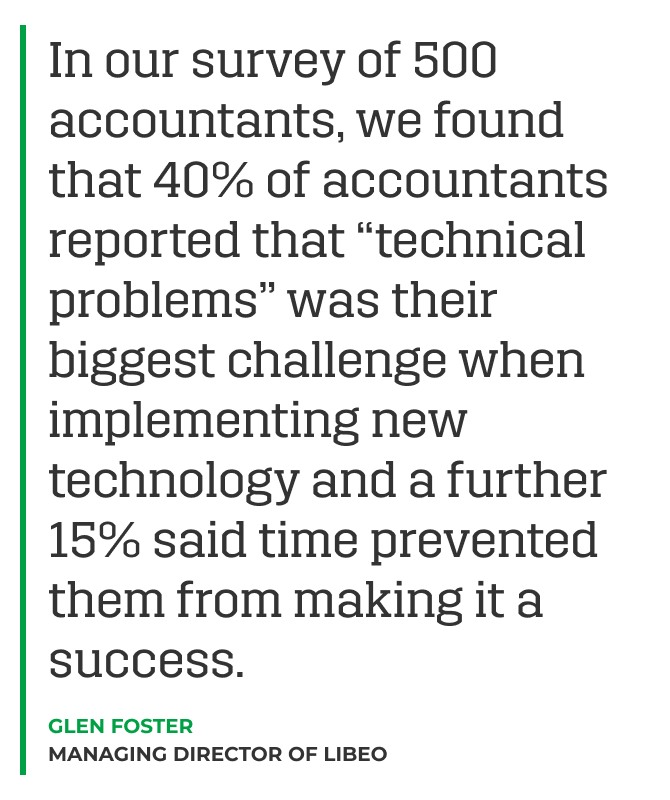

In our series of interviews for the Future Positive Podcast, we recently featured Glen Foster, Managing Director of Libeo and formerly Sales Director at Xero, as we discussed the development of digital tools in the accountancy market.

He shared his experiences of the past 15 years of digital adoption and how the use of tech has developed in the accountancy profession. Speaking to Alex Clark and Kirsty McGregor, Capitalise Accountant-in-Residence, he discusses how firms can successfully roll out these new tools.

Glen recalled how the most shrewd firm leaders were not afraid to ask the Xero team members how other firms had achieved the highest level of adoption and therefore greater efficiencies. He shared these key learnings:

-

The firms who are most successful at driving digital adoption across the practice and the client base had someone specifically responsible for this area. They were given the time to learn about the wide range of apps across the stores in the different general ledger platforms and develop the skills and systems to advise clients about their own needs and their required ‘tech stack’

-

It was better to appoint more than one person into this role rather than a single figurehead. These specialists are highly marketable to the wider profession, so practices should ensure they reduce the risk of being exposed by spreading this expertise around the firm

-

This team should have the support of the senior leadership team and have delegated authority across the firm to implement & drive this change

-

Training team members as well as clients was important as part of the process of implementing new tech

-

This work can be and should be chargeable as a consultancy service

-

Leadership teams and the specialist team members should recognise that most people do not like change and should be willing to strongly encourage clients to move to a cloud technology, not waiting for business owners to request it themselves

-

Once the data is moved onto the cloud and is reliable, the most valuable extension of that is achieved when that data can drive insights to direct conversations with their business to support their decision making and confidence

The outsourced or virtual finance director service enables firms to become integral with their clients’ businesses as you can communicate with them on a much more frequent basis. This strengthens your relationships and ensures you can provide a steady stream of valuable advice which has a substantial impact on their growth and success.

Listen to the full podcast here.

United Kingdom

United Kingdom  South Africa

South Africa