Help clients build stronger businesses

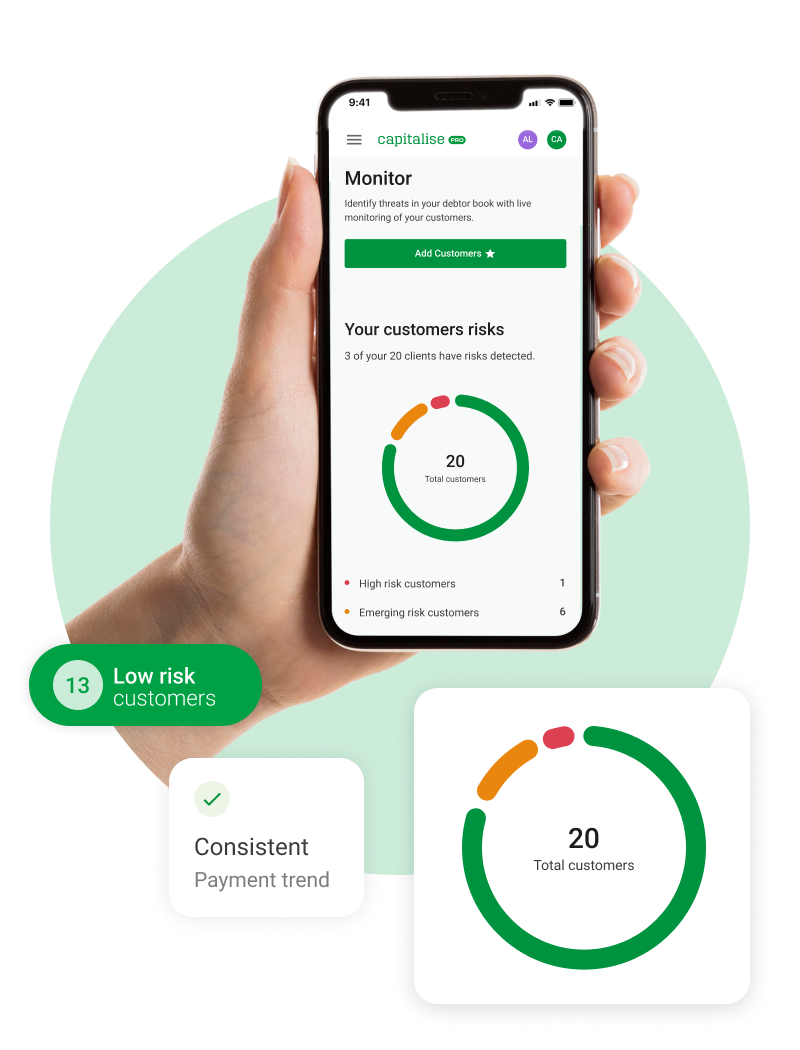

Some clients need help to keep on track with debt repayments. Other clients could easily improve their business credit rating. Monitor gives you the insight to help them take action.

We're here to help your clients on their business journey - start to exit. Support your clients who need help with business finance but without building an advisory team.

Now available with 10 clients for free - and on the Xero App Store.

Get started with 10 clients for free to fund and monitor the financial health of your clients

Already registered? Just login to start your free trial.

Help your clients access business finance from a wide panel of lenders. Create an application and we'll take it from there with support from our Funding Specialists.

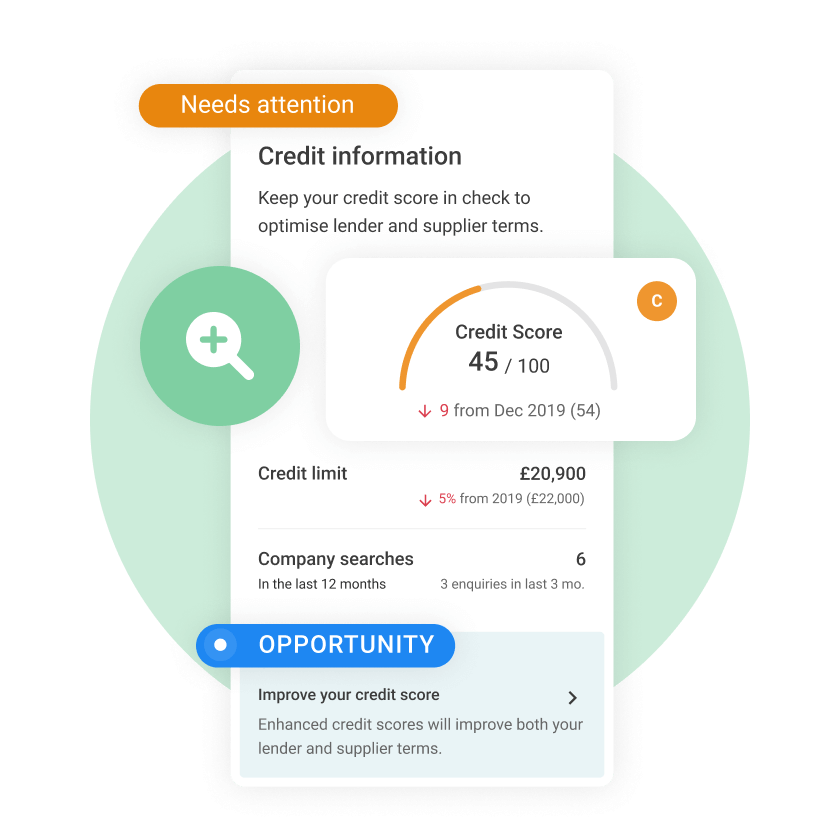

Get a credit report on every client, powered by Experian. Understand the funding eligibility and access to our Credit Review Service to seek an improve their score (an additional fee)

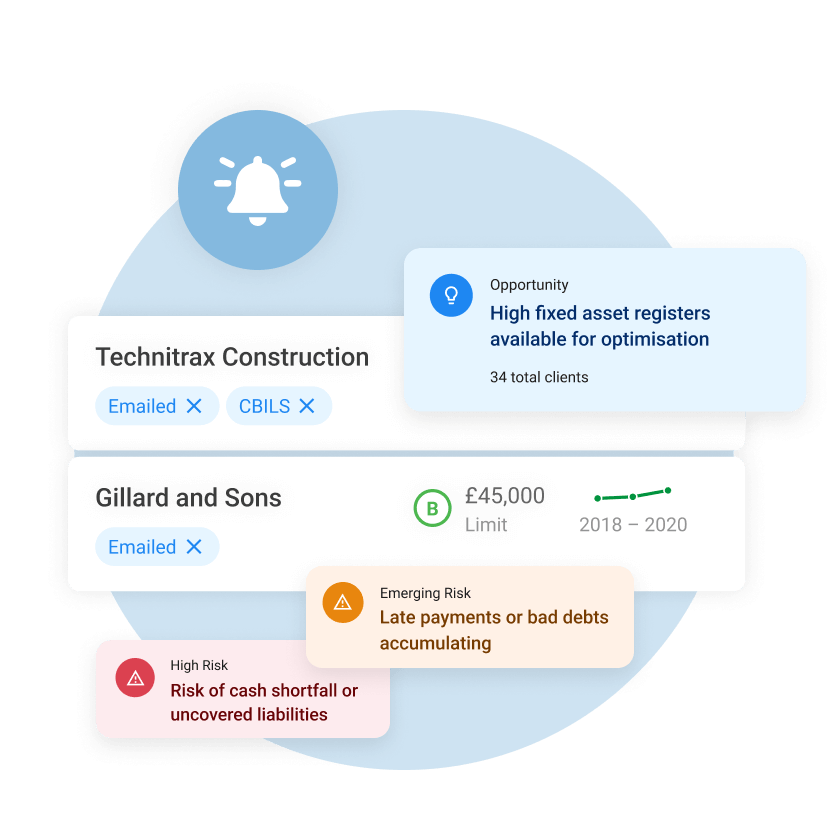

Monitor tracks over 40 health metrics for each client to make sure you're always up to speed on any risks or opportunities on each of your clients.

Work with our partner services to access industry grants, R&D Claims (and funding) plus recovering debts from the debtor book.

Our platform can work in two key ways for your firm

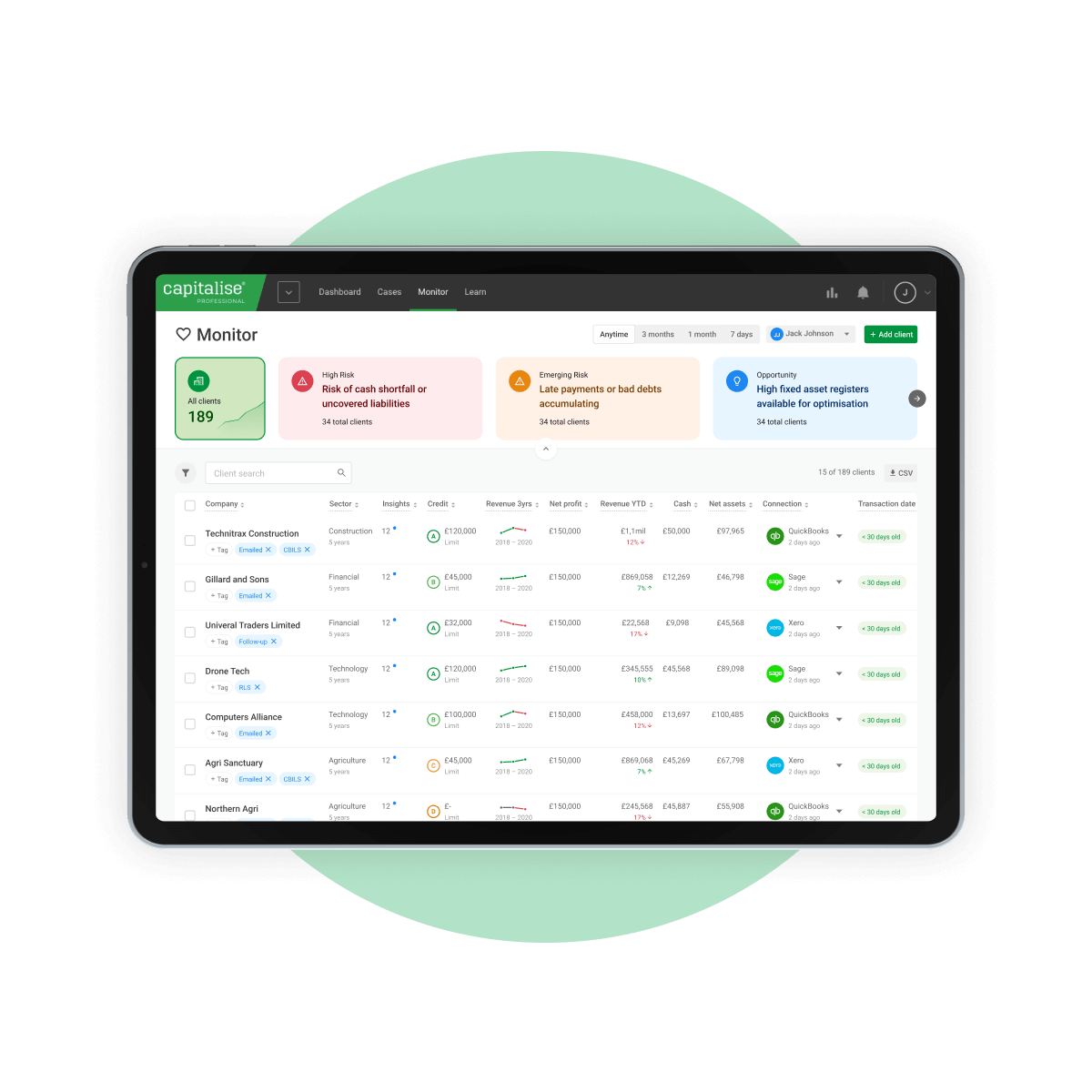

Import your client portfolio, segment and filter as needed

Import your client portfolio, segment and filter as needed

View credit scores, payment performance, CCJs and insights

View credit scores, payment performance, CCJs and insights

Track funding facilities, how they’re used and when better options are available

Track funding facilities, how they’re used and when better options are available

Get tips and talking points from our Corporate Finance Analysis

Get tips and talking points from our Corporate Finance Analysis

High risk alerts on CCJs, drops in credit scores

High risk alerts on CCJs, drops in credit scores

Emerging risks and opportunity to open up discussion points

Emerging risks and opportunity to open up discussion points

Connect with Xero, QuickBooks and Sage to get deeper insights

Connect with Xero, QuickBooks and Sage to get deeper insights

Help your clients discover a healthier way to do business

Help your clients discover a healthier way to do business

Share or download as a PDF

Share or download as a PDF

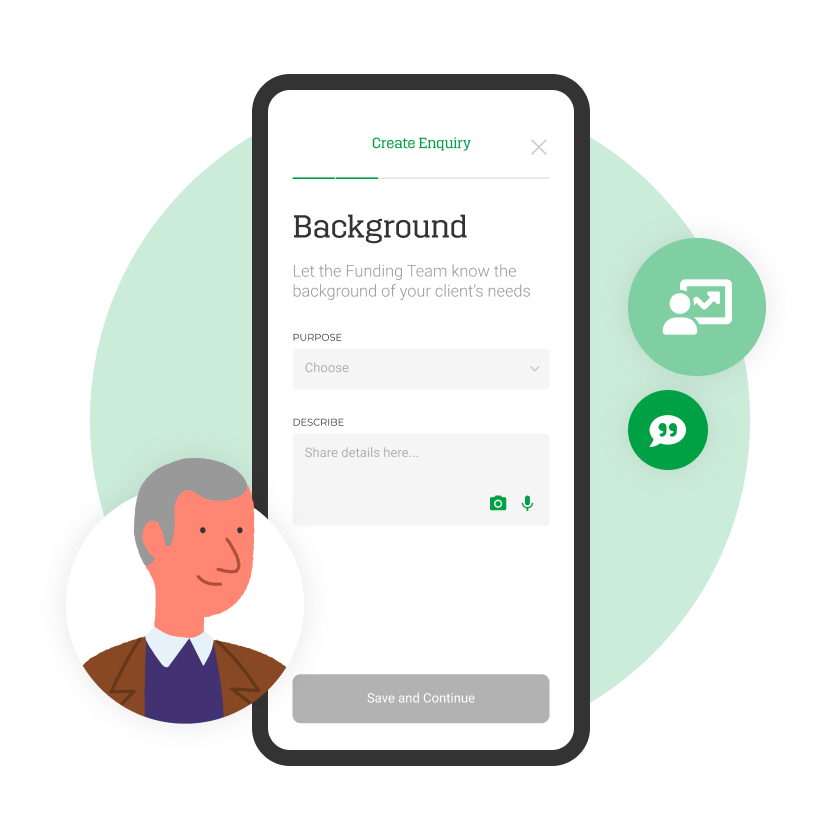

Discuss eligibility for funding, grants, R&D and debt recovery

Discuss eligibility for funding, grants, R&D and debt recovery

Open up conversations with your clients into new services with our helpful narratives

Open up conversations with your clients into new services with our helpful narratives

Get closer to your client and differentiate your service to understand your client's needs better

Get closer to your client and differentiate your service to understand your client's needs better

Onboard your clients to monitor their business, powered by Experian

Onboard your clients to monitor their business, powered by Experian

Set and control what services they can get from your firm

Set and control what services they can get from your firm

Be alerted if the client needs anything - from funding to urgent corporate action

Be alerted if the client needs anything - from funding to urgent corporate action