Improve your credit score. Get better funding. Reduce risk to your business.

All when you upgrade to Capitalise for Business Pro from £19/month

Unlock your full business credit profile, including your actual business credit score as the banks and lenders see it. Capitalise is the only platform that uses those in-depth Experian insights to match your business with funding!

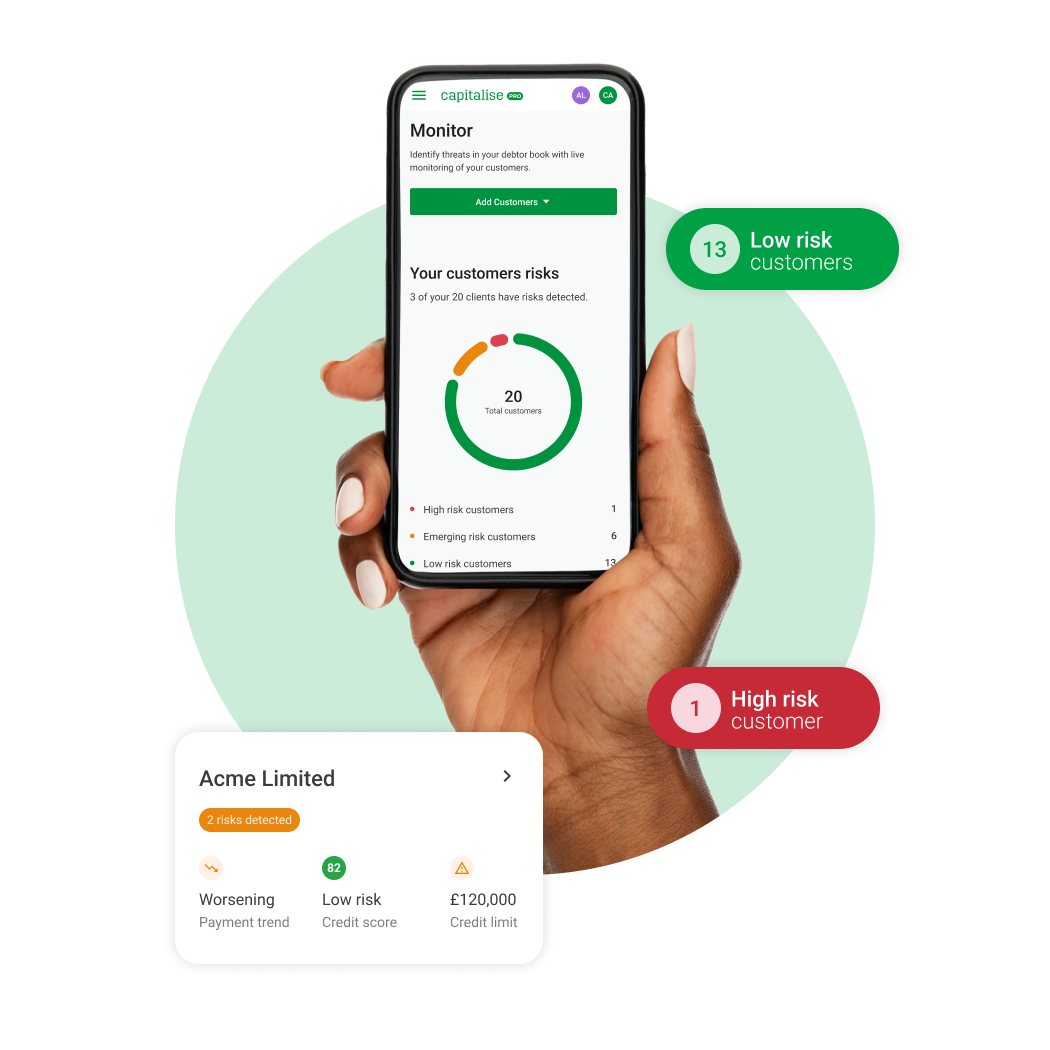

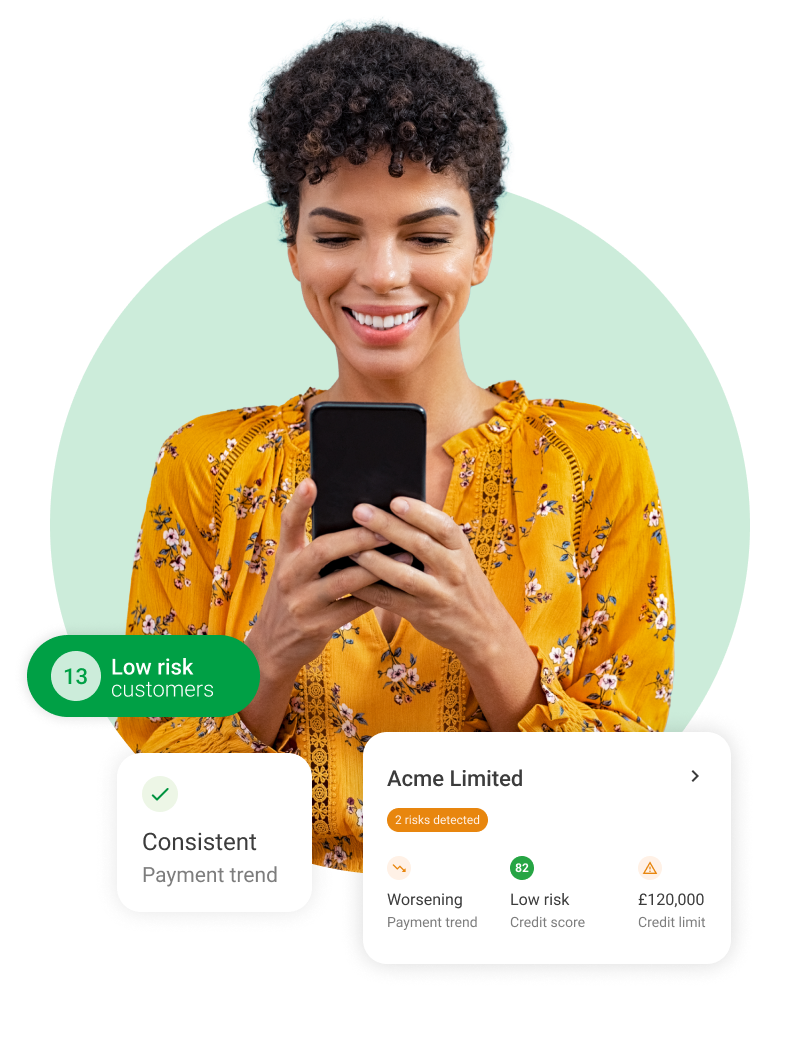

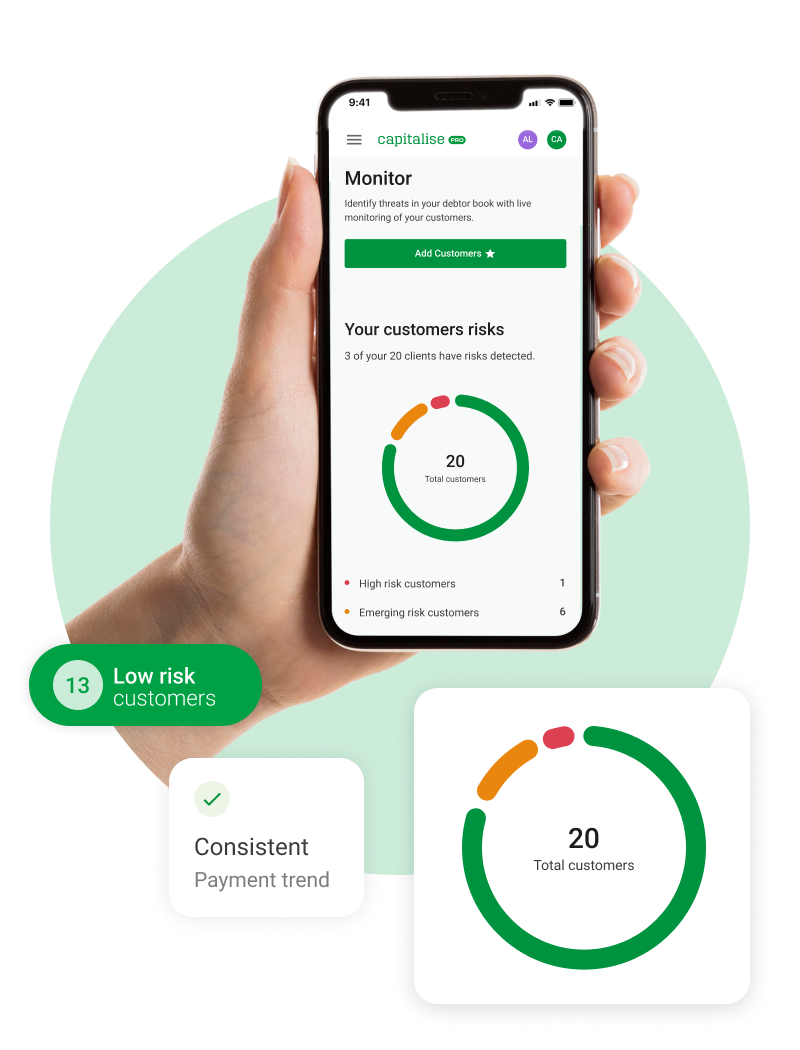

Get instant alerts on changes to your score and a free consultation with a credit specialist. Credit check up to 100 other businesses, monitor their payment performance and get alerts on changes to their financial situation.

Using instant alerts and specialist support, you have all the tools to improve your business credit score. You’ll win new customers and negotiate better terms with suppliers. With a better credit score powered by Experian insights, you can access more affordable funding..

Make stronger, more strategic decisions by sussing out the financial stability of other businesses. You’ll know how much trade credit to offer or expect, whether your invoices are likely to be paid on time and how well your competitors are doing.

Spot risks early and boost your balance sheet with better funding

A good place to start understanding your company credit profile.

Recommended

Recommended

Your full credit profile plus 10 company credit checks.

Your full credit profile plus 100 credit checks.Ideal for finance and compliance teams looking for a risk management tool.

Learn more

Learn more

Your business credit score: Basic score

Your business credit score: Basic score

Credit risk factors: Basic factors

Credit risk factors: Basic factors

Payment performance on trade accounts

Payment performance on trade accounts

Your business credit score: Actual score

Your business credit score: Actual score

Credit score history

Credit score history

Credit risk factors: All factors

Credit risk factors: All factors

Underlying criteria impacting your score

Underlying criteria impacting your score

Payment performance on trade accounts

Payment performance on trade accounts

Tracks bank accounts and borrowing

Tracks bank accounts and borrowing

Legal notices

Legal notices

PDF download

PDF download

Notification on changes

Notification on changes

Your business credit score: Actual score

Your business credit score: Actual score

Credit score history

Credit score history

Credit risk factors: All factors

Credit risk factors: All factors

Underlying criteria impacting your score

Underlying criteria impacting your score

Payment performance on trade accounts

Payment performance on trade accounts

Tracks bank accounts and borrowing

Tracks bank accounts and borrowing

Legal notices

Legal notices

PDF download

PDF download

Notification on changes

Notification on changes

Your business credit score: Actual score

Your business credit score: Actual score

Credit score history

Credit score history

Credit risk factors: All factors

Credit risk factors: All factors

Underlying criteria impacting your score

Underlying criteria impacting your score

Payment performance on trade accounts

Payment performance on trade accounts

Tracks bank accounts and borrowing

Tracks bank accounts and borrowing

Legal notices

Legal notices

PDF download

PDF download

Notification on changes

Notification on changes

Learn more

Learn more

Tips on how to improve

Tips on how to improve

Credit review with Experian: £495

Credit review with Experian: £495

Tips on how to improve

Tips on how to improve

Consultation with a specialist

Consultation with a specialist

Credit review with Experian: £375 (save £120)

Credit review with Experian: £375 (save £120)

Tips on how to improve

Tips on how to improve

Consultation with a specialist

Consultation with a specialist

Credit review with Experian: £375 (save £120)

Credit review with Experian: £375 (save £120)

Tips on how to improve

Tips on how to improve

Consultation with a specialist

Consultation with a specialist

Credit review with Experian: £375 (save £120)

Credit review with Experian: £375 (save £120)

Learn more

Learn more

Check credit scores of other companies

Check credit scores of other companies

Check credit scores of other companies: 3 checks

Check credit scores of other companies: 3 checks

View company credit profiles

View company credit profiles

Understand risks to cash flow

Understand risks to cash flow

Company financials

Company financials

Alerts when risks are detected

Alerts when risks are detected

Check credit scores of other companies: 10 checks

Check credit scores of other companies: 10 checks

View company credit profiles

View company credit profiles

Understand risks to cash flow

Understand risks to cash flow

Company financials

Company financials

Alerts when risks are detected

Alerts when risks are detected

Check credit scores of other companies: 100 checks

Check credit scores of other companies: 100 checks

View company credit profiles

View company credit profiles

Understand risks to cash flow

Understand risks to cash flow

Company financials

Company financials

Alerts when risks are detected

Alerts when risks are detected

Learn more

Learn more

Access 100+ lenders

Access 100+ lenders

Marketplace specialist support

Marketplace specialist support

Access 100+ lenders

Access 100+ lenders

Marketplace specialist support

Marketplace specialist support

Access 100+ lenders

Access 100+ lenders

Marketplace specialist support

Marketplace specialist support

Access 100+ lenders

Access 100+ lenders

Marketplace specialist support

Marketplace specialist support

Get your business credit score professionally reviewed by Experian and see if you can boost it.

Reduce risk to your business by running company credit checks on customers, suppliers and competitors

Get matched with the right lenders for your business with a single search.

A credit score is the measure of how creditworthy your business is. In other words, your score shows a bank or lender how much of a risk it would be to lend your business money. The higher your score, the more likely it is that your business can pay back any debt, for example the repayments on a loan. Credit agencies each have their own scale for calculating your credit score. Our credit agency partner, Experian, uses the Commercial Delphi Score with scores that range from 0 (the highest risk) to 100 (the lowest risk).

Your credit score is important because it’s a measure of the financial health of your business. Not only does it show your financial position today, but it can be the difference between a healthy and unhealthy position in the future. The higher your credit score, the more funding you can get to fuel everyday operations and ambitious next steps. Businesses with higher scores can negotiate better terms with suppliers and are more likely to win contracts with new clients.

Read more about credit scores and why they’re important here.

There are several factors that affect your credit score – both positively and negatively. These include how promptly you pay suppliers and whether or not you have any legal notices against your business. Your Companies House SIC code is also a factor and so is your filing history. Credit agencies will also consider the age, industry and location of your business as well as certain information about its directors.

The exact steps you need to take to improve your credit score will be specific to your business and the factors that are having a negative impact. But here are some general guidelines you can use to get started:

Read more about improving your credit score here.

Your personal credit score measures how creditworthy you are as an individual. In other words, could you personally pay back a debt? If you wanted an overdraft on your personal bank account for example, your bank would look at your score to decide whether you’d be able to make the monthly payments. Your business credit score is a measure of how creditworthy your business is. If you applied for a business loan, the lender would look at your business credit score to decide whether your business would be able to keep up the repayments.

You can check your credit score right now by signing up to Capitalise for Business. If you’re already signed up, you can check your score at any time by simply logging in.

With Capitalise for Business, you can access all your credit score insights starting at £19/month (plus VAT). Every time you log in, you’ll be able to see: