We know January is a bit busier than usual. Whilst you might have had your head down in Tax Returns the Capitalise team have been working hard to improve the way you can work with your clients going into 2022.

In this blog you’ll find out about the latest updates we’ve made to the Capitalise Platform including:

-

The ability to filter by insights in Monitor

-

Credit information insights in Monitor

-

A first look at sharing insights with Capital Reports

All developed to help make conversations with your clients more collaborative and actionable.

What’s new?

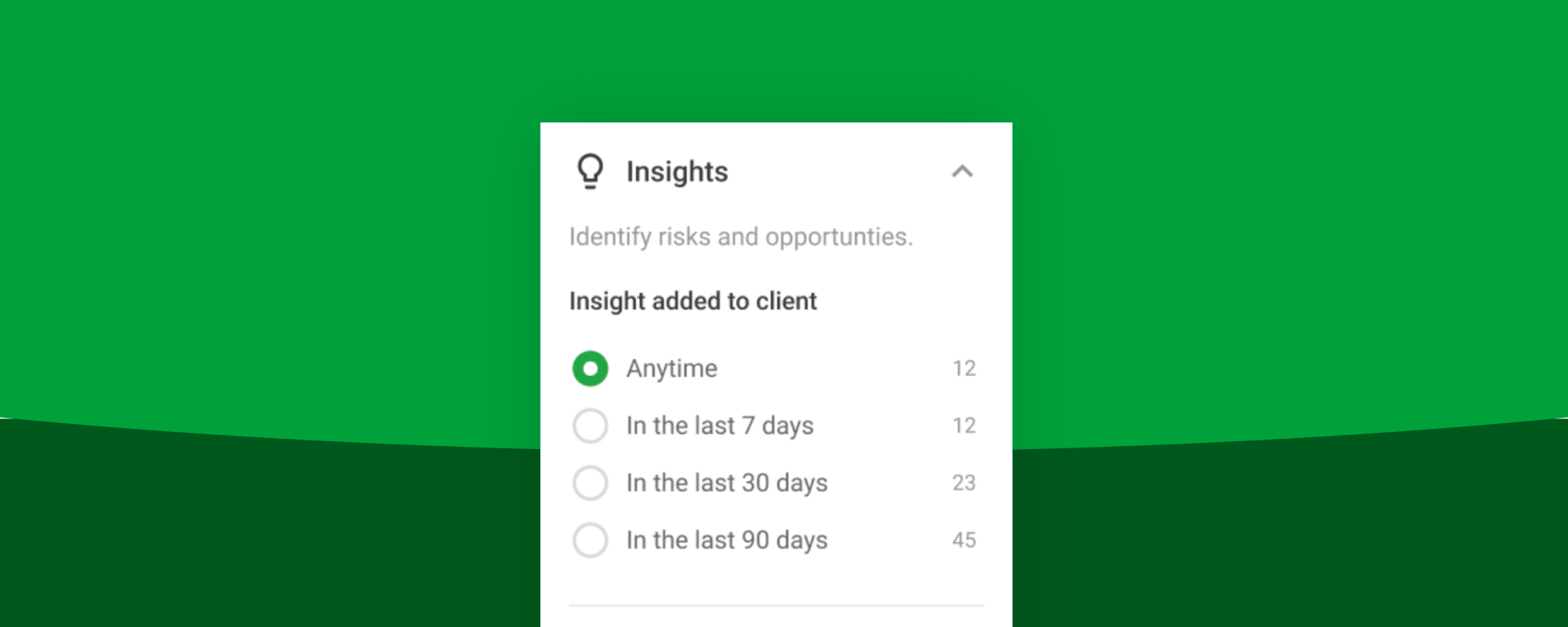

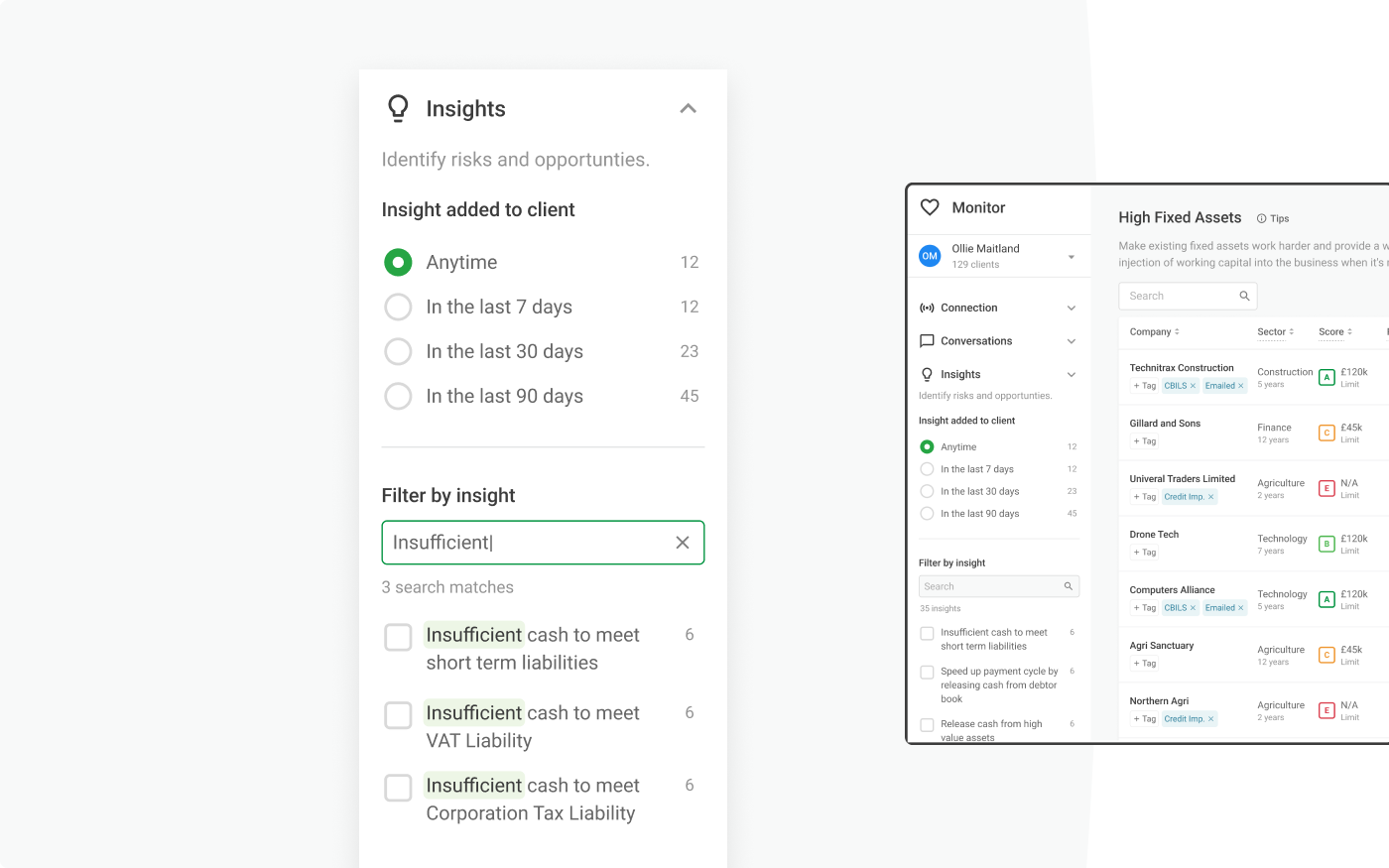

Ability to filter by insights on Monitor

We’ve added a new filter option into the filter menu in Monitor to allow you to filter by insight. This enables you to get a much easier look at the key needs and opportunities across your whole client portfolio. All at once.

For example, you’ll now see a side-panel filter option including all the key insights pulled. By selecting these, you’ll filter out the clients that the opportunity relates to. Such as clients that have “poor liquidity” or “insufficient cash”.

Allowing you to prep and prepare client meetings much more efficiently across your whole portfolio. Helping you spot risks before they become a threat.

Credit information based insights

In September last year we announced an investment from Experian. This investment has allowed us to develop new insights within Monitor. This new data will enable you to pull and review all clients' Experian credit data.

This means you’ll be able to view recent credit searches done, new CCJs registered, credit limit reductions, credit limit increases and/or business payments getting later. As well as highlight when credit score is below industry average.

Allowing you, the adviser, to better and more proactively take action, spot risks to supplier terms, look for funding options, consider credit improvement and much more.

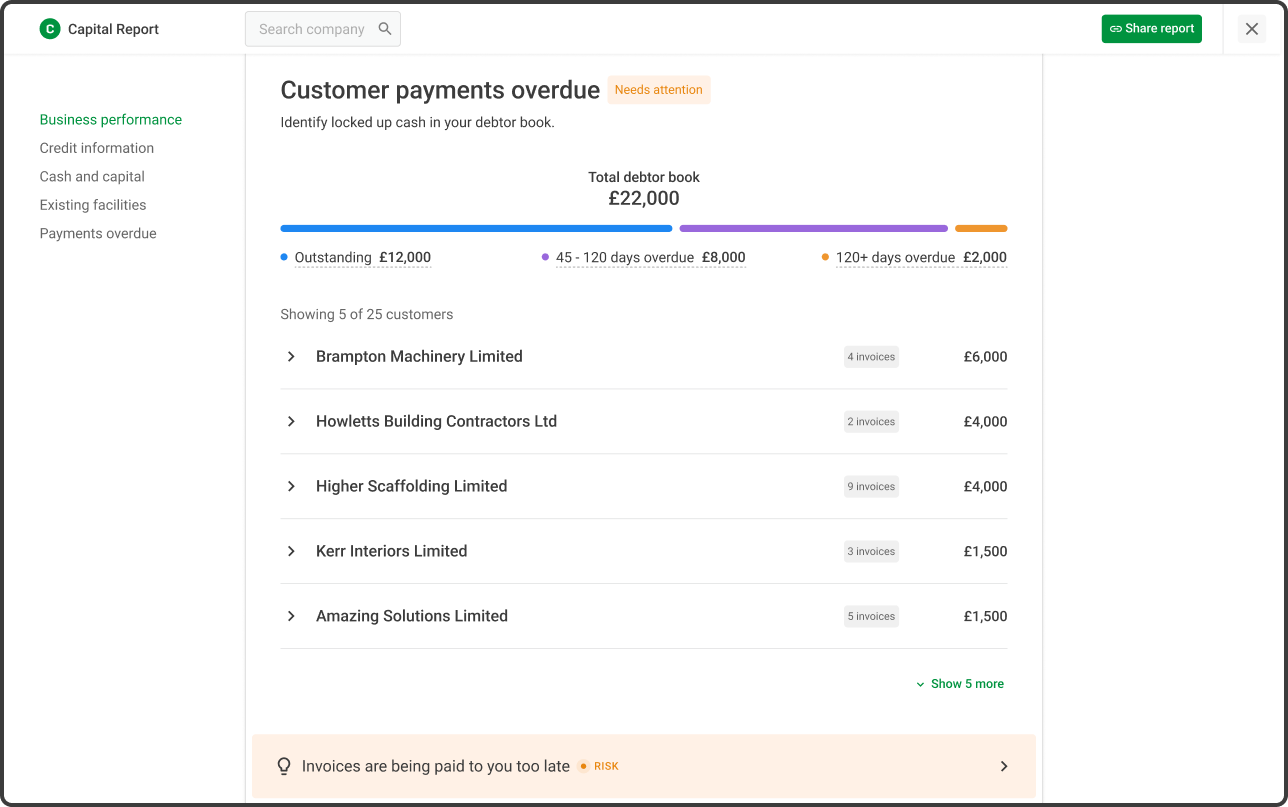

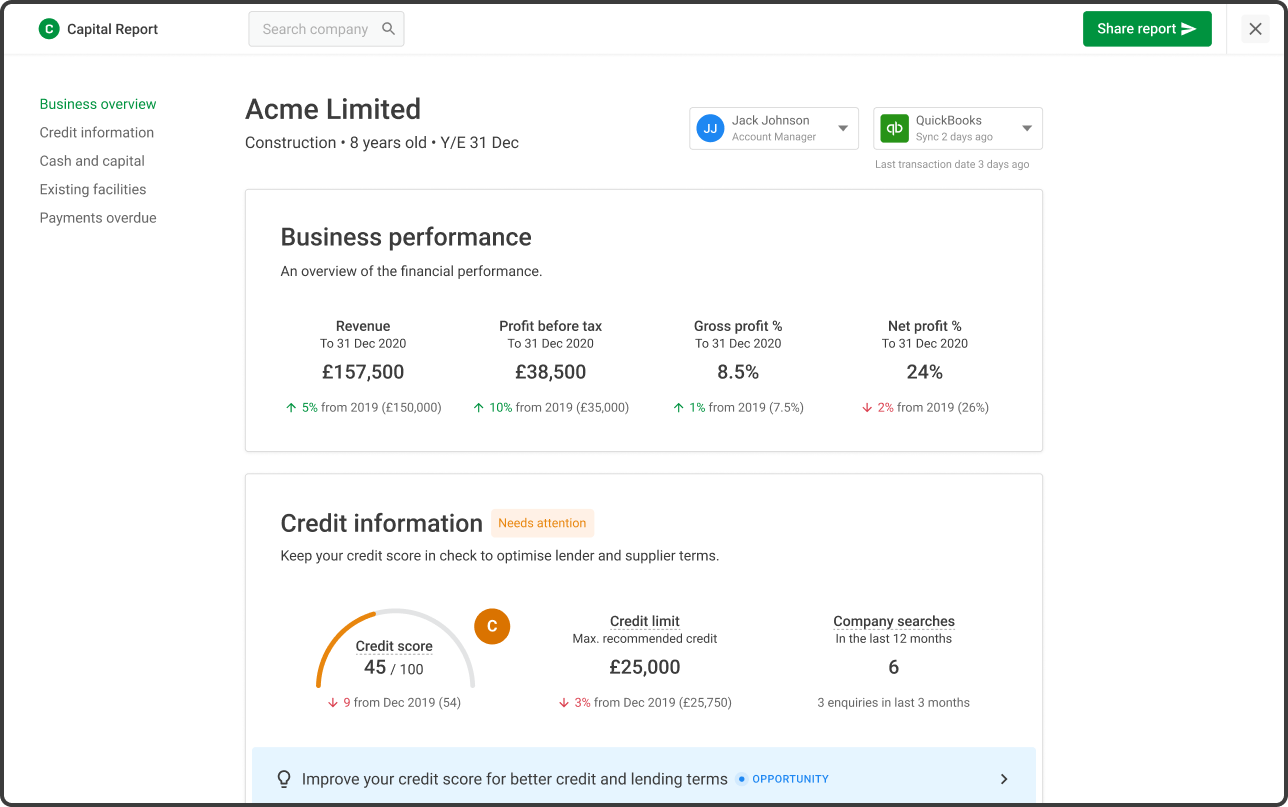

Sharing insights with Capital Report

We’ve now created Capital Reports sharing feature of the credit insights pulled by Monitor. This means you can now share a live version of the report with your clients. Giving them greater insight, control and understanding of their business finance too.

Simply share the report with your client, by clicking “share report” and “copy link”. By doing this, your client can receive access to the report by simply signing up and logging in to the platform. Giving you both visuals on the report to support your conversations and insights.

By signing up they can access their Capital Report on an ongoing basis and get access to their Experian credit report for free.

With all these updates and changes, we're sure you’ll find kick-starting your client meetings and providing pro-active, actionable and insightful conversations that much easier.

Leaving both you and your clients feeling more confident and ready to make decisions that make a real difference to the health of their business.

If you’re already a capitalise partner login here to see the changes. If you're not, click here and have a chat with our team. They will be more than happy to give you a run through.

United Kingdom

United Kingdom  South Africa

South Africa