On the 20 July 2022 the UK Government announced that the Recovery Loan Scheme (RLS) will stick around for an extra two years. Helping your small businesses clients juggle their post-pandemic ramp up with new pressures like increased costs and rising inflation.

The RLS extension means that more small businesses will be able to get ongoing access to between £1,000 and £2 million in funding through term loans, overdrafts, asset finance and invoice finance.

We expects the first lender to start accepting applications in August. But you can start preparing and discussing applications with your clients and our funding specialist today! Ready for when applications open.

So far, the UK government hasn’t released much information about changes to RLS after July 2022. One key change that has been mentioned, is that lenders may now ask for a personal guarantee, regardless of the amount of funding applied for.

The other fact we're sure of it the maximum amount of funding available through RLS hasn’t changed. Businesses will still be able to borrow up to £2 million through the extended scheme.

Applications for the extended Recovery Loan Scheme haven’t opened just yet but we’ll update you as soon as we know more.

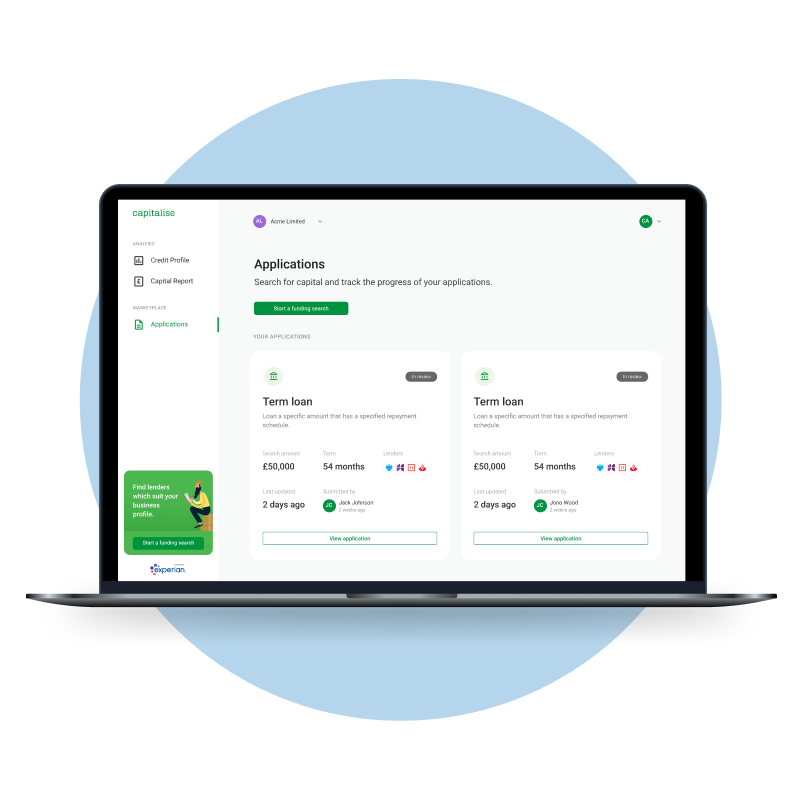

Once applications are open, you'll be able to apply for RLS funding directly from within the Capitalise platform as normal.

A straightforward cash injection you pay back over time. You might use a loan for investing in R&D, move to a new premises, or even refinance an existing loan

Speed up your business cashflow by getting an advance on money owed to you in invoices, without waiting for debtors to pay you

A loan design for purchasing assets for you're business. You might upgrade your equipment, tech, or invest in machinery

This lets spend beyond your business account balance, which could be useful if you're trying to speed up cashflow while waiting for invoices to be paid. Sometimes referred to as a Revolving Credit Facility

Once lenders have been approved by The British Business Bank you'll be able to apply for RLS funding directly from within the Capitalise platform.

Please be aware that some lenders may request additional information but this list is the minimum we need to be able to determine which lenders are

most appropriate:

• Loan amount, purpose, and term

• A short paragraph on the business background and how it has been impacted by Covid-19

• Last 2 full sets of filed accounts

• Last 12 months bank statements (PDF format & no older than 7 days)

• Shareholder & directors details - name, DOB and home address

• Up to date management accounts

• Current debt position of existing loans, facilities etc

You could use a Recovery Loan for the following business loan products:

With a Recovery Loan, term loans and asset finance facilities are available for up to six years. Business overdrafts and invoice finance are available on term lengths for up to three years.

Yes, a Recovery Loan can sit alongside existing government-supported facilities without the need to refinance - if below the maximum facility limit. Anything borrowed under CBILS or CLBILS will count towards a business’ maximum amount.

Yes, subject to meeting the scheme eligibility requirements and provided they do not borrow more than what the business is entitled to.

Eligibility is very similar to CBILS.

Provided other criteria are met, RLS is open to:

The Recovery Loan Scheme is managed by the British Business Bank on behalf of, and with the financial backing of, the Secretary of State for Business, Energy & Industrial Strategy. British Business Bank plc is a development bank wholly owned by HM Government. It is not authorised or regulated by the PRA or the FCA. Visit http://www.british-business-bank.co.uk/recovery-loan-scheme for more information.