Keeping small business balance sheets healthy often means keeping tabs on external risks which can creep up. For example, changes to debtors' payments, upcoming tax liabilities, and cashflow all impact their available working capital. Two seismic and urgent impacts of this can be a loss of supplier trade credit terms or a reduction in funding facility.

This is why we help our accounting partners Monitor client’s business credit scores and take action with our Credit Review Service alongside our funding platform.

Alerts and insights to changes to credit scores

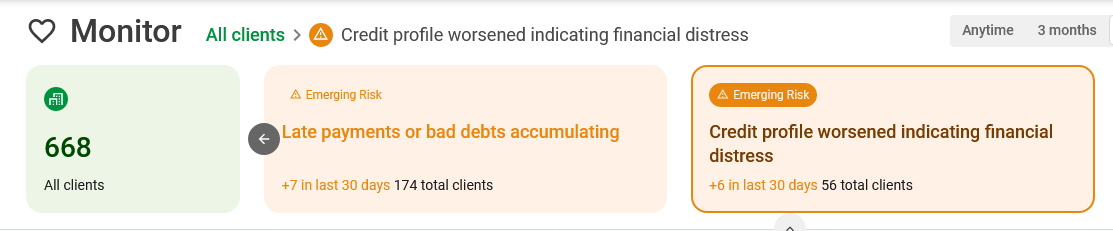

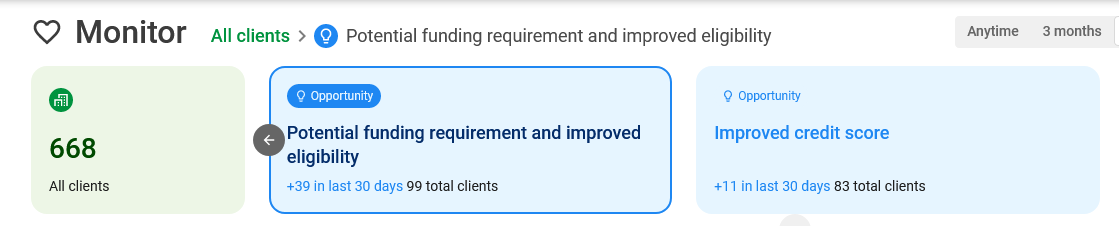

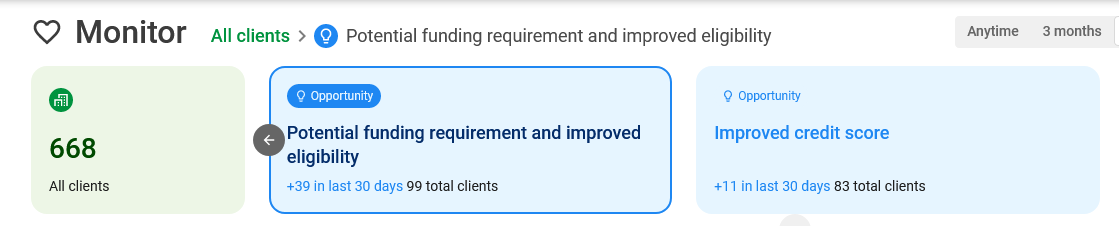

In April, we released two new conversations to make it easier to find clients who might be impacted by changes to their credit profiles.

Conversation 1: Credit profile worsening indicating financial distress

Conversation 2: Improved funding eligibility

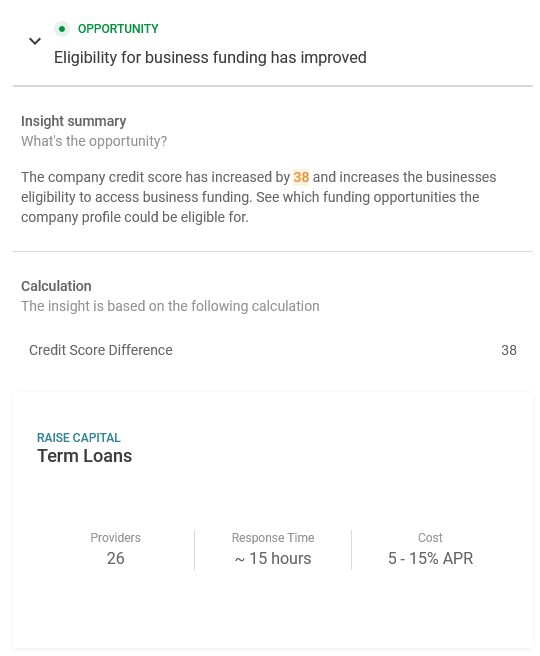

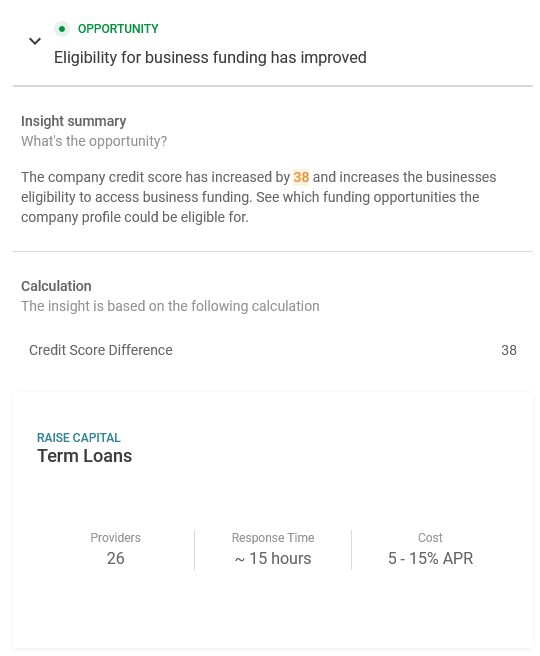

When a business credit score improved credit score they might be eligible for better funding rates.

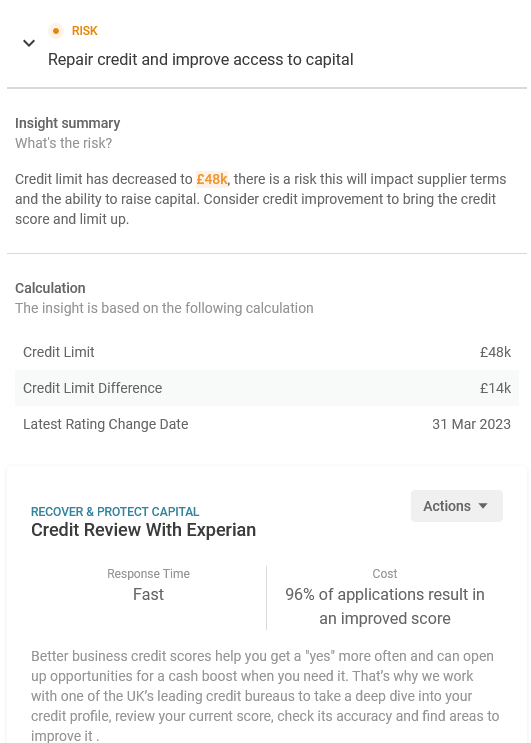

Similarly, drilling into the insight will explain in more detail the impact plus an opportunity to take action with a search into our funding marketplace.

Inviting your client to access client tools

As a next step firms can invite your client to Capitalise for Business simply hit hitting the “Invite” link directly on the platform.

Either you can invite them to access their platform themselves or if you have client licences available you can assign a licence so they get access to their full credit experience.

Did you know that your clients can access a Credit Review Service discounted by £120 through your firm with Capitalise? 96% of cases result in an positive increase on their score or credit limit.

If you’d like to learn more about the Credit Review Service, reach out to the team.