Recovery Loan Scheme extended until 2024

The UK government has just extended The Recovery Loan Scheme (RLS) until 2024. That’s an extra two years of more funding for more of your clients. Easing the short-term pressure of rising costs and fuel their long-term growth plans.

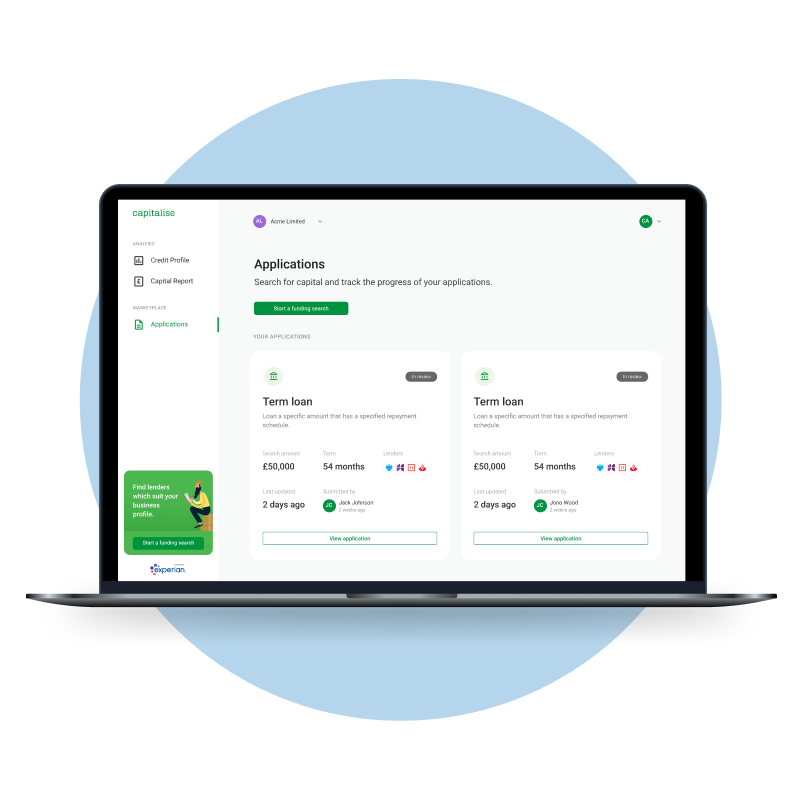

You can start an application for your clients today! ready for when the first lenders start accepting applications in August.