How is an Experian business credit score calculated?

There are a number of credit bureaus in the UK, each of these will calculate business credit scores based on a range of factors and using their own, proprietary algorithms.

Experian is the prime bureau in the UK used by major lenders and providers of trade credit. To calculate your business’ delphi score and your band, they’ll use a variety of publicly available information. This can include your latest set of accounts at Companies House, your payment performance as reported by your larger suppliers and any legal notices registered against your business. They may also use factors such as your business’ age and industry to make an assessment.

What does an “A” score band mean?

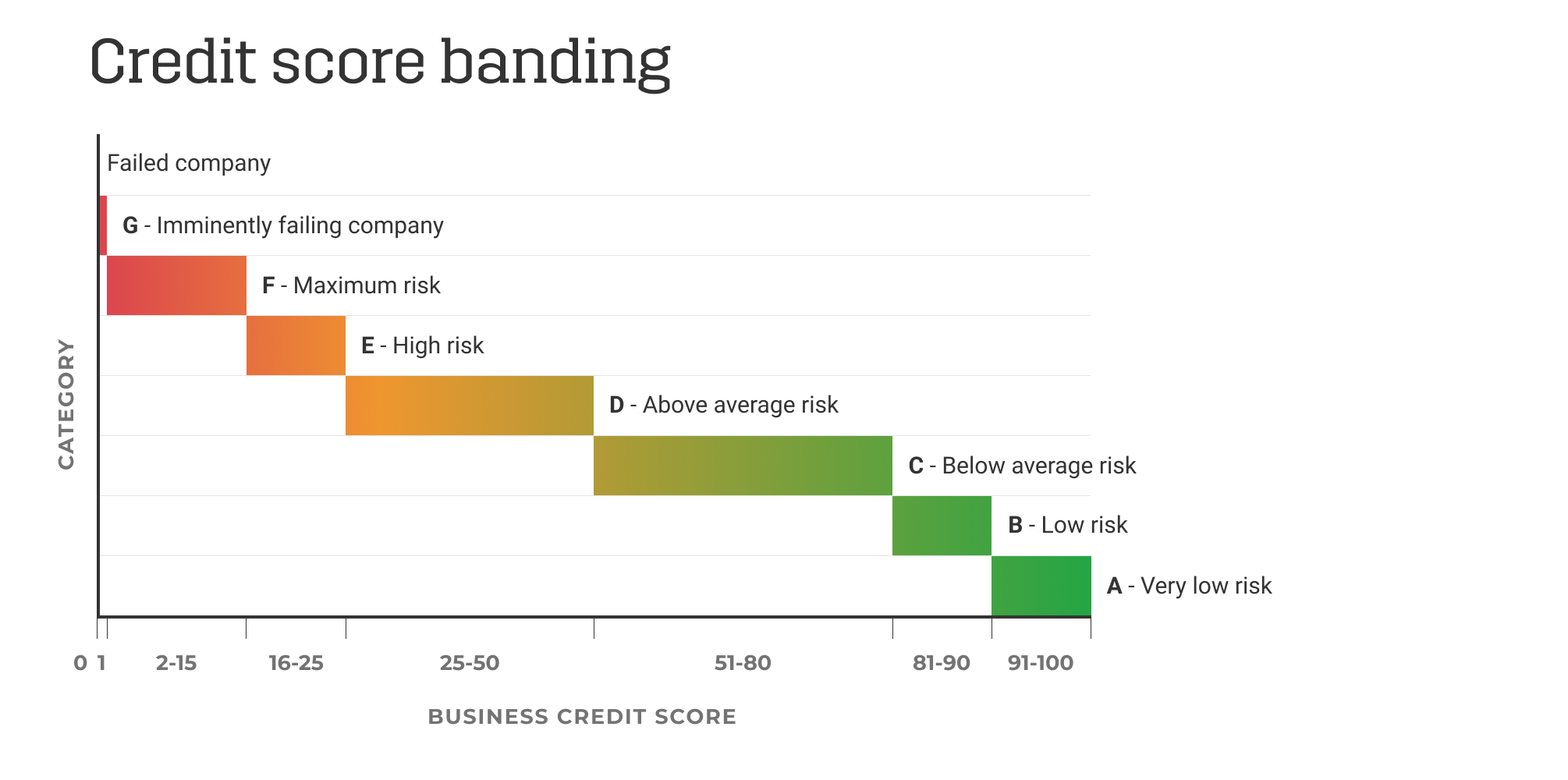

A score between 91 and 100, or an "A" credit score is the highest possible band. This brings significant advantages:

- Favourable lending terms: You’re likely to secure the best lending terms, including lower interest rates, provided your business’ financial history is also strong.

- Better supplier relationships: Suppliers may offer you more favourable credit terms, higher credit limits, and even better pricing when your business is in the highest score band.

- Enhanced business profile and reputation: A high credit score can make your business more appealing. It may help if you’re bidding for a new contract, or preparing for a sale.

What does a ‘B’ score band mean?

A score between 81 and 90 is classified as a "B" credit score. While not the highest band, it is still a good credit score and will offer several benefits for your business:

- Competitive lending terms: You should be able to secure reasonable lending terms, meeting the credit thresholds of many lenders, although possibly at higher interest rates than businesses with an "A" score.

- Solid supplier credit: Suppliers are likely to provide you with good credit terms.

- Respectable business profile: A "B" credit score helps maintain a positive business profile. It can be beneficial when seeking new customers, entering joint ventures, or planning for a future sale.

What does a ‘C’ credit score band mean?

A credit score of between 51 and 80 is a very wide band. It is also known as a “C” credit score and will come with a few challenges:

- Limited lending options: With mainstream lenders tightening their criteria, your business might not qualify for their products, pushing you toward alternative lenders which may come with higher interest rates.

- Restricted supplier credit: While you may still receive credit from suppliers, they might impose stricter terms, limiting your access to working capital.

- Average business profile: A "C" credit score may be perceived as average, potentially affecting your appeal to other businesses.

What does a ‘D’ credit score band mean?

A "D" credit score, which ranges from 25 to 50, can be seen as high risk for other businesses so it will likely bring several challenges:

- Difficulty in securing loans: With tighter lending criteria, most mainstream banks and lenders may reject your applications, forcing you to rely on a smaller pool of specialist lenders who charge higher interest rates.

- Limited supplier credit: Securing credit from suppliers, especially those using trade indemnity cover, will be challenging. You may need to pay upfront, which could impact your cash flow.

- Weaker business profile: A "D" credit score can negatively impact your business's profile, making it less attractive to potential customers, partners, recruits, or buyers.

Is it possible to change your Experian business score band?

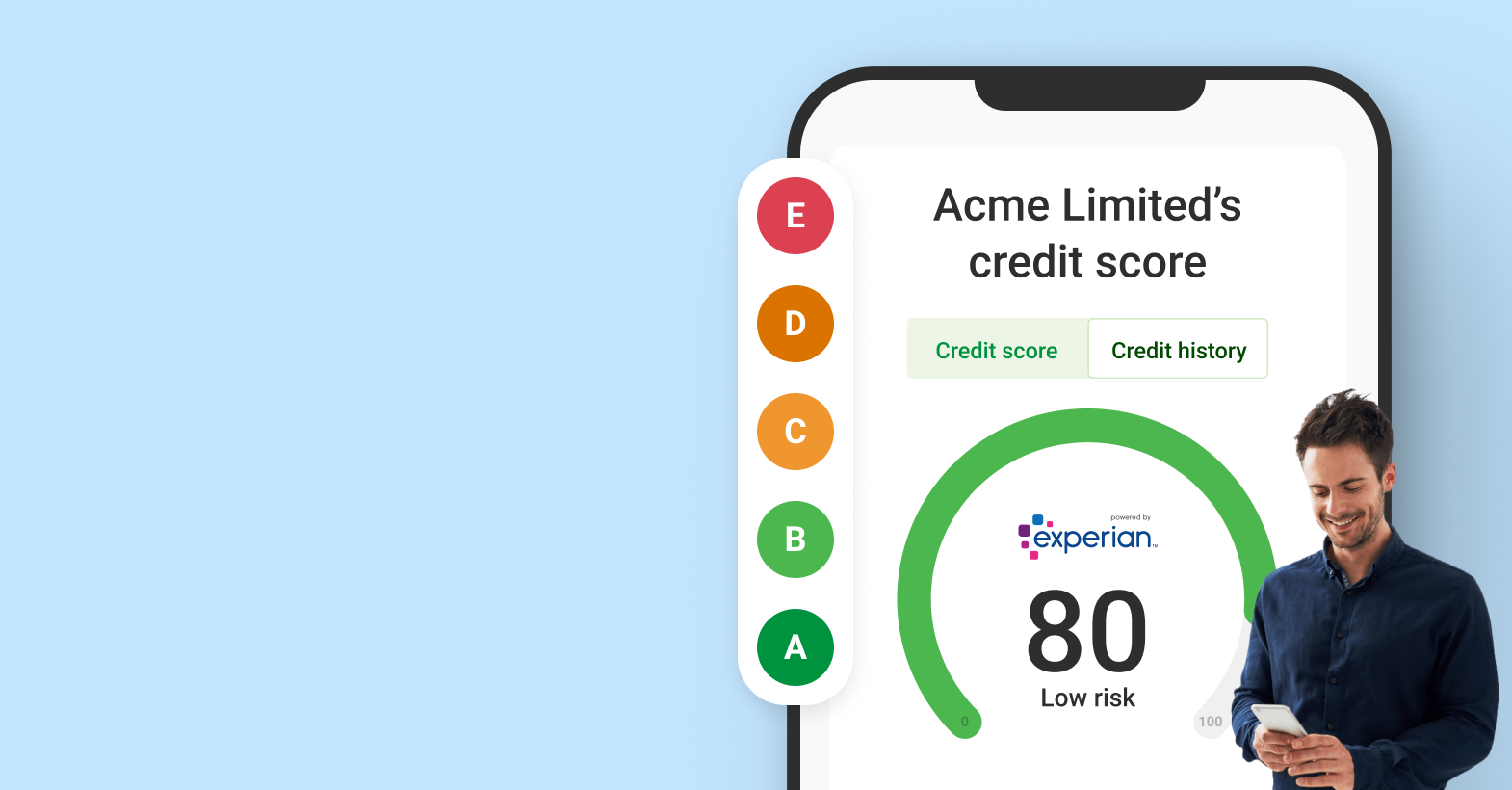

Yes, it is possible to improve your business credit score band. Keeping track of your credit score is a good place to start. With Capitalise for Business, not only can you monitor your business credit score continuously, but you also receive alerts on any changes, allowing you to quickly address and resolve potential issues. Plus, our platform shows you the specific factors affecting your score so you’ll receive tailored insights into how you could improve it.

Credit bureaus update their records monthly, and typically reassess scores following significant events, such as the filing of financial statements.

Since business credit scores are largely calculated based on publicly available information, it can take some time for your credit score to improve organically.

Through our partnership with Experian, our Credit Review Service enables you to provide up to date information to the credit bureau so that they can reassess your credit score quickly. Taking only a couple of days, in 96% of cases this results in an improvement.

Sign up to get your business credit score reviewed today.

United Kingdom

United Kingdom  South Africa

South Africa