The Growth Guarantee Scheme (GGS) is a UK Government initiative that launched on 1 July 2024, replacing the Recovery Loan Scheme. The Growth Guarantee Scheme is designed to help UK businesses access funding they might not otherwise qualify for by reducing the lender’s risk.

The Growth Guarantee Scheme exists to continue to support small businesses across the UK, offering funding options from £1,000 and up to £2 million through term loans, invoice finance, asset finance, and overdrafts. With 70% of the loan guaranteed by the government, GGS is designed to make finance more accessible for small businesses.

Whether you’re looking to expand, invest in new equipment, or strengthen cash flow, the Growth Guarantee Scheme could provide the financial support your business needs.

The terms of the Growth Guarantee Scheme are similar to the previous Recovery Loan Scheme. To be eligible, your business needs to:

The decision to offer a Growth Guarantee Scheme is always at the lender's discretion. Lenders will only choose to lend on the scheme if there is a clear affordability shown to support the loan. If the business meets their normal lending criteria, they must offer the facility on their usual commercial lending terms, instead of using the Growth Guarantee Scheme.

A straightforward cash injection you pay back over time. You might use a loan for R&D, moving to a new premises, or refinancing an existing loan.

Invoice finance enables you to speed up your business cash flow by getting an advance on money owed to you in invoices, without waiting for debtors to pay you.

A loan designed for purchasing assets for your business. You might upgrade your equipment, tech, or invest in machinery.

Business overdrafts let you spend beyond your business account balance, maybe for a new project which requires marketing investment or a bargain stock purchase.

Applications for the Growth Guarantee Scheme are open until March 2026.

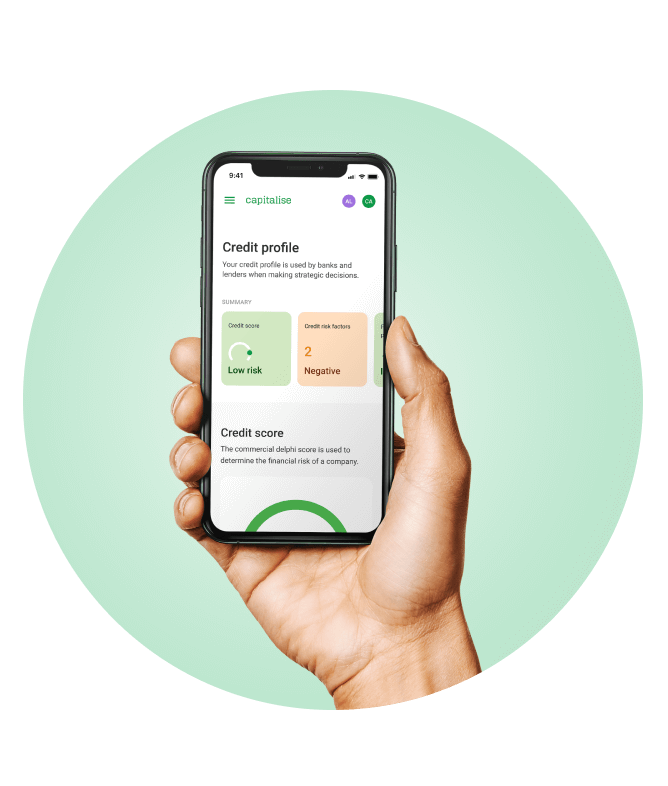

To apply, simply sign up, or login to your Capitalise for Business account. From here you can see how much you could be eligible to borrow and start your funding application.

Alongside dedicated support from a funding specialist, you will be able to apply to multiple lenders in just one application.

Lenders may ask for additional information, but these documents are typically needed:

A government guaranteed loan means the government provides a safety net for the lender. Under the Growth Guarantee Scheme, the government guarantees 70% of the loan amount. This means that if the business is unable to repay, the government will cover 70% of the outstanding balance, reducing the lender’s risk.

This backing makes it easier for lenders to offer loans to businesses that might not otherwise meet their eligibility criteria. However, it's important to note that the business remains fully responsible for repaying the loan in full.

Repayments for the Growth Guarantee Loan Scheme will start from month one of the loan. Your monthly repayments will be clearly laid out in the terms of the loan offer, if you receive one. Interest for a GGS loan also starts from month one.

The Growth Guarantee Scheme is backed by the UK Government. This means that the Government will guarantee 70% of the loan for the lender. This does not mean the borrowing business is not liable. The borrower will always be responsible for repaying the loan in full. If for a legitimate reason the business cannot repay, the Government will repay the lender up to 70%.

The Growth Guarantee Scheme is very similar to the previous Recovery Loan Scheme which ended in June 2024. As with the RLS, lenders are likely to ask for a personal guarantee, regardless of the amount of funding applied for. This is where it differs from the original Coronavirus Business Interruption Loan Scheme (CBILS) and Bounceback Loan Scheme (BBLS). Although, your main home still cannot be taken as additional security by the lender.

The maximum amount of funding available through the Growth Guarantee Scheme hasn’t changed. Businesses will still be able to borrow up to £2 million, but this is inclusive of any other previous guarantee loans which are still outstanding (such as RLS, CBILS or CLBILS) and if they were taken out after 1st August 2022. Any guarantee scheme loans taken before 1st August 2022, will not count in this calculation.

We’ve already helped numerous businesses secure GGS loans to support their growth and overcome financial barriers.

One great example is a community interest company dedicated to improving mental health support in schools and community spaces. They approached Capitalise to fund their marketing efforts and boost working capital. After submitting their application, they were approved for £74,000 on the same day, empowering them to move forward confidently with their mission.

Loans under the Growth Guarantee Scheme are partially backed by the government.

This reduces the risk for lenders, making them more willing to lend to businesses that might not have qualified otherwise. Although businesses still need to repay the full loan amount, the scheme encourages growth by making crucial funding more accessible.

The Recovery Loan Scheme was replaced by the Growth Guarantee Scheme on 01 July 2024.

A wide range of lenders accredited by the British Business Bank offer the Growth Guarantee Scheme. You can find the full list on the British Business Bank’s website. At Capitalise, we partner with 100+ UK lenders, including many offering GGS loans. With a single application through Capitalise, you can easily apply to multiple lenders at once, maximising your chances of finding the right funding fit for your business.

Yes, it is possible that a Growth Guarantee Scheme facility can sit alongside existing government supported facilities without the need to refinance, if certain conditions are met.

These are:

Any outstanding borrowing under RLS, CBILS or CLBILS taken after 1 August 2022 will count towards a business’ maximum borrowing amount.

The Growth Guarantee Scheme is managed by the British Business Bank on behalf of, and with the financial backing of, the Secretary of State for Business, Energy & Industrial Strategy. British Business Bank plc is a development bank wholly owned by HM Government. It is not authorised or regulated by the PRA or the FCA.

On the Growth Guarantee Scheme, term loans and asset finance facilities are available for up to six years. Business overdrafts and invoice finance are available on term lengths for up to three years.