With all the excitement around the Capital Reports and new launches designed to make your client conversations more collaborative and actionable, we wanted to answer some of the common questions you’ve been asking us.

Check out these quick FAQs to help you better understand how you can discover new credit-based insights to lead conversations and supercharge your client meetings.

1. What is the Capital Report?

The Capital Report is a shareable feature that lives inside our Monitor platform. Designed to bring all your clients' insights together in one, easy to navigate place.

Bringing together financial performance data, credit profiles and accounting data into a single point of view of the financial health of your clients. Complete with insights and knowledgeable content, Capital Reports provides the team with the confidence to support your clients’ ambitions and form deeper relationships.

2. What is the Capital Report’s purpose?

The Capital Report was designed with the sole purpose of helping accountants have easy access to shareable data that they can share with their clients. To empower them to have more ownership of their numbers and have more purposeful conversations.

The purpose of the report is to offer you three main benefits:

- Prepare for meetings in minutes

By connecting your client’s accounting software you’ll have the talking points and data you need for your client meetings at your fingertips. Helping you save time on pre-meeting preparation and enabling you to tailor and personalise your approach to your clients.

- Spot risks and opportunities

Look at the key needs and opportunities across your whole portfolio in one place. With new filtering abilities on Monitor, you’ll be able to filter clients to explore specific opportunities such as ‘poor liquidity’ or ‘insufficient cash’. Helping you target your clients’ business risks before they become a threat, with ease.

- Share directly with clients

Capital Reports offers you the ability to share live versions of the report with your clients. Giving them insight, control and understanding of their business finance.

Helping you to have a more collaborative relationship, empowering your clients to have more ownership of their numbers. The main aim is that you’ll be better equipped to supercharge both your client conversations and your relationship.

3. What is the Capital Report made up of?

The Capital Report is a report detailing business performance and credit based data.

- Business performance: Get a clear overview of your clients’ most important business information including revenue and profit before tax – helping you better keep track and spot when there is poor liquidity in business.

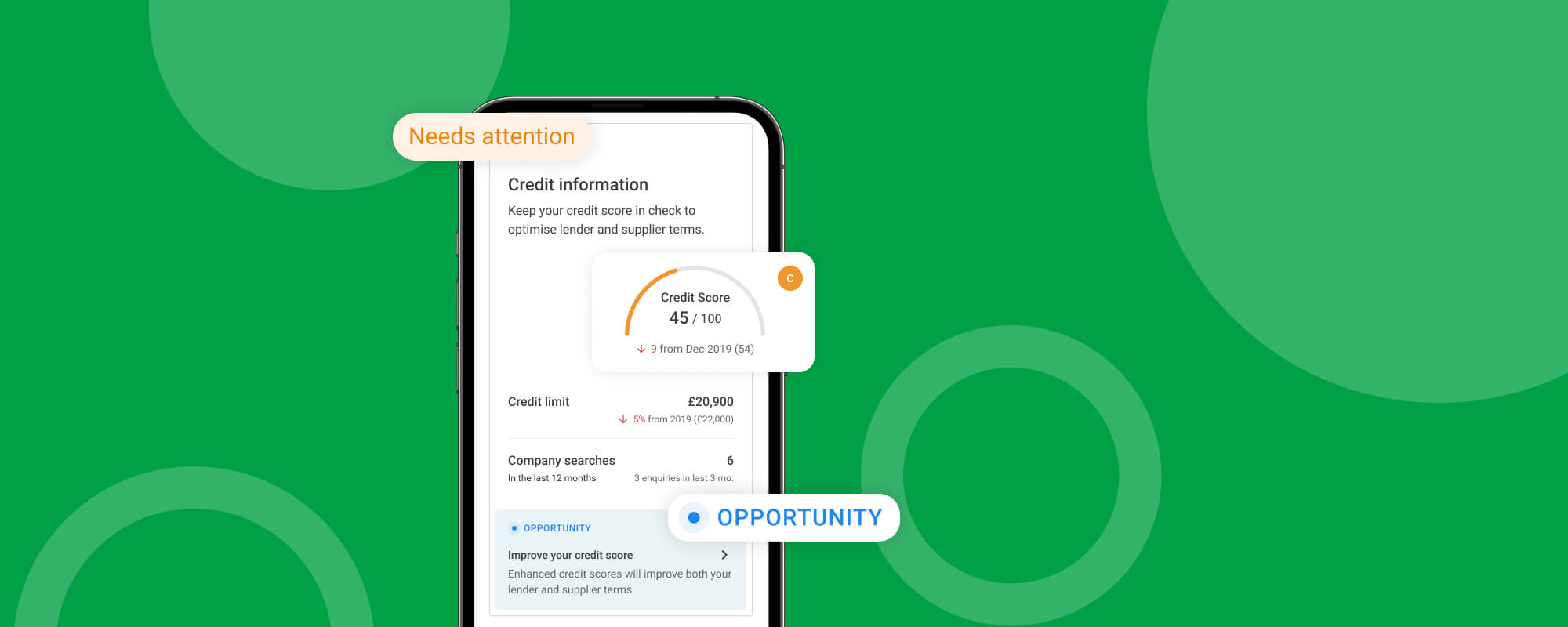

- Credit information: See credit score and risk factors as well as how many searches have been carried out in the last 12 months.

- Credit risk factors: Get notified instantly when CCJs are identified and warnings when your clients’ credit scores change.

- Payment performance: Instant notifications on business payments to get a better understanding of how your clients are making payments.

- Cash and capital: Ensure that your clients consistently have good working capital in their business. Proactively identify when there is insufficient cash to meet short term liabilities. Giving you more data to advise your clients when to take action. For example, refinancing any expensive overdraft facilities or releasing cash from high value assets.

4. What do I do with the Capital Report?

The Capital Report is designed to help you become a go-to mentor for all your clients. Giving you the tools to get insights at your fingertips, enter meetings with more data and all without the extensive prep.

You’ll feel more confident about delivering quality conversations to your clients that help them better reach their business goals and build healthier businesses.

Log in to the platform to check out all these features for yourself.

United Kingdom

United Kingdom  South Africa

South Africa