Opening a new branch and expanding the reach of your business is a turning point in any company’s growth. But to finance this expansion, you’ll generally need to access some new routes to funding. If your company currently has a poor business credit score, this can be a challenge, with lenders less willing to offer you a funding deal.

The good news is that Capitalise offers a simple and effective credit improvement service that helps you turn your credit score from high-risk to low-risk.

We spoke to Nick Richardson, our Head of Funding, to hear how credit improvement helped a pizza restaurant enhance their rating and secure the best possible funding.

Helping a pizza business fire up their credit score

Helping ambitious businesses achieve their goals is at the heart of what we do at Capitalise.

A business with a strong balance sheet and excellent routes to funding is in a great position to expand and grow. But to secure the best funding deals, it’s vital for your business to also have a good credit score and a low-risk credit rating. If you’re not in control of your credit profile, you’re not truly in control of your financial management.

Understanding your business credit profile gives you an edge. If your current credit score has room for improvement, you can quickly take action to improve your rating. As Nick Richardson explains, this is how we first began working with our pizza restaurant client:

"The pizza business was looking to grow. This meant raising additional finance so they had the funds to open more restaurants in the Glasgow area. Their poor credit rating with the leading UK credit agency was holding them back from accessing the finance they needed to grow.

The company’s credit score had been affected by sector-wide downgrades in the hospitality industry during the Covid-19 pandemic. The business had also filed exempt accounts, meaning that the business was being judged on a 9-month-old view of its balance sheet. This didn’t show their recent upturn in sales or their strong revenue position.”

Taking action to improve their credit score

Unlike many businesses in the food and hospitality sector, the pizza restaurant had continued to trade successfully throughout the pandemic. The company had overcome the challenge of reduced sales from sit-down meals by expanding and diversifying their offering. The company had taken a chance by starting a new pizza delivery service and offering DIY home pizza kits.

As Nick points out, this innovative change of direction made a big difference to their finances:

"Securing a new revenue stream from pizza deliveries and DIY kits helped the business get through the lean months at the height of lockdown. And having come out the other side, the business was now in a stable financial position, unlike some of its competitors.

Working with our credit improvement partner, we were able to share the business’s full, provisional and year-to-date (YTD) statutory accounts with the credit agency. These accounts helped to demonstrate their current positive trading activity, without this forming part of their publicly viewable data. The credit agency now had a current, in-depth view of the pizza company’s finances, allowing them to reassess the restaurant’s credit score.”

The results: getting the funds to grow

Submitting updated financial records may not sound like a hugely significant move. But with an improved view of the pizza company’s recent trading, the agency was in a better position to supply an honest and reliable credit score for our client.

Small changes can have big results, as Nick explains:

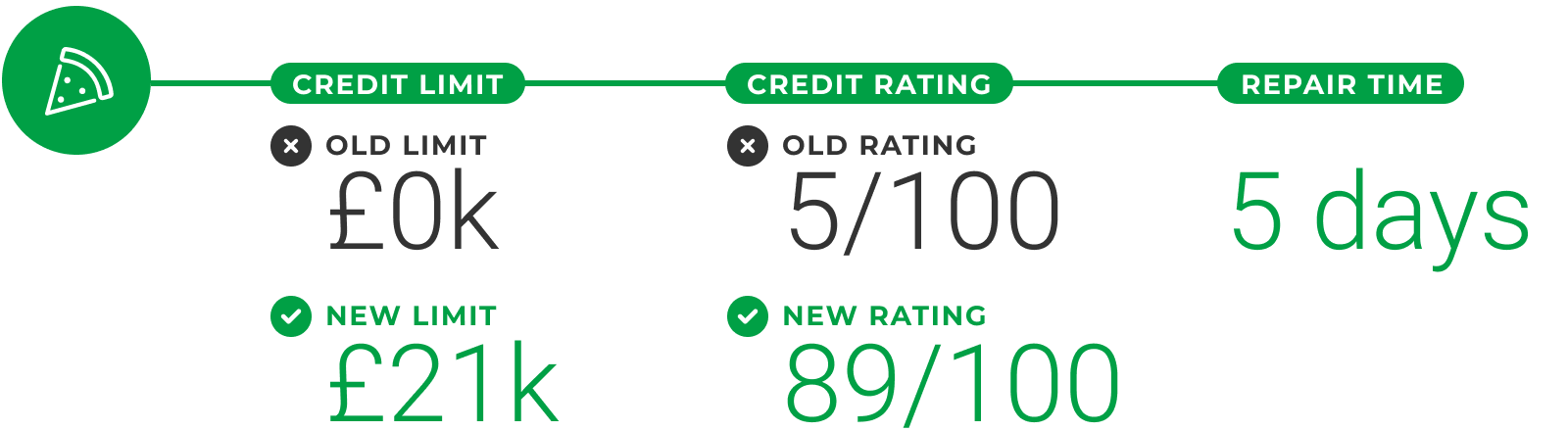

"In just five working days, we significantly improved the pizza company’s credit rating and their limit with the agency. We took the company from the maximum risk category down to a low risk category. This immediately opened up the company’s options to a panel of funders.

With an improved credit score, the pizza company owners were able to secure the funding they needed and begin the process of opening new restaurants across the city.”

Want to maximise your business credit score and open up your routes to growth funding? We’d love to talk to you about credit improvement and ways to boost your business finance.

Get in touch with us to start your credit improvement journey.

-

Call us on 020 3666 0810

United Kingdom

United Kingdom  South Africa

South Africa