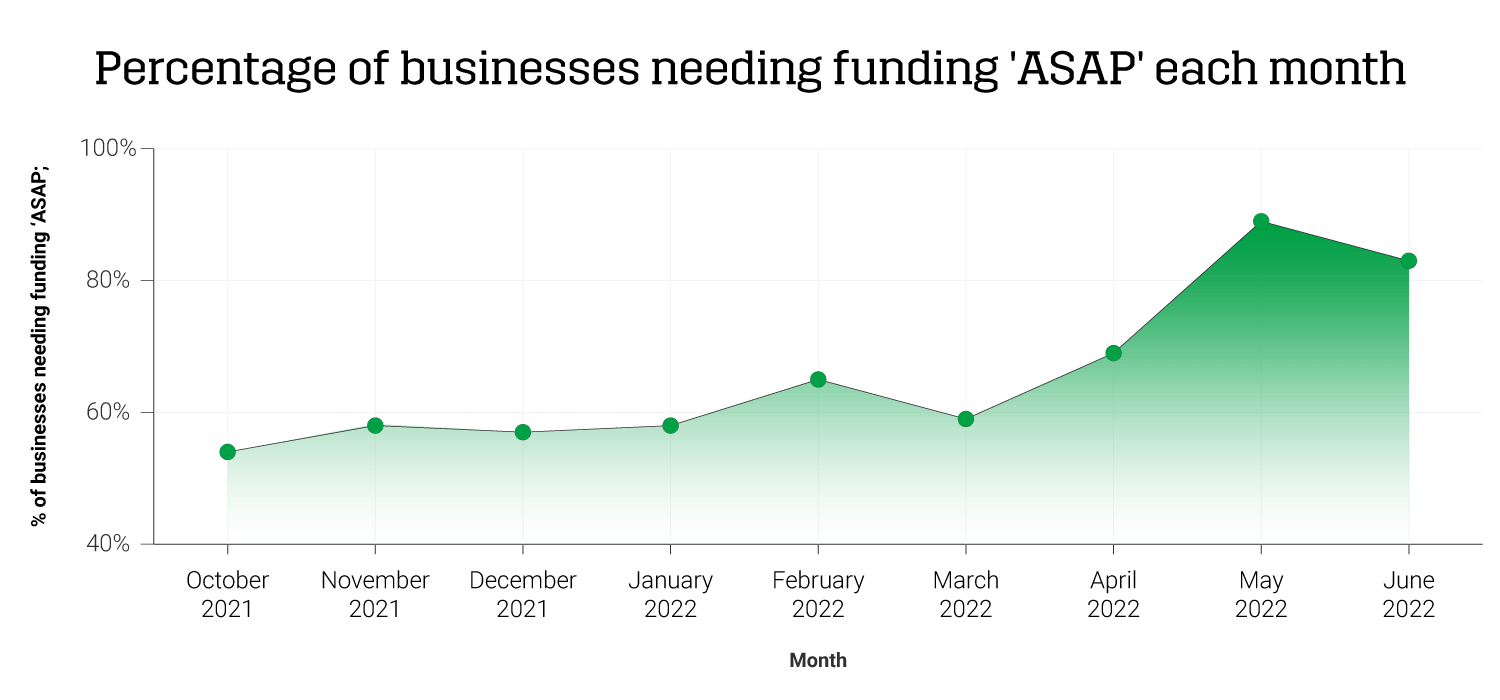

This dash for cash indicates a shift in borrowing behaviour and the need for businesses to get finance urgently to keep their businesses growing healthily.

From soaring inflation and supply chain delays to changes to government lending, there’s a lot impacting your small business clients. The need for funding is most likely a direct result of this changing landscape.

However, the massive spike we’re seeing also indicates that these businesses are struggling to look ahead to spot cashflow risks and the need for supporting finance.

On average, we’ve consistently found that businesses would apply for funding just seven days before they needed it. It seems that this month, businesses need funding on the day they are start applying. A concerning statistic.

Less time available means businesses may have less options, and may have to settle for more expensive loans - that could inevitably put more pressure on their bottom line.

At Capitalise, we question how we can help businesses get ahead of their funding needs and better prepare ahead of time. The answer is their accountants and the tools we have to support you!

Here are some Capitalise tips and tools you can use to help support your clients:

1. Start conversations about cashflow

Your clients are dealing with a lot of unpredictability. But the most urgent cashflow problems and funding needs could be spotted with simple habitual conversations.

Being in control of the numbers is a key part of your value as an advisor, but asking the right meaningful questions really sets you apart.

Dive deep into how your clients are feeling about their business health as well as their future plans. This can keep you in the loop with everything going on in their world. Help reveal funding needs and predict what is needed to bring their plans to life.

If they mention difficulties making payments on time, an inability to hire new key staff or buy new equipment or even an expensive project coming up - it may highlight some roadblocks they’re hitting in terms of cash.

Getting to grips with this early, can help you plan with them the resources they need to keep plans moving forward and business ticking along. Now and in the future.

Top tip: Make funding an agenda point in every meeting.

2. Get insights into your clients cashflow changes

The changing landscape puts pressure on your clients. We know this. But, we also know that it makes your role as their advisor that much more important… but often difficult.

When spare time is limited, yet proactive and consistent cashflow management is required - it can be a challenge to get the insights you need, ahead of time, every time.

With our Monitor platform you can fast-track your conversations. Get real-time accountancy data, credit insights and companies house information to arm you with a 360 view of your clients’ cashflow, credit profile and funding.

The platform segments and filters your entire client portfolio to spot risks and opportunities, see, share and point out cashflow trends and much more. Meaning you’ll have the insights and data you need for better strategic funding advice, without the extensive prep involved.

Within Monitor, the Capital Reports feature makes this a breeze. Designed to help you have easier access to shareable data that you can share with your clients.

Find out more about how you can use this feature to prepare for your meetings in minutes and have funding conversations, that much earlier!

Top tip: Run regular Capital Reports that flag all the main talking points for your client meetings.

3. Have a full funding network at your fingertips

With this increased need for funding, clients will be looking to you more than ever. And more urgently.

61% of businesses we spoke to said they don’t know how to access funding. Yet, say those funds are key to achieving their 2022 goals.

Those businesses knew there were more options available than just the standard banks. But found the process confusing.

With Capitalise, you can connect your clients with a marketplace of 100+ lenders. To offer the most suitable funding and loans, finance facilities and grants.

Helping you not only spot the need for funding, but also find the right solutions.

With 55% of accountants keen to give their clients more services, this is a great way to expand your value and offering.

Top tip: Use our marketplace to offer a variety of different funding solutions that truly meet the needs of each client

4. Track your clients credit score

Tracking your business credit score can help your clients access more attractive finance.

We found only 29% of business leaders keep track of their credit rating. A very low number considering Experian data shows leaders who do so are more likely to get affordable loans.

Paul Surtees, CEO of Capitalise, offers businesses this advice, “imagine how much easier it would be to apply for funding when you already know how much you can borrow. If you’re not already checking your score regularly and looking to improve it when needed, then make 2022 you year to start”,

Using our Monitor platform you can help secure your clients future. And open the doors to more funding - now or whenever needed in the future.

When lenders have evidence of a stronger credit position, funding is less expensive and more attainable.

Top tip: Help your clients understand and track their credit score, to allow for better funding options

“Need funding, no problem.”

With more business obstacles to overcome, being in the right position to offer proactive and actionable funding advice and solutions is irreplaceable to your clients.

The staggering increase of 45% of businesses looking for funding now, means you’ve never been better placed to supercharge your conversations and reinforce your position as their go-to-adviser. Helping build out your own service at the time as promoting your clients sustainable business growth.

Speak to your Partnership Manager today to find out we can help your clients access the funding that is right for them. If you’re not yet signed up, book in a chat with our team to learn more about how we can help.

United Kingdom

United Kingdom  South Africa

South Africa