With business loans, as with personal loans, repayments are made monthly across the term of the product. E.g. 12 months, 24 months etc.

Lenders will consider some of the following criteria:

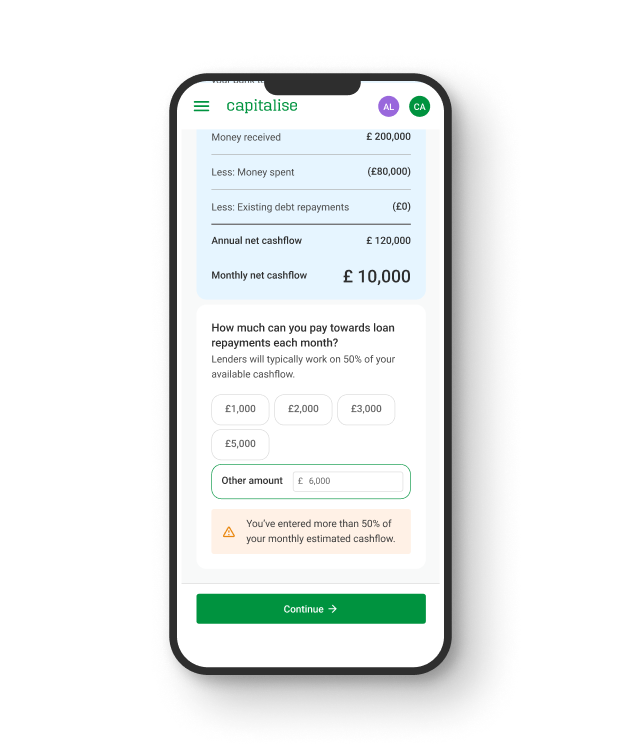

For example, if your business took a £120,000 loan for 2 years then it would need to repay £5,000 plus interest every month. This means that your business would need to generate significantly more than £5,000 each month in cash to comfortably afford that loan. This is what lenders are looking at when it comes to affordability.

This repayment must from the profit in your business (or free cashflow in technical speak) and come after different expenses you might have in the business have been deducted. This will include any existing repayments, dividends or periodic payments you might have.

Our Funding Calculator can help you calculate how much you might be able to borrow with a certain budget.

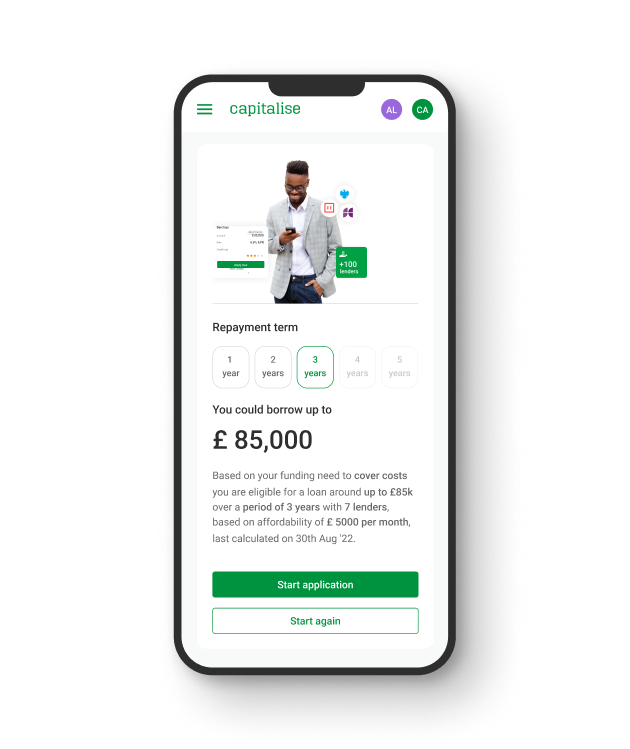

The business loan and funding you can get will depend on which funding product you opt for, the lender you work with and the length of the term-loan. Your eligibility will also consider:

This information shows banks and lenders how your business is performing, its stability and the risk of borrowing to you.

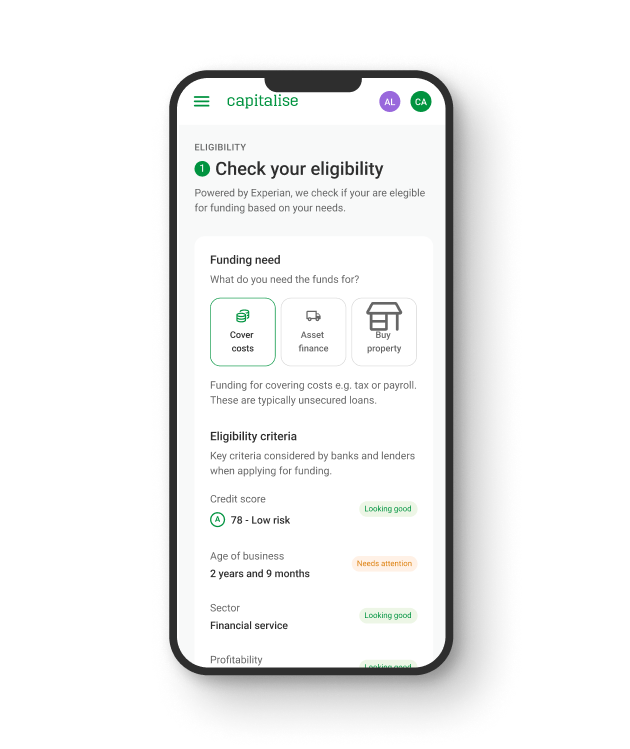

The Business Loan Calculator can help you instantly understand your eligibility for funding as it’s based on your business filed accounts and current Experian-powered business credit profile.

Using the Funding Calculator, you’ll be able to understand what business loans you could be eligible for in seconds. Including average monthly interest payments and any additional costs associated with different funding products.

You’ll be able to see exactly what funding your business can access by matching your Experian business credit profile and publicly available data from Companies House to calculate your funding eligibility.

From covering costs to investing in assets, tell us what you need the funds for

From covering costs to investing in assets, tell us what you need the funds for

View your eligibility criteria, such as your business credit score and years trading

View your eligibility criteria, such as your business credit score and years trading

Tell us what your preferred monthly budget would look like

Tell us what your preferred monthly budget would look like

Option to get a budget estimate using your Experian credit profile

Option to get a budget estimate using your Experian credit profile

Estimate how much would you like to borrow, based on your preferred repayments

Estimate how much would you like to borrow, based on your preferred repayments

See a full breakdown of what those repayments would look like

See a full breakdown of what those repayments would look like

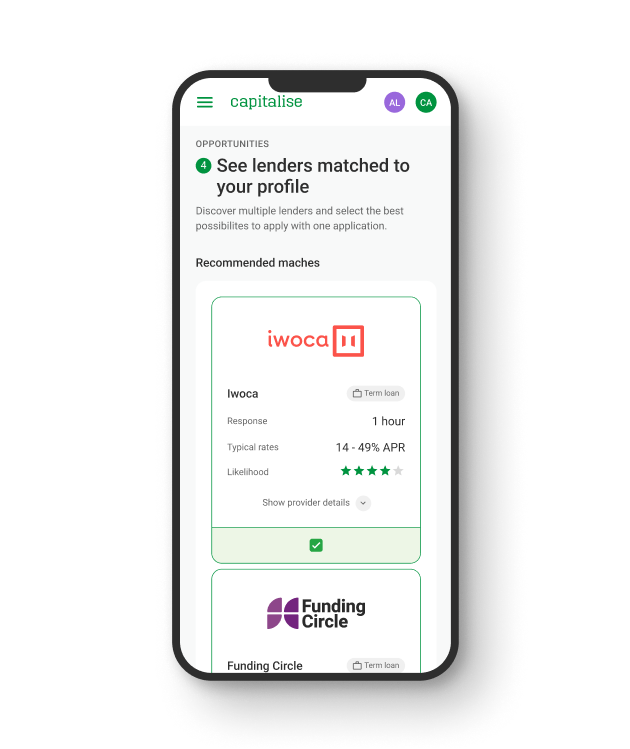

Typical rates from each lender

Typical rates from each lender

The likelihood of you being accepted if you did apply

The likelihood of you being accepted if you did apply

The time that lender would typically respond to you in

The time that lender would typically respond to you in

Capitalise has a panel of 100+ business lenders to help you find the best suited funding match. The Business Loan Calculator can help you understand what lenders would loan funds to your business so you can better understand your options.

We work with banks, specialist lenders and alternative lenders to offer a wide range of funding solutions. Here’s some of the funding products we have that may suit your business plans.

A term loan helps you cover costs in your business by accessing a loan payment and repaying it month by month until it’s fully repaid. This is similar to a personal loan in how it’s calculated.

For a buy-to-let or commercial mortgage the term is usually longer than 10 years and the calculation depends on the income expected from your tenants.

Buying an asset such as a car, technology or equipment is one of the easiest ways to get finance since lenders will look at the quality of the asset being purchased.

Yes, even if your business is a UK start-up you can still qualify for a business loan. However, you may be subject to higher interest rates and more expensive terms as your business credit profile will be less established and show less evidence of your business affordability.

Yes. To apply for a business loan through our Capitalise platform, your business will need to be registered and operating in the UK.

In some cases, rates start from 7.9%.

At Capitalise, we work with 100+ lenders including a number of institutional lenders, including high street banks, alternative lenders and independent lenders. Working with a wide range of different finance providers means we’re able to offer businesses different types of funding to suit their business needs.

These include; Asset Finance, Invoice Finance, Merchant Cash Advance, Trade Finance, Working Capital, Property Finance.

Capitalise makes it easy to find, compare and select lenders who are most likely to give you an offer.

A poor business credit score can make accessing funding difficult, but there’s a good chance you still have options available. We work with specialist lenders who can look to match your credit profile to business loans that fit your business needs.

We can also help you understand what’s holding your business credit score back and how you can look to improve it.

Learn more here about Bad Credit Business Loans, or delve into our Credit Review Service to see if we can help you improve your credit today.