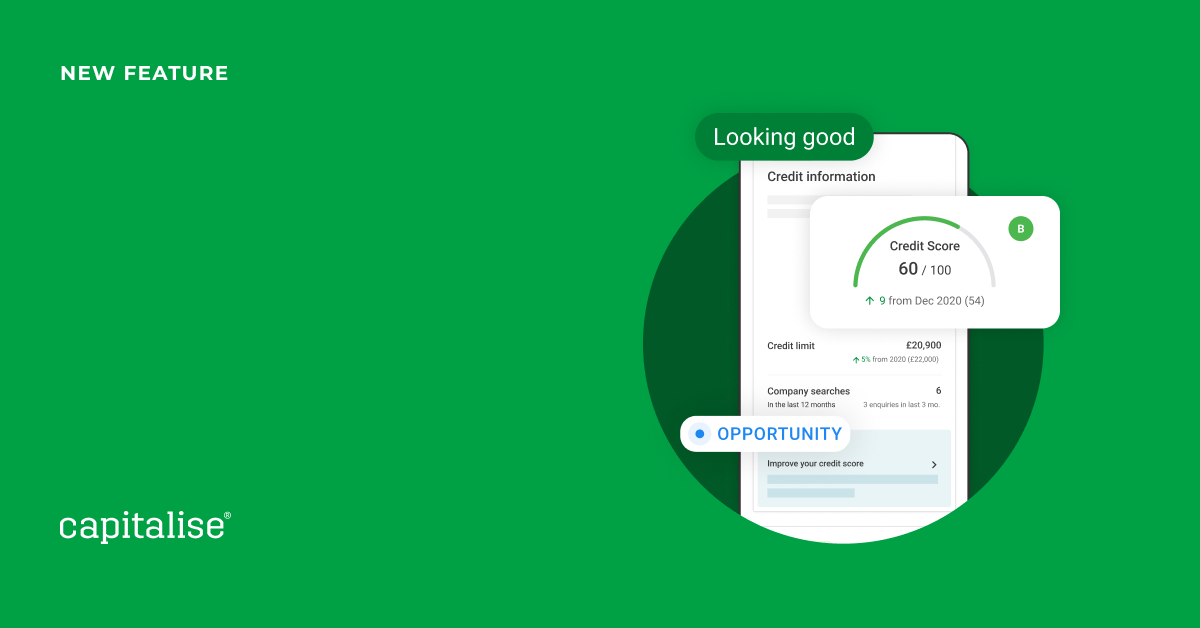

The Capital Report pulls company information, business performance insights, Experian powered credit profiles and credit risk factors together.. Now, with the new downloadable reports you can share this data with your clients more easily, and supercharge your conversations in every meeting.

Start meaningful conversations

Whether you’re out to impress a prospective client or looking to support your existing portfolio, the Capital Report is a snapshot of a report to see how others view their business. Whether that is lenders, suppliers or tender judges, business credit scores are playing a significant factor in your small business clients’ financial health.

Top reasons why a client might want to know their credit score

-

Help a client to understand their eligibility for funding

-

Help a client understand a decline for funding or trade credit

-

Help a client understand their current supplier terms

-

Help check if their credit profile has changed

Add-on service for your clients

Keeping tabs on a business credit score is a key piece of good practice for small businesses. Many firms are adding the business credit score into their reporting packs to keep an eye out for early warning signs of changing financial circumstances.

As always, all this will be tracked for you in Monitor with alerts across your client portfolio to react to any important changes and protect clients from unforeseen changes. And now with downloadable reports, you can explain these insights to your clients by sharing them, with a click of a button.

Try it out with your clients

If you already have an account on Capitalise then simply login to Monitor and check out the new download feature. This feature is available on our paid plans but if you’d like to have a demo to try it out, get in touch with us.

If you’re new to Capitalise and would like to learn more about our feature, book a chat and we’ll show you the platform in action.

United Kingdom

United Kingdom  South Africa

South Africa