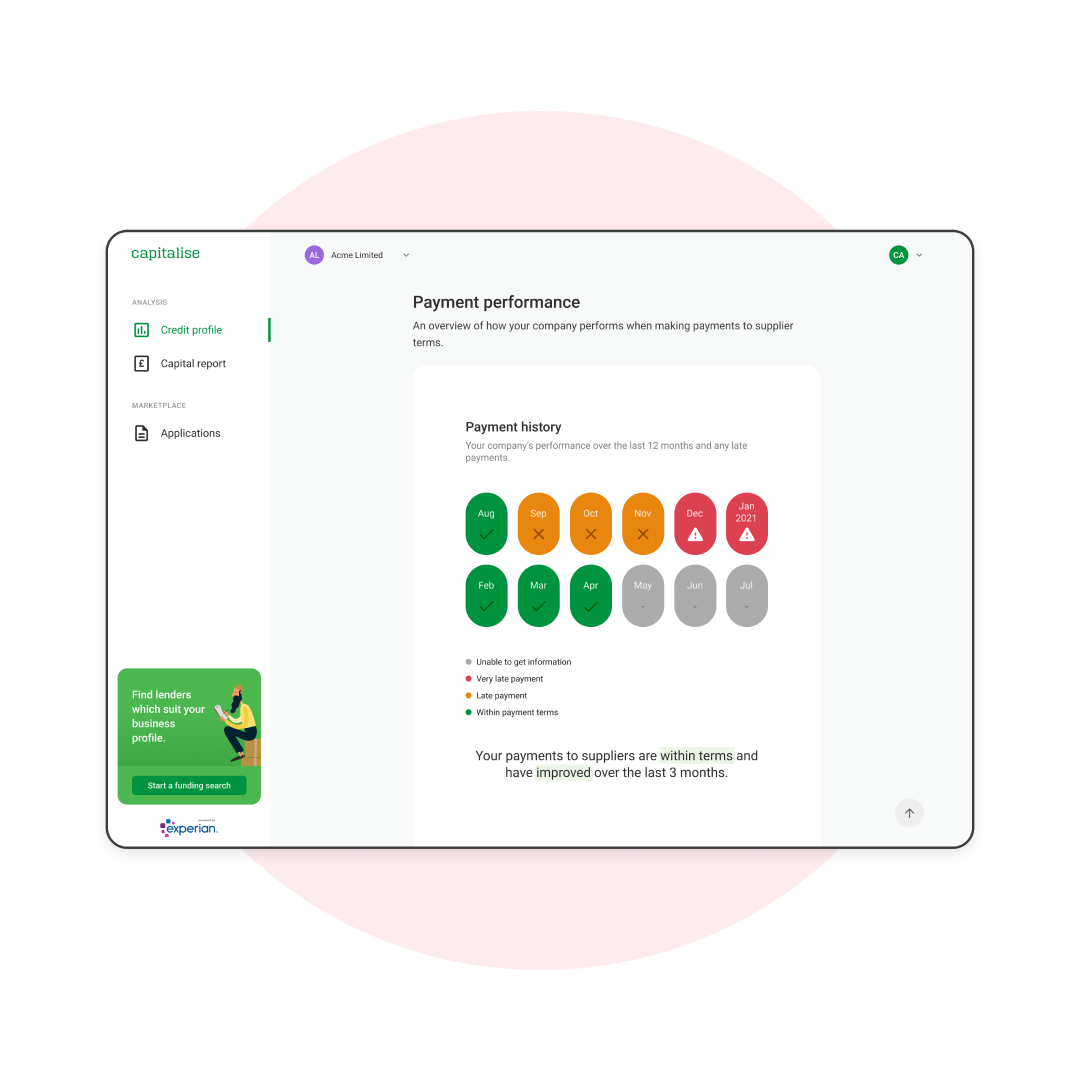

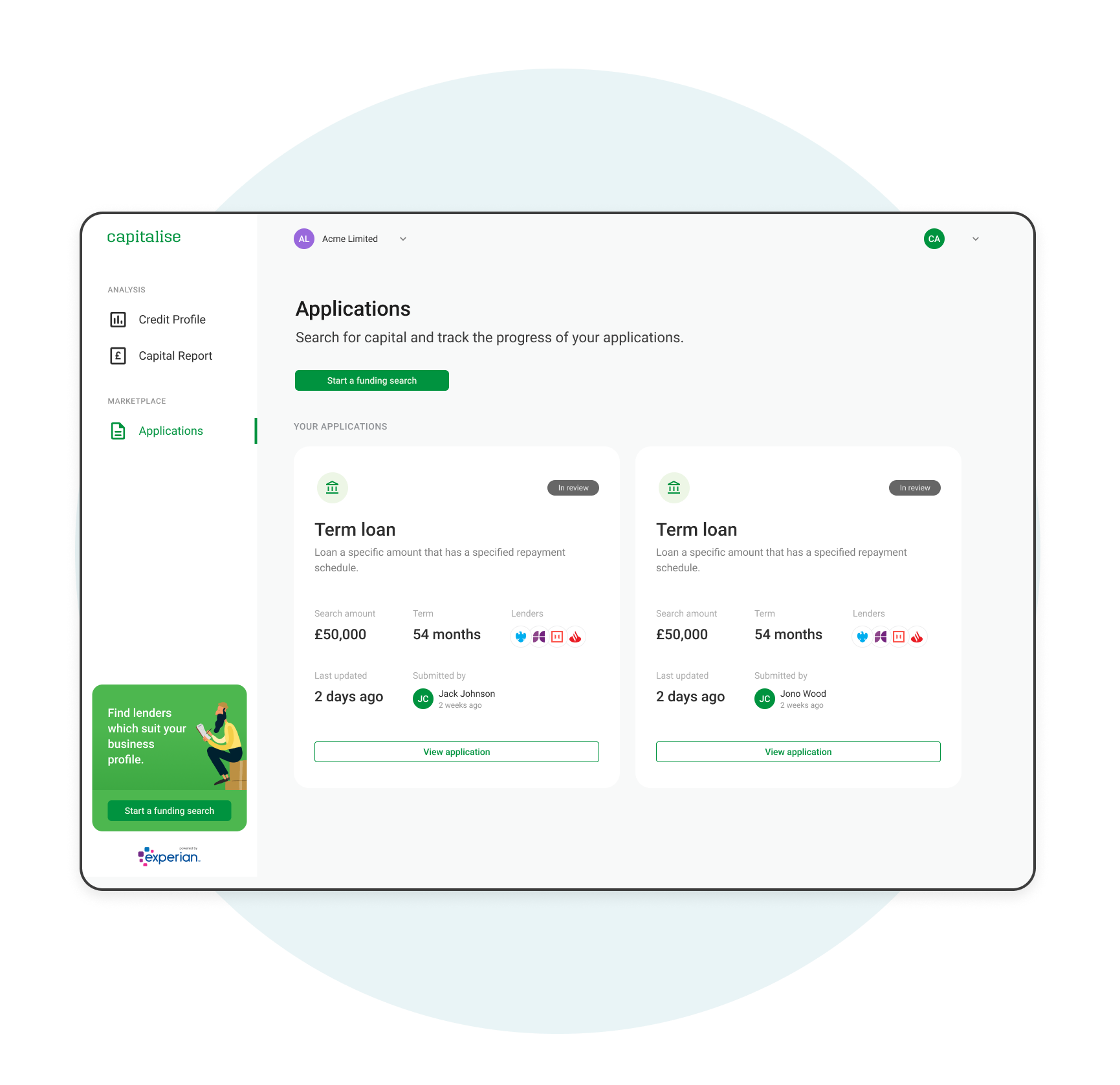

Check a UK company credit score, get alerts on your customer's credit position and monitor their payment performance. Get started by creating your free account