Cash flow is the movement of money in and out of your business over a period of time. Cash flow isn’t just about how much money you're making, it's also about when you receive it and when you need to spend it. Understanding cash flow helps you anticipate financial ebbs and flows, so you can make informed decisions about when to spend, save or invest money back into your business.

Effectively managing your business cash flow helps to prevent financial strain or potential insolvency by ensuring there's enough cash to cover daily expenses like salaries, rent, utilities and supplier payments.

Knowing whether your cash flow is positive or negative gives you insight into the financial health of your business. This insight can help to make more informed decisions for the business, for example on budgeting, investment and resource allocation based on real-time data.

If you manage your cash flow well, you’ll have the flexibility to navigate changes and a cash buffer to help weather unexpected expenses or economic downturn.

Having positive cash flow means that funds are freely available for you to use to invest back into the business or in new products, markets and technology to sustain profitability.

Paying your suppliers on time is essential for building and maintaining good relationships, as well as accessing favourable terms and discounts. Managing cash flow effectively will enable you to meet these financial obligations on time.

While profitability is essential for business success, it does not guarantee positive cash flow. Effective cash flow management ensures that you can convert profits into cash and reinvest it back into your business to support ongoing operations and growth initiatives.

Lenders and creditors can assess the cash flow position of your business when making a decision about extending finance. A positive cash flow demonstrates financial stability, reliability and the ability to meet debt obligations, which can make it easier for your business to access funding.

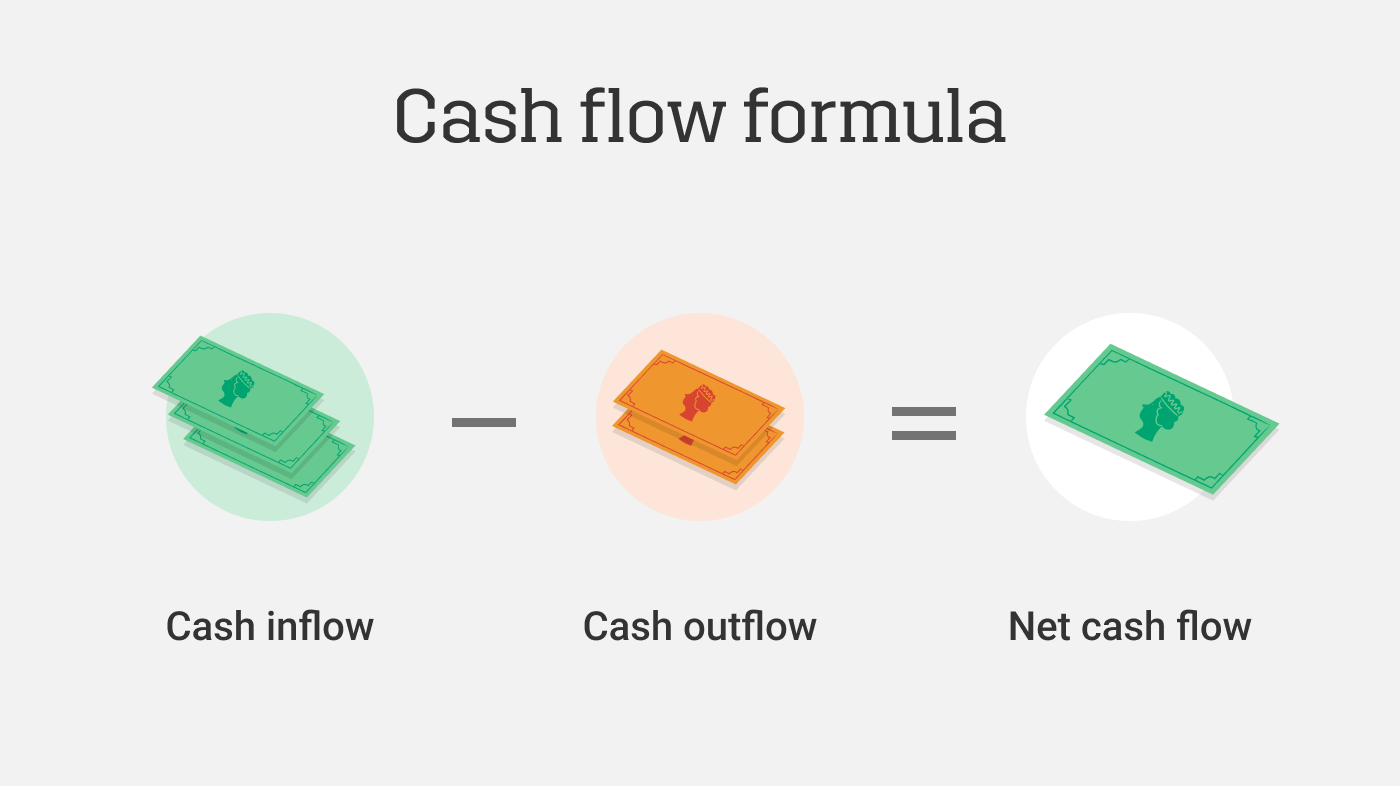

Net cash flow is the difference between the cash inflows and cash outflows of your business during a specific period. It indicates whether your business is generating more cash than it's spending.

Net cash flow is the amount of money that is coming into your business (cash inflows) minus the amount of money going out (cash outflows).

To calculate net cash flow, you can use this formula:

If the result is positive, this indicates a healthy cash flow, whereas a negative result could suggest some cash flow problems.

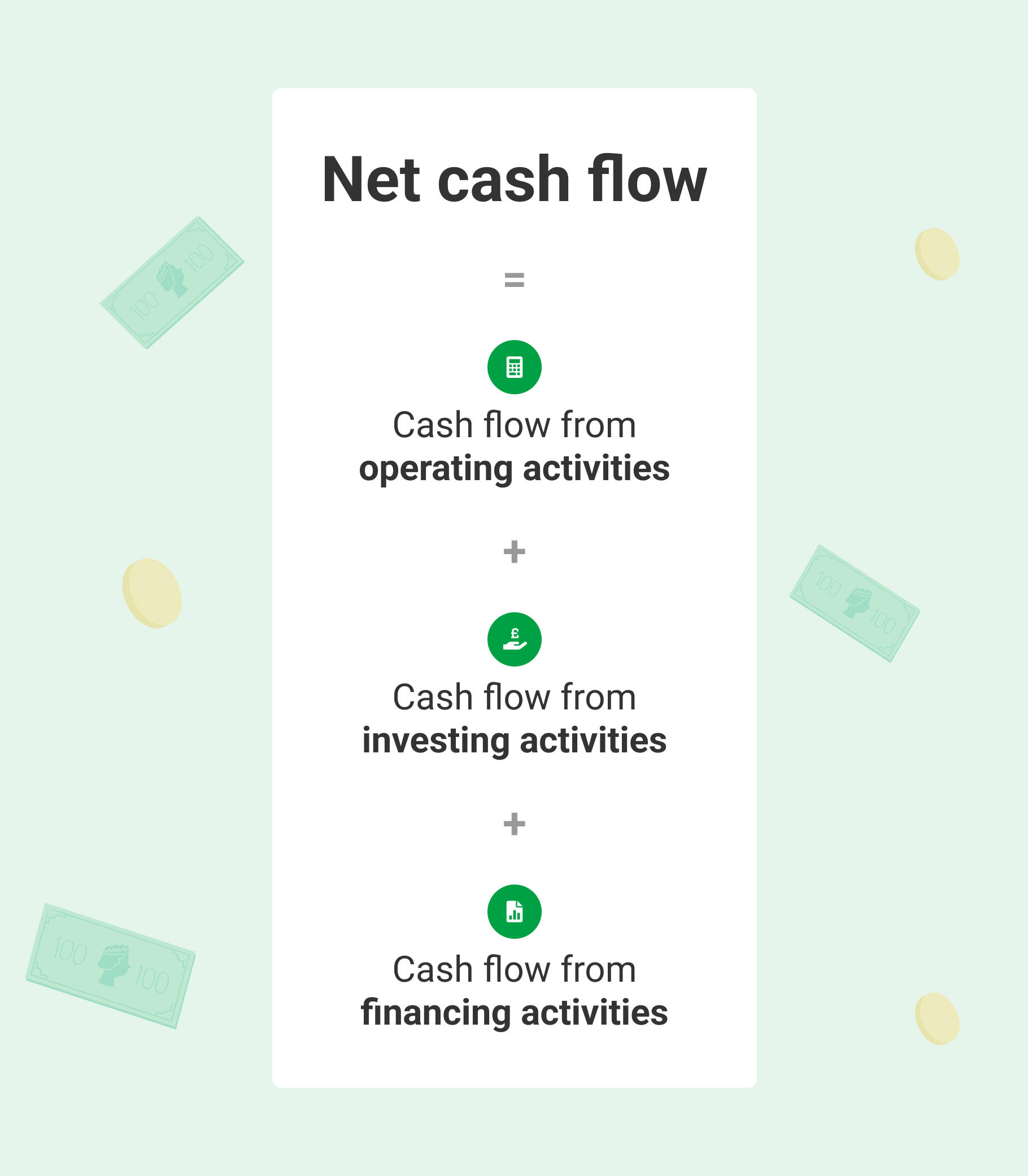

You can also calculate net cash flow by using a formula that splits cash flow by category. These categories include the cash flow from operating activities, cash flow from investing activities and cash flow from financing activities.

Using these values, you could use the following formula to calculate net cash flow:

Free cash flow represents the cash that your business has left over after covering all its operating expenses and any capital expenditure (this means cash that's invested in long-term growth through the purchase of equipment, or other assets).

Free cash flow is a critical indicator of the financial health of your business and performance. It provides insight into its ability to generate cash that can be used for various other purposes, such as paying dividends to shareholders, reducing debt, making acquisitions, or funding future growth initiatives

Here’s the formula to calculate free cash flow:

Free cash flow = Net cash from operating activities - Capital expenditures

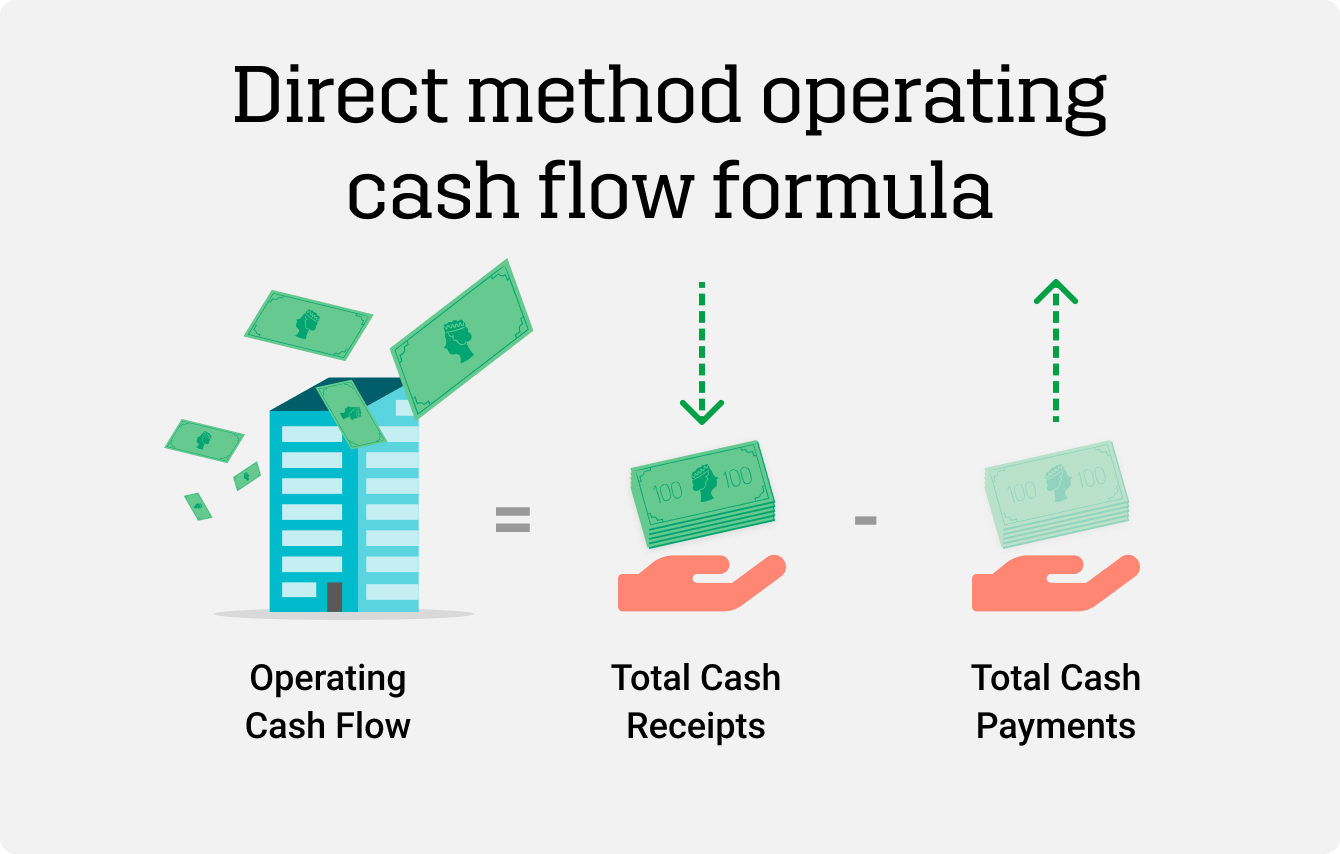

Operating cash flow (OCF) measures the cash that your business generates from its normal business operations within a specific period, typically a quarter or a year.

Positive operating cash flow indicates that the business' operations are generating more cash than they are consuming, which is generally a sign of good financial health.

Negative operating cash flow suggests that a company may be struggling to generate sufficient cash from its operations and may need to rely on finance.

Here are some tips for how you could improve cash flow:

Try to implement a good credit control process to reduce the number of customers who pay late. You could do this by clearly communicating payment terms and offering incentives like early payment discounts and penalties for late payment. This will help to mitigate the risk of delayed cash inflows.

If you have existing supplier relationships, you could try to negotiate extended payment deadlines or discounts for early payments. This can help you align your cash outflows with your cash inflows, improving overall cash flow stability.

If you’re looking to work with new suppliers, your business credit score could be the key to establishing the relationships with your best foot forward. When you first start working with a supplier, they won’t yet know how reliable your business is. This means that your business credit score is a way for suppliers to assess whether or not to offer you more credit, or better terms.

Having a good business credit score and an improved trade credit limit means you could access more credit and better terms. Try to take steps to improve your credit score over time. If you’re looking for a faster result, you could also have your credit score reviewed to see if you can boost it.

Make sure you review your expenses regularly to identify areas where you can reduce costs. You could implement cost-saving measures such as renegotiating contracts, consolidating suppliers, or optimising your inventory management to free up cash for other business needs.

If your cash flow is strained, you could explore business finance options such as a revolving credit facility or short term loans to address temporary cash flow gaps or unexpected expenses. Trade finance, or invoice finance, depending on your business’ needs, could also be used to ease cash flow by speeding up your payment cycle.

You can use historical data and future projections to forecast your cash flow. This will enable you to anticipate potential cash flow shortages so you can proactively adjust your business operations where you can.

Forecasting your cash flow allows you to predict your future cash inflows and outflows so that you can plan and manage your finances effectively. Cash flow forecasting can help with better decision-making regarding investments, expenses, and resource allocation while also mitigating financial risks such as late payments and unexpected expenses.

To create a cash flow forecast you’ll need to follow these steps:

Once you have this data, you can put it into a cash flow forecast template. We’ve created a free downloadable template you can use in Google Sheets to help you manage your business cash flow over the next year.

A cash flow statement is another tool that you can use to manage your business’ cash flow. It’s a financial document that provides detailed information on the cash inflows and cash outflows of your business over a period of time, usually a fiscal quarter.

A cash flow statement includes three main sections, these are:

Checking company credit scores plays a critical part of an effective credit control process, in ensuring you're paid on time, reducing credit risks, and maintaining a healthy cash flow. Get started today with 20 free company credit checks.

There are two methods used to create a cash flow statement: the direct method and the indirect method. Here’s how to understand the difference:

Direct Method: Tracks cash inflows and outflows directly from operating activities, offering transparency.

Indirect Method: Starts with net income and adjusts to derive cash flow from operations, aligning with accounting standards.

Discounted cash flow is a financial valuation method used to estimate the intrinsic value of an investment or project by discounting its future cash flows to present value.

Profit measures the difference between revenue and expenses over a period, whereas cash flow focuses on the actual movement of cash in and out of your business. Profit does not always equate to positive cash flow because cash flow considers factors such as timing of receipts and payments, debt repayments, and investments in assets.

If you have problems with your cash flow, it’s best practice to take proactive measures such as reducing expenses and negotiating payment terms with suppliers. You could also explore your options for finance to ease a cash flow shortage, such as a cash flow loan. There are many business funding options which can help to spread payments in a way that will work best for your business and your cash flow. At Capitalise we work with 100+ UK lenders to help match you with a suitable option for your business. Simply search for funding and speak with a dedicated funding specialist to get started.