See your clients differently, so you can get ahead in your funding conversations.

Predicting which clients need your attention starts with understanding their circumstances - and no-one knows their numbers better than you, their accountant. But unless you’re the Rain Man it’s difficult to visualise your entire portfolio without a little help from technology.

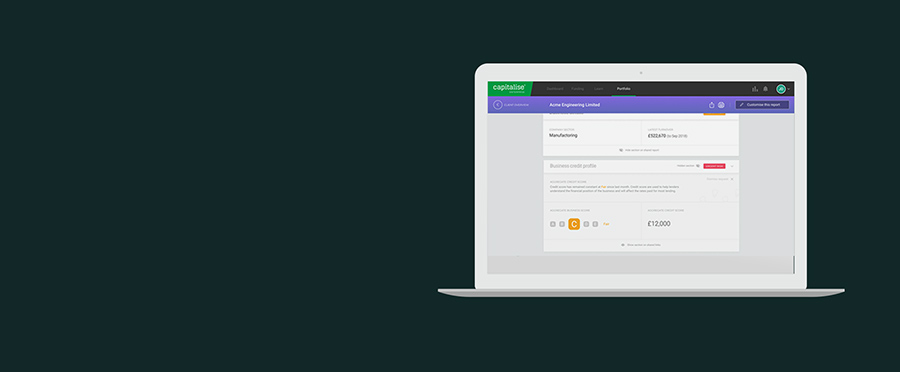

Monitor is here to give you a helping hand in seeing the capital position of your clients with a new lens. *

* Available for advisers subscribing to Pro and Partner.

Anticipating your clients’ needs

Recently, we talked about Client Experience and channelling the 5* Hotelier where firms such as Raffingers have invested in training, processes - and their choice of technology partners. This prepares a firm to respond to requests. But how about getting there before the client asks?

In Japan, the “art of anticipation” Kikubari (気配り) is a preemptive customer service which makes a guest or client feel so welcome. This Japanese style of silent and unprompted customer service is all about adding value above and beyond. It’s about strengthening a relationship.

Monitor gives you that view. And across all your clients at once.

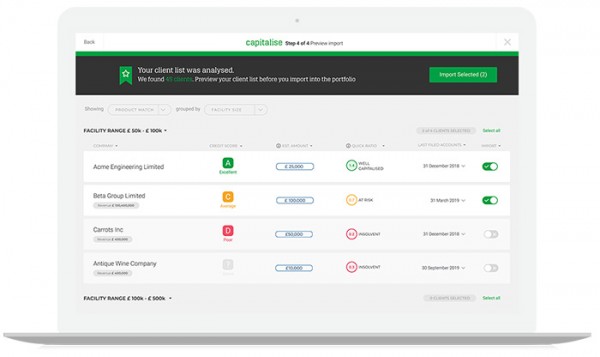

Analysing your portfolio. Instantly.

United Kingdom

United Kingdom  South Africa

South Africa