Only 29% of businesses strongly agree that they keep tabs on their credit score. And just 24% know how to improve it. That’s the sobering feedback from our recent Get Fit For Business report. But with your credit score being such a critical factor in creating a financially stable business, it’s important to check your rating as regularly as possible.

We’ve pulled out five vital reasons for checking your business credit score. And how Capitalise for Business is the starting point for getting in complete control of your creditworthiness.

1. Find out your current credit score in real time

If you don’t know your current business credit score, it’s high time you found out. Your score is a measure of your creditworthiness – in other words, how much of a risk your business poses to providers of credit and finance.

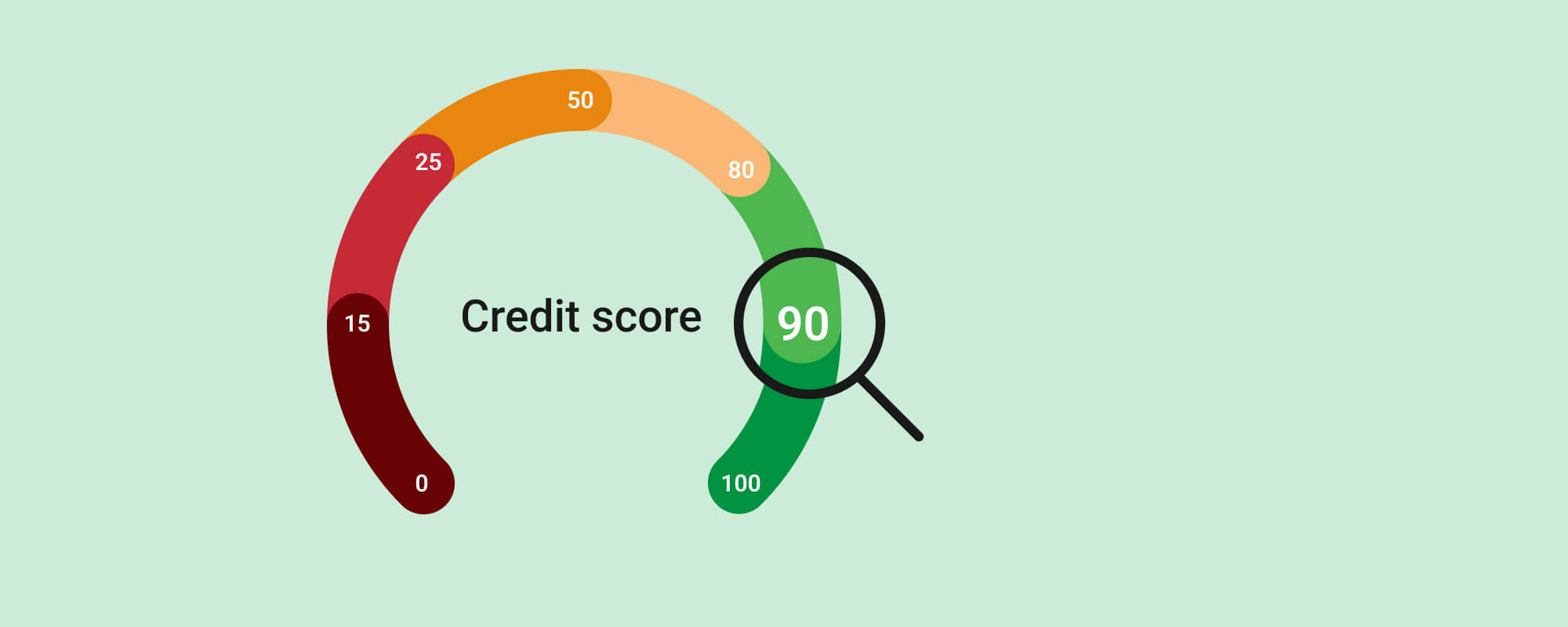

Credit agencies, like Experian, give your business a score between 0 to 100 using the Delphi scale. Having a good credit score comes down to being judged as ‘low risk’ For example, a score of 2 to 15 = maximum risk, 51 to 80 = below average risk and 81 to 90 = low risk.

Checking your score with a credit agency means:

-

You remove the mystery around your credit score

-

You can assess how your current score is impacting on your credit position

-

You can begin the process of improving your credit score

2. See how your credit score is tracking over time

76% of the leaders we spoke to keep track of their credit score – and there’s a clear reason why. Improving your credit rating is easier when you’re regularly keeping tabs on your credit score.

Improving your credit score is an important part of any good financial management strategy. By taking the right credit improvement steps, you enhance the agencies’ perception of your risk level. And the more you can do to reduce your risk, the better your credit score will be.

By tracking your score, you can:

-

Focus on credit improvement and immediately see the impact it’s having

-

Track the impact on your score over time and aim for an agreed credit score goal

-

Check for any peaks and dips in the score and take appropriate action

3. Manage your credit utilisation rate

Good management of your credit utilisation rate helps you get the best from your available credit. But what exactly does ‘credit utilisation’ mean?

Your credit utilisation rate is measured by looking at the percentage of your available credit that you’re currently using. For example, you might have a total of £10,000 in credit available on two credit cards. If your current balance on those two cards is £5,000 on one, your credit utilisation rate is 50% – you're using half of the total credit you have available.

Frequent checks on your credit position help you to:

-

Track your credit utilisation rate and keep to the recommended 30% rate or lower

-

Take action to balance out your use of credit and bring your rate down

-

Keep your rate at a manageable level, so it doesn’t have a negative impact on your credit score (a high utilisation rate can increase your risk with the agencies).

4. Improve your creditworthiness when approaching new customers and suppliers

59% of the leaders we spoke to regularly track the credit scores of their customers and suppliers. And if customers and suppliers are checking your score, you need to do everything in your power to make it the best score possible.

There are plenty of low-effort and high-impact ways to enhance your credit score. There’s no ‘instant fix’ to a bad credit score, of course. But by making small incremental improvements, you can regularly check your score and see how these changes are improving your risk rating.

Think about:

-

Improving your payment history – by always paying suppliers on time, you prove to the credit agencies that you have the liquid cash to pay your bills

-

Filing full versions of your statutory accounts – with detailed financial statements available to the credit agencies, they can make informed decisions on your credit score.

-

Nurturing your supplier relationships – if you can build better levels of trust, businesses will be more inclined to open up lines of credit.

-

Checking the industry code you’re listed under at Companies House – if you’re using a SIC code for a higher risk sector, this can have an impact on your credit score.

5. Use Capitalise for Business to keep your credit in check

It’s never been easier to check your business credit score and stay in control of your credit position. Capitalise for Business gives you all your finance insights in one place, for free!

By logging into the Capitalise for Business dashboard, you get all the info you need with just a few clicks. View a complete credit profile for your business. Check your credit score and track it over time. And apply for funding with 100+ different lenders – all through the one platform.

By tracking your score and focusing on credit improvement, you can:

-

Negotiate better terms with suppliers

-

Win more contracts with bigger clients

-

Access affordable funding with ease

-

Get ahead of risks and opportunities

Sign up for Capitalise for Business – and take control of your credit score.

United Kingdom

United Kingdom  South Africa

South Africa