Property market overview

The total value of UK housing stock hit a record £7.39tn at the end of 2019, showing a £101.8bn (1.4%) gain for the year, with 40% of that value uplift attributed to new home development.

Are businesses missing a key source of funds?

The Bank of England estimates that 53% of this housing stock is unencumbered, with 47% mortgaged. This suggests that approximately a sixth of the housing market is occupied by private renters and are therefore classed as Buy-to-let, revealing a huge potential market for secured lending - both regulated and unregulated.

As we look optimistically towards recovery and CBILS, along with other government-sponsored schemes, reaches maturity, there can be no doubt that property-backed and secured lending will be some of the most resilient forms of funding on offer to businesses. Here at Capitalise, we’re committed to opening up this source of capital on our marketplace.

Property finance lenders on our marketplace

There are around 340 regulated mortgage lenders and administrators - with many more sitting in the unregulated market.

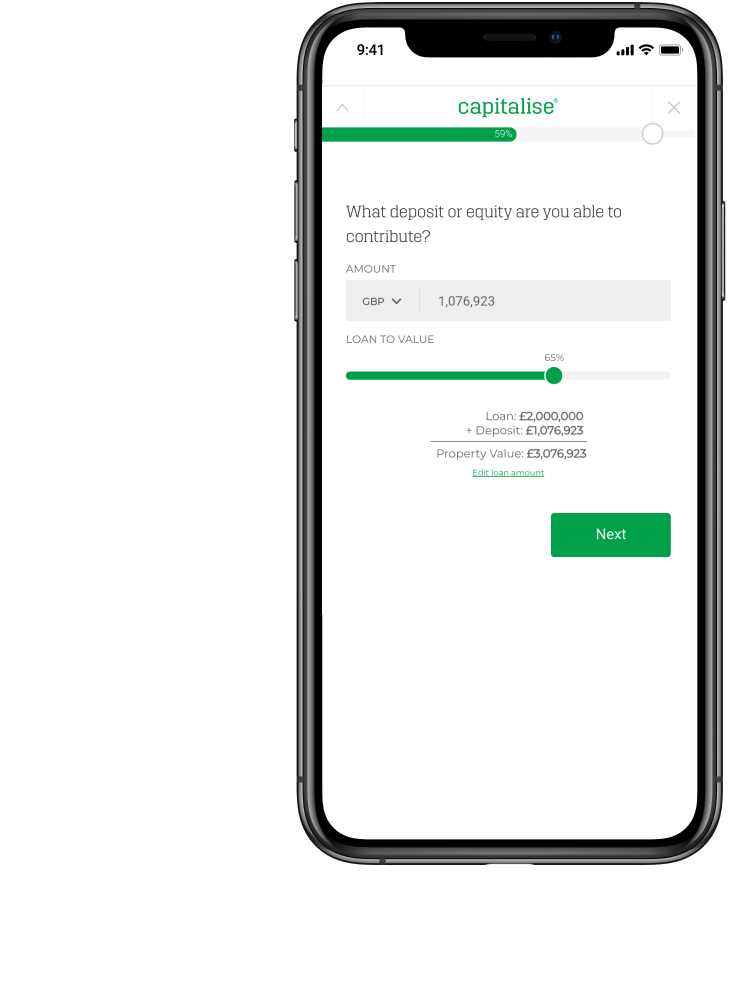

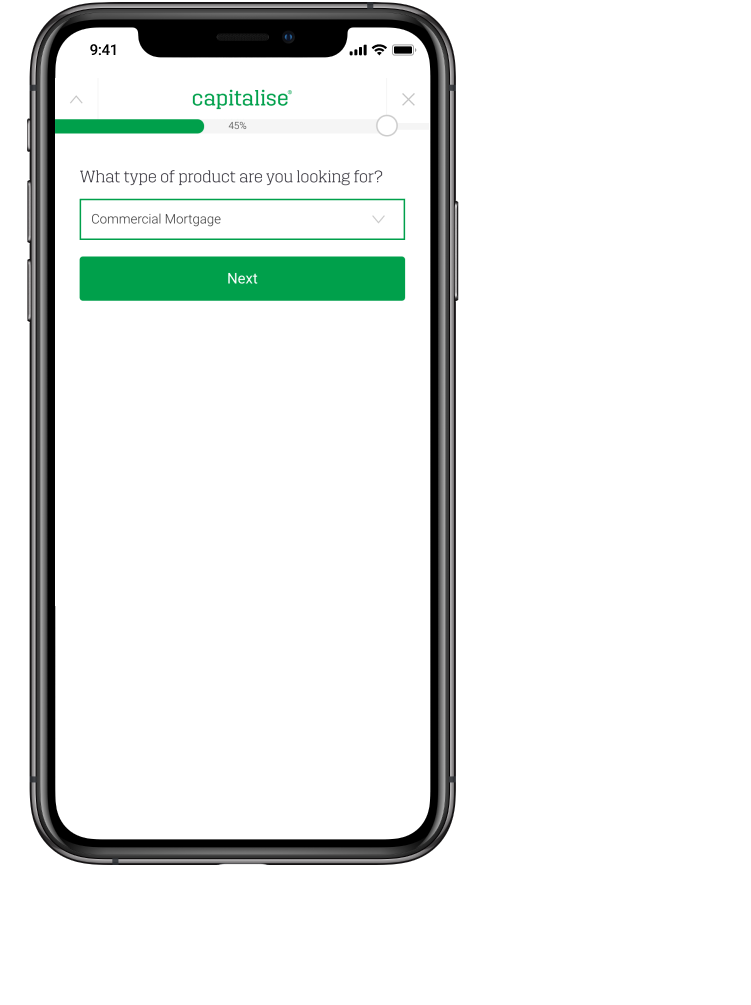

We have access to a full range of unregulated property lending on our platform, across Commercial Mortgages, Commercial Investment, BTL & BTL Portfolios, Bridging Loans, Structured Asset Finance, Development Finance and Mezzanine Finance.

United Kingdom

United Kingdom  South Africa

South Africa