Small business loans provide your business with a lump sum of money that must be repaid over a set period, typically with interest. The terms, interest rates, and repayment schedules vary depending on the lender and the specific loan product. Some small business loans work by requiring the business to have collateral. This means the loan is secured against an asset, which the lender can claim if the loan isn’t repaid. While others may be unsecured, meaning they do not require collateral. Instead unsecured small business loans rely on the business's credit score and financial reliability to ensure repayment.

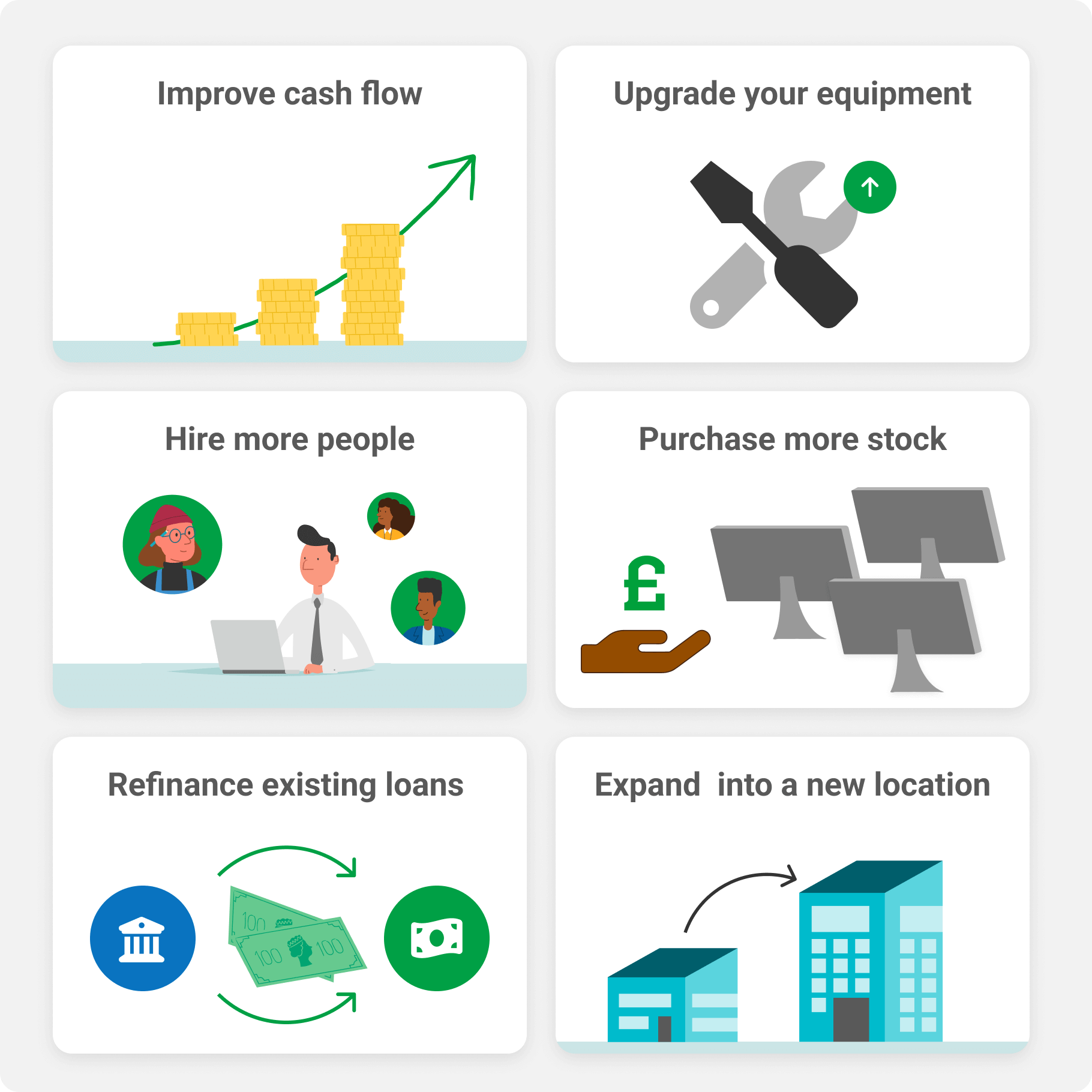

Getting a small business loan can be a smart way to help your business grow and keep your finances in check. This extra money can be used to improve your operations, expand your services, or simply keep things running smoothly. Here's how you might use a small business loan:

Before applying for a loan, it's helpful to estimate your potential loan repayments. Our small business loan calculator helps you estimate your monthly repayments based on the loan amount, interest rate, and repayment term. Simply enter the relevant details to see how different loan scenarios could work for your business.

What do you need the funding for?

Funding for covering costs e.g. tax or payroll. These are typically unsecured loans.

For how long do you want to pay back your loan?

Interest rate

Loan amount

£ -Total interest amount

£ - 11% APR over a 3 yearsTotal repayable

£ -Total monthly repayment

£ - / monthNot sure what your business can afford?

Sign up to check your affordabilityTo be eligible for a small business loan, you generally need to:

Lenders may also look for positive cash flow, or a solid business plan to achieve positive cash flow as part of their assessment.

If you don't meet these criteria, it doesn't mean we won't be able to help you get a business loan. However, meeting these requirements will maximise your chances of approval and give you more options.

Here's a step by step of how the process of applying for a small business loan works with Capitalise:

Typically, you'll need to provide the following documents when you apply for a small business loan:

| Types of small business loans | Pros | Cons | Best for |

|---|---|---|---|

| No personal guarantee small business loans | No risk to your personal assets | Can come with higher interest rates | Businesses without sizable assets |

| Business lines of credit | Flexible use | Potential for high fees | Ongoing operational expenses |

| Invoice finance | Immediate cash flow from unpaid invoices | Depends on client payments | Businesses with delayed payment cycles |

| Asset finance | Spread the payments of expensive equipment | Depends on the value of the asset | Acquiring high-value equipment |

| Merchant cash advance | Easier on cash flow as repayments are based on sales | Higher cost of borrowing | Businesses with high credit card sales |

| Short term small business loan | Quick access to funds | Higher monthly repayments | Short-term financial needs |

| Long term small business loan | Lower monthly payments | Longer debt commitment | Large, long-term investments |

Compare your options from 100+ business lenders.

Yes, some lenders do offer small business startup loans. However, these can be more difficult to obtain due to the limited options available. Once you have a few months of trading history, more financing options become available to you.

Finding the best small business loan will involve comparing various lenders and loan products to determine which one suits your business needs best. Using a loan matching platform like Capitalise can help streamline this process by pairing your business with lenders that offer competitive rates and favourable terms based on your specific requirements.

Interest rates on small business loans vary depending on several factors, including the lender, the type of loan, the loan term, and how creditworthy your business is.

Generally, rates can range from as low as 9% to upwards of 20% or more for high-risk borrowers. It's important to compare offers from different lenders to find the most competitive rate for your business.

The time it takes to get a small business loan can vary widely depending on the lender and the type of loan. Traditional banks might take several weeks to process a loan application. Whereas alternative lenders could approve and disburse funds in a matter of days.

When you search for funding with Capitalise, you could get a business loan in as little as 48 hours from application.

Small business loan terms can vary based on the lender and the specific loan product you choose. Here’s a general breakdown:

Short term loans: Typically 3 to 18 months.

Medium term loans: Usually 1 to 5 years.

Long term loans: Can range from 5 to 25 years.

The terms will also depend on the loan amount, the purpose of the loan, and the financial health of your business. It's important to choose a term that aligns with your business's cash flow and repayment capacity.

While a good business credit score can significantly improve your chances of getting a loan with favourable terms, it's not always a strict requirement. Some lenders can provide bad credit business loans where they will focus more on your business's cash flow, than credit history.

However, having a good business credit score can help you secure better interest rates and loan terms, so it's wise to check your business credit score before applying. If your credit score is low, consider reviewing your credit profile with Capitalise. In 96% of cases, this results in an improvement, putting you in a stronger position to apply for a loan.