Accountants will always be businesses’ closest relationship

Small business owners’ reliance on their accountant is paramount; firstly as the person keeping the business within the compliance “straight and narrow” but also as a trusted adviser on everything financial (and probably legal).

Few SMEs have access to any other expert advice on their business plans and operations other than through their accountant. In fact, in their Small Business Matter report, ICAEW indicate that “48% name their accountant as their most trusted business adviser”.

Shaping a lead-in service

Top reasons for having an audit or review engagement with their accountant point to raising finance

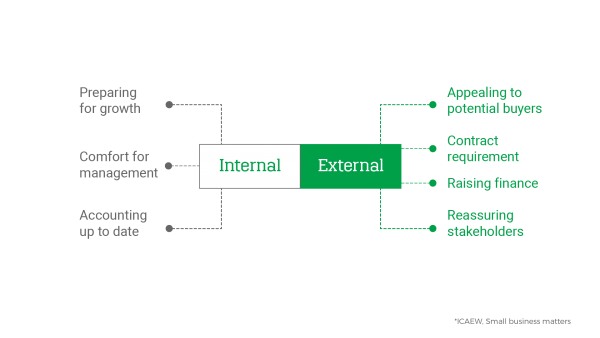

From the ICAEW study, 7 factors are listed to indicate where a SME will seek an audit or review on the businesses. These are all opportunities to access a business who is open to buying advisory services - i.e. they might be a prospect.

It is likely that 5 of the 7 factors (excluding “Comfort for management” and “Accounting up to date”) are going to present an opportunity for accountants to at least have a discussion around what finance options are available in the market.

BIS supports access to finance being a key driver

Also from the same report, data from BIS suggests that on the subject of raising finance, and that of those seeking advice on raising finance, “60% had sought that advice from their accountant (21% had gone to a bank, and only 7% to a specialist financial adviser)”.

A paper from Northumbria Research by Scott, Jonathan and Irwin (2007) on “How SME owners' characteristics influence external advice and access to finance” also “found that accountants are the primary sources of advice (35 per cent) followed by family and friends (25-30 per cent)”.

An ability to quickly call up finance options is a key differentiator for accountants

Whether a business intends to actually take finance when they are in an audit or review engagement is missing the point, in our opinion. Much of the reasoning behind a business taking finance depends on how much it costs, so a search needs to be quick and easy.

By using a service such as Capitalise.com - whether through our Funding Report feature to present the options available to your client without engaging lenders or actively to run a Funding Search to engage lenders and receive offers - allows you to service your advice with more supporting materials and options.

Sign-up to Capitalise.com for free!

With some 360+ business lenders in the UK market are you sure you’re giving your best service to your clients? Capitalise.com has 85 lenders on our platform ready to answer your search - either you can control the process or you can invite your client to engage with lenders. Sign up today to take advantage of Capitalise's free funding and credit reports, a 20% shared commission and more! Read more at: https://capitalise.com/partners/introduction

United Kingdom

United Kingdom  South Africa

South Africa