There are several reasons why an accounting firm should have a digital strategy for all clients, not least because HMRC’s Making Tax Digital rollout is still inevitable, despite it being delayed in the short-term.

Whilst smaller clients moved to cloud accounting easier than more established companies, there is still the need to have a transformation strategy to progress larger companies’ processes onto a digital system, even if they appear less willing to migrate from their current systems.

When cloud accounting exploded onto the market, it was initially thought it was only suitable for small businesses whose business owners wanted to personally raise invoices and process their own receipts from their mobile phone.

However, cloud systems and the accompanying ecosystem have since developed so much that they, and the apps which support the choice of general ledger package, can manage all manner of larger companies’ requirements.

Xero states that it can easily handle multi-branch companies with hundreds of employees, multiple bank accounts, overseas currencies and several payment processing systems. In fact, Xero itself, a company with around 500-1,000 employees, uses Xero to manage their own accounting.

We cover how you could support your firm to encourage clients to move to cloud accounting, so they can access more insights about their data.

Benefits for both client and accountant

- Improved client experience

By having a digital strategy, accounting firms can offer their clients a more seamless experience and enable both to be looking at the same data in real-time. Cloud data can also now link smoothly to most CRM & ERP systems providing insights across teams. Additional add-on tools for processing, analytics, forecasting or accessing capital (such as Capitalise) can help boards make better business decisions.

- Increased efficiency

Digital strategies can streamline the accounting process, making it faster and more accurate. This can help both clients and accounting firms better manage their resources and reduce costs, especially when four quarterly and one annual set of financial statements will be required post-MTD.

- Greater accessibility

A digital strategy can enable accounting and audit firms to serve clients remotely, which can increase accessibility for clients who may not be located nearby. As hybrid and nomadic working becomes more common, it is also useful when your firm’s or your client’s team members work in different locations and all need to access the same financial data from anywhere.

- Enhanced security

A digital strategy can help accounting firms to better protect their clients' financial data. With the right security measures in place, clients can be assured that their sensitive financial information is protected from cyber threats.

Firms who have made the leap to transform all clients

The International Accounting Bulletin recently interviewed some CEOs of major firms and international networks. The article “Tech and Talent to reshape accounting firms in 2023” includes several references to the digital transformation of their clients, typically all larger companies.

Shifting the accounting process to cloud data has now become the norm for their clients and this allows the firm to provide more relevant and targeted communications. Below are some examples:

- Prime Global's CEO explained that his member firm in the Netherlands has invested in a “data warehouse which enables them to take a 360-degree view of their clients. If the Government introduces new requirements in the Budget, within 24 hours clients receive a customised email explaining the specific impact on them.” Boards of larger companies will find this advice invaluable.

- Nicholsons manages the preparation of all their clients financial statements through Xero, whether their clients use it in-house themselves or not. This ensures Nicholsons own operational processes are identical across the firm. It also means when the client is ready to migrate, their financial history will already be on the platform.

- Bishop Fleming, a Top 30 firm of accountants, has become accredited as Xero Platinum Partners, Sage Business Cloud Certified Expert and a QuickBooks Platinum ProAdvisor to give their clients the choice of platforms. They offer a 1 hour “Free Accounting Systems Consultation” to discuss options and set up training.

Where to next?

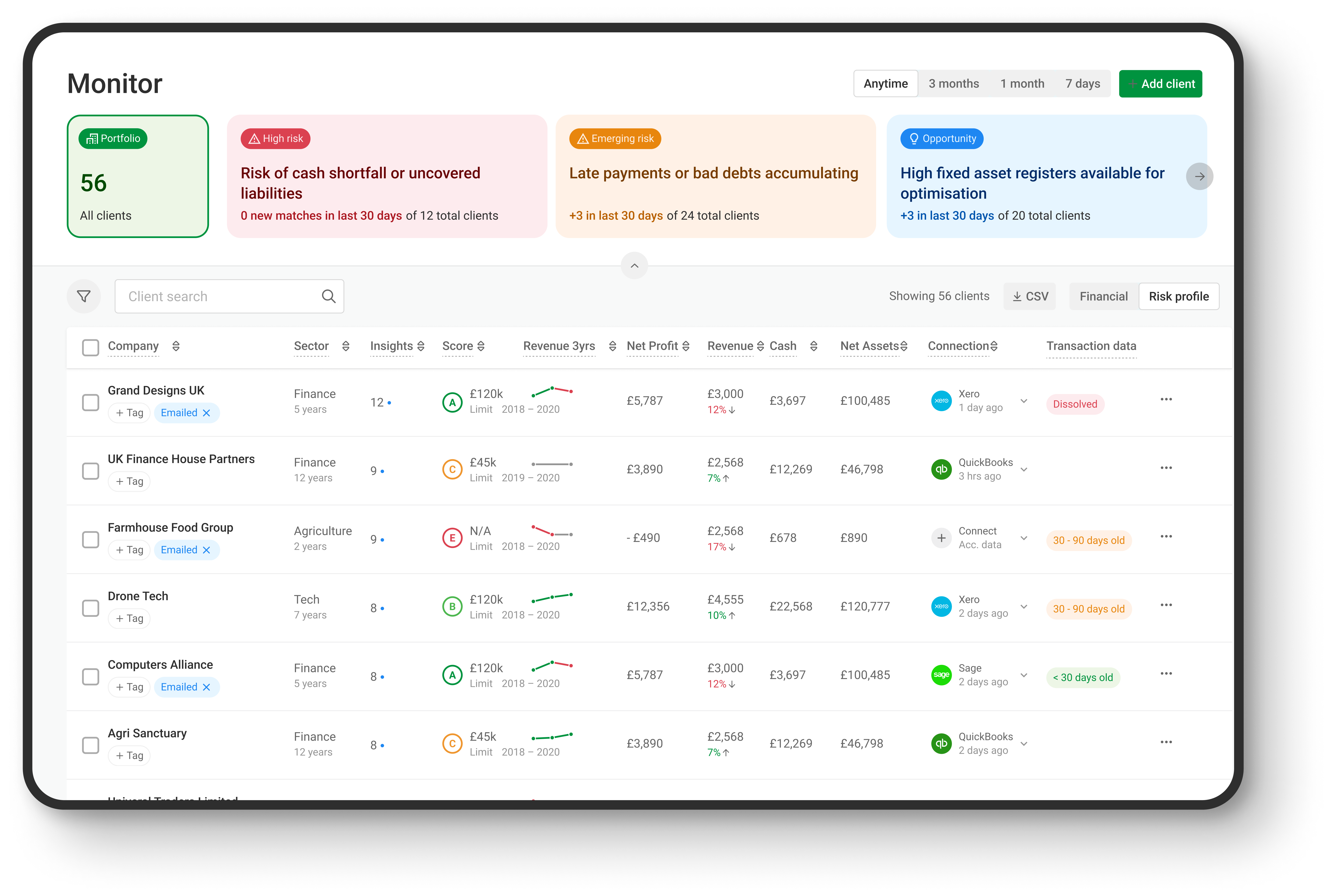

Capitalise's Monitor can provide insights on public data for all limited companies. However, when cloud accounting is also connected, the insights around potential risk and opportunities are much richer. The accompanying Capital Report can then be used by clients as part of their monthly board meeting agenda and enable them to make appropriate decisions in good time.

United Kingdom

United Kingdom  South Africa

South Africa