Accountants are the natural relationship managers of funding

Funding is a simple concept - like investing, buying a house or starting a company. However, in practice, the detail and process is daunting for many business owners.

Businesses who are serious about achieving their vision are often that same half of clients who are using funding. Are they going to their bank, to brokers, trying out online lenders or seeking equity investment?

Are any of the banks, brokers or digital lenders giving impartial advice on the funding journey?

Against the backdrop of bank managers falling from 22,000 in 1990 to under 7,000 today [Source: British Bankers Association], we think not - and believe in accountants and advisers being active in solving access to finance.

Complex, made simple

Amidst having to pick from 300+ lenders in the market specialising in an array of different debt products and leaving on average just 7 days to do so [BDRC Q4 Business Finance Monitor], business owners don’t give themselves the best chance.

Our answer? A scalable, intuitive platform for accountants and advisers to power the balance sheets of their clients and deepen their relationships

Adviser-led funding: Our design principles

- One search, one marketplace: promote diversity - from banks to alternative lenders

- Thinking beyond funding: funding is the starting line, advisory is the journey

- Lean on our knowledge: we’re here to help you

- Dependable Partnership: we’re in this together

- Be value-add for the adviser: cloud advisory is about doing things your clients can’t

- Privacy by design: GDPR, compliance and privacy are features

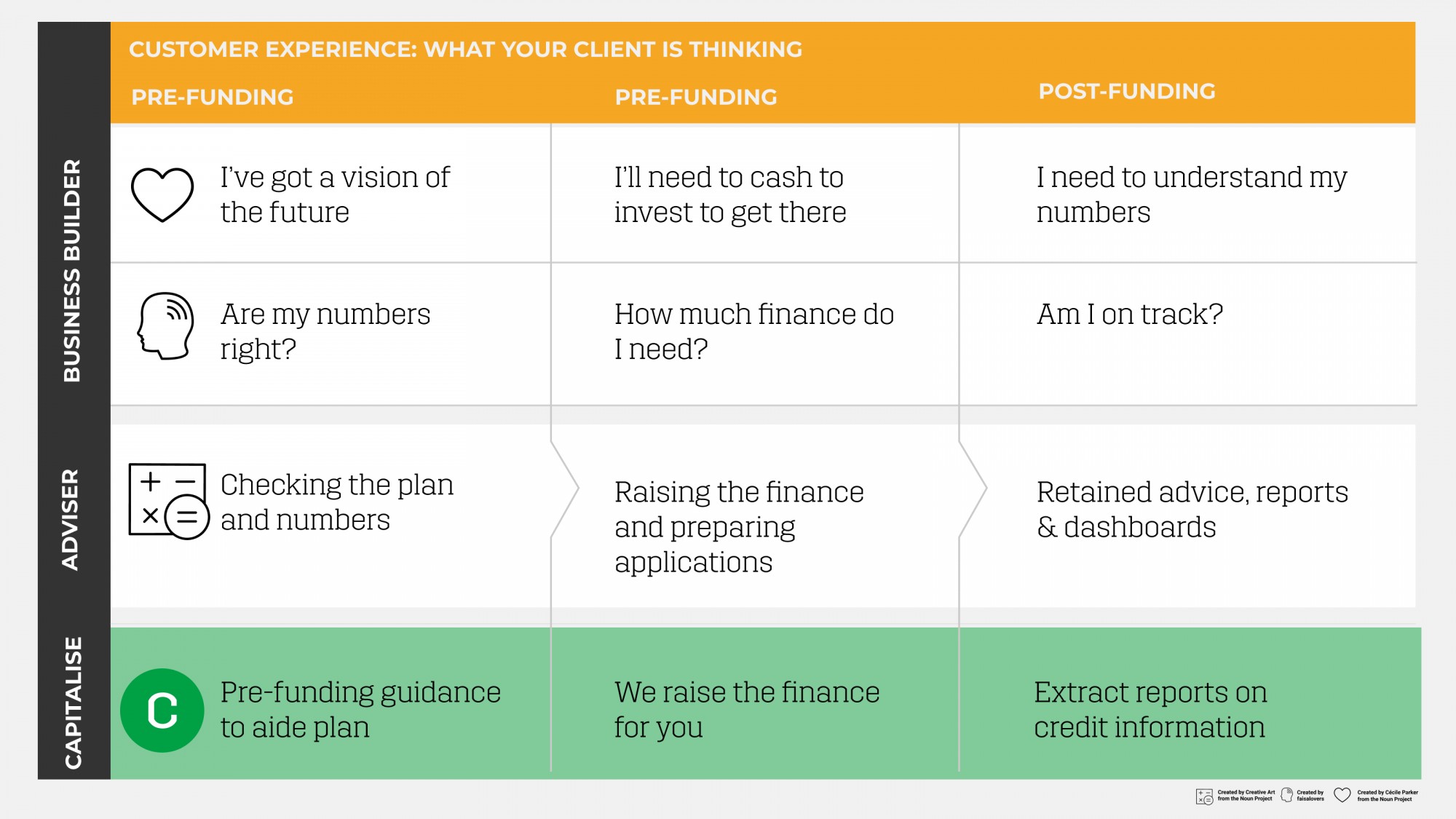

Accountant + Business builder: A natural partnership

With the budgeting, cash-flow and business plans charting a route to a future vision the question comes around the finer details of the plan. Business builders may understand the broad plan, the value proposition or market but they typically haven’t had a career in finance or building cash flows.

This partnership between the advisory accountant and the business builder is a beautiful and powerful harmony.

Capitalise works with over 1,000 accounting firms - from being “corporate finance lite” in large firms to being the one-stop shop for funding in smaller firms, we’d love to start our partnership with you.

This will help us achieve our vision of a future of more sustainable businesses, supported by experts, built on strong balance sheets.

United Kingdom

United Kingdom  South Africa

South Africa