✅ Detect potential credit risks to your business

✅ Know your customer’s business credit score

✅ Suggested credit limits to offer your customers and suppliers

✅ Check for any legal notices recently registered

When you’re working with other businesses, you may not always know whether they’re going to pay you on-time. Leaving your business cashflow open to risks.

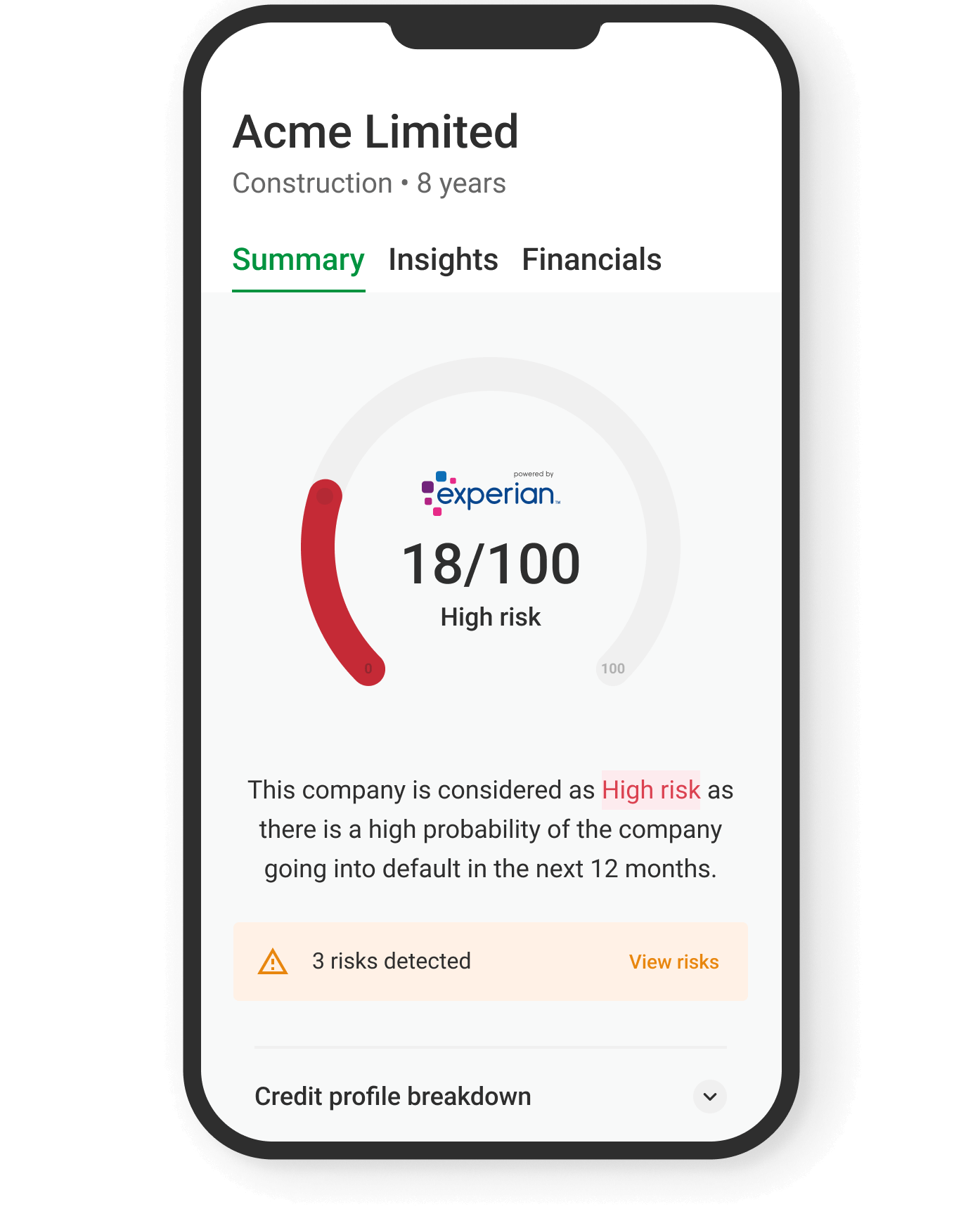

Do you know whether your customers have legal notices/CCJs registered to their business? Are they financially stable? Do they have a good credit score and history?

Wouldn’t you want to know this before you start working together?

Other people’s poor credit poses risks to how you do business. Offering credit to a business with a poor credit score, may impact the likelihood that you’ll get paid on time, impacting operations up and down your chain.

If a company you work with has an unpaid CCJ, it’s likely that they owe money elsewhere. This could impact their ability to meet the terms you agreed. Imagine knowing that before sending your first invoice.

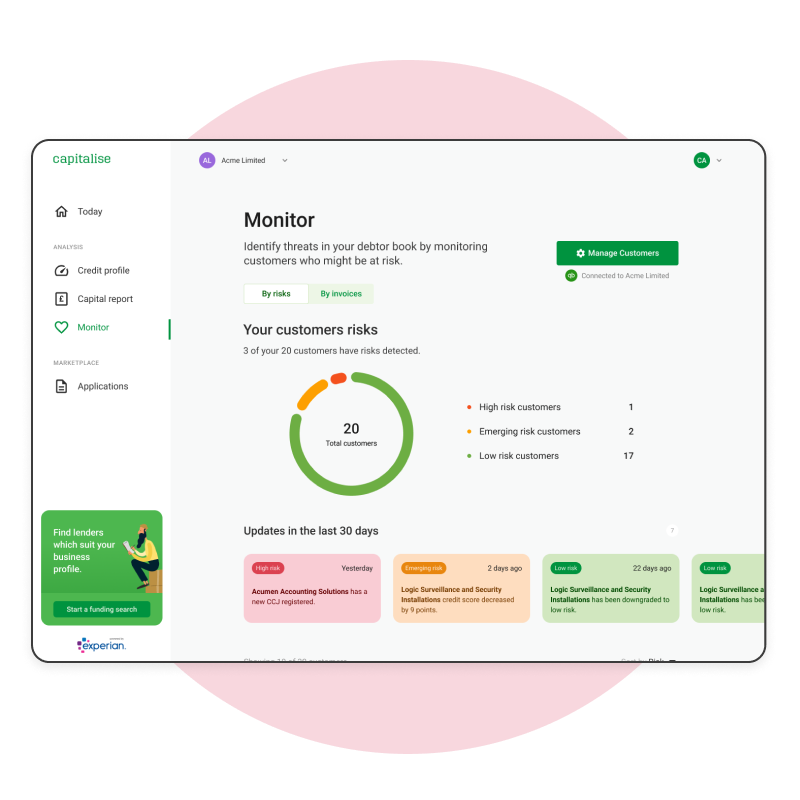

Spot risks, potential delays or risks of insolvency within your supply chain and better protect your business:

Spot risks early from the businesses you work with

3 full company credit checks. For companies up to 2 years old

Recommended

Recommended

10 companies with credit checks plus a full credit profile for your own company.

Your full credit profile plus 100 credit checks. Ideal for finance and compliance teams looking for a risk management tool.

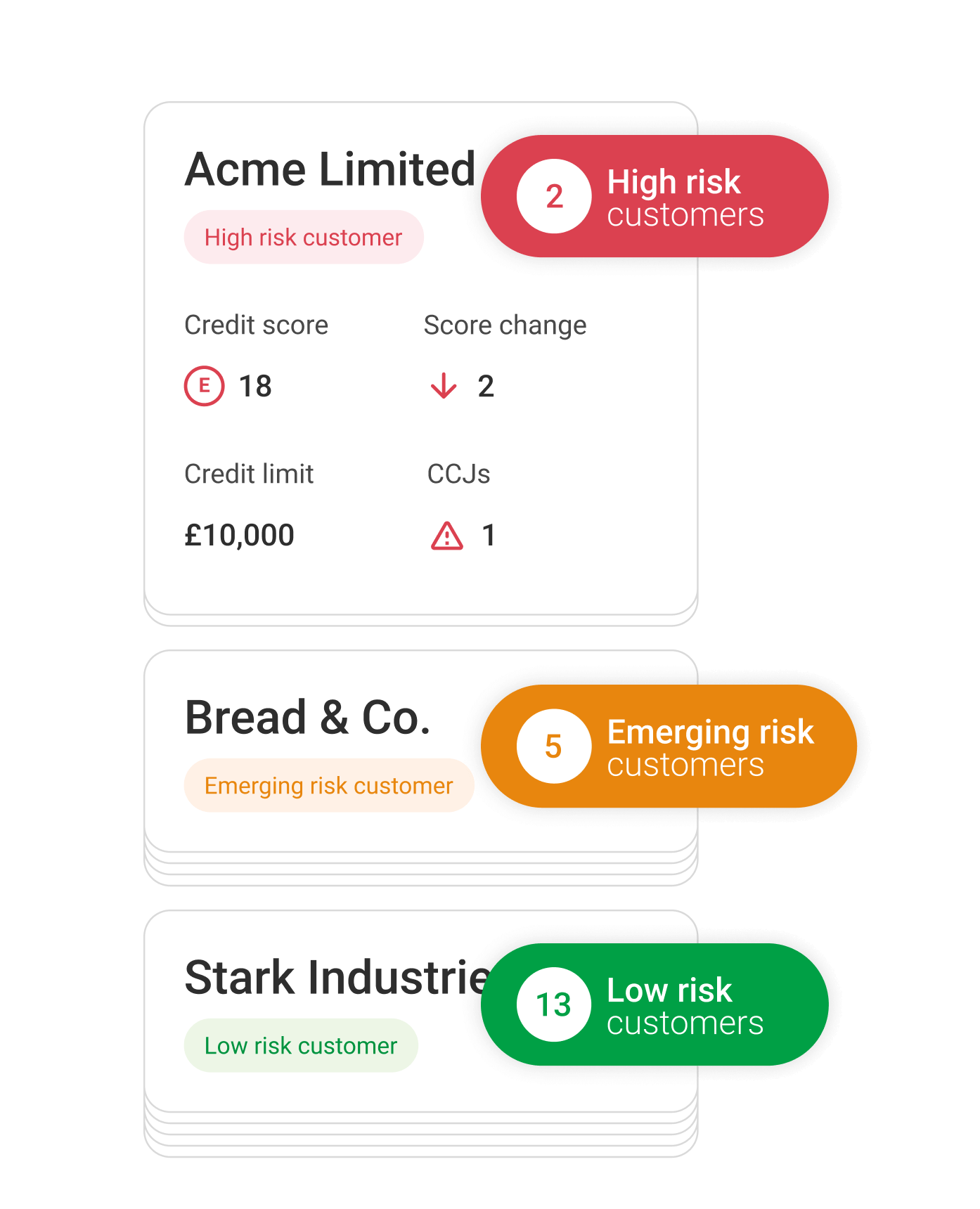

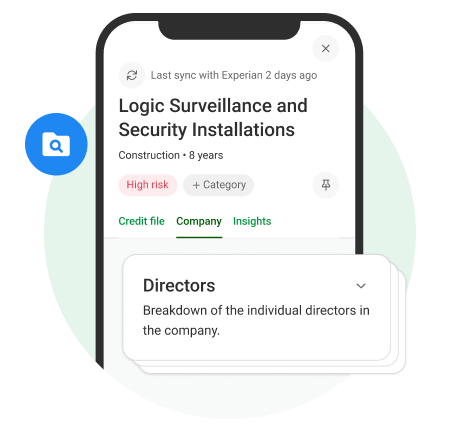

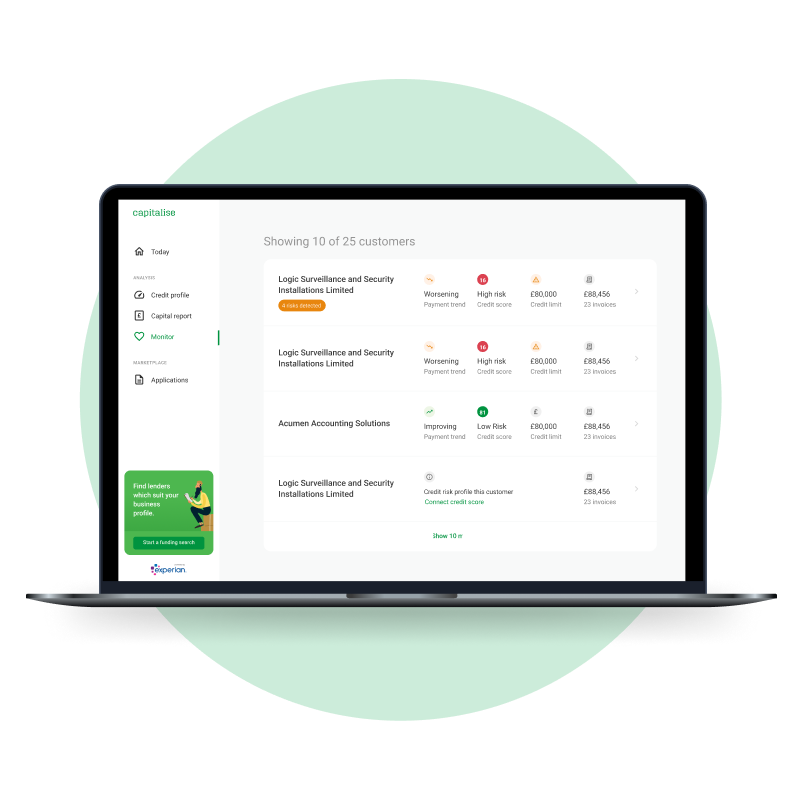

See company credit scores and the risk bracket those businesses sit in

See company credit scores and the risk bracket those businesses sit in

Spot emerging risks by monitoring any credit score changes

Spot emerging risks by monitoring any credit score changes

Know if you’re likely to get paid on time by viewing their credit score history

Know if you’re likely to get paid on time by viewing their credit score history

Check company credit history and any legal notices for your customers or suppliers

Check company credit history and any legal notices for your customers or suppliers

Spot any legal notices such as County Court Judgements against businesses to ensure they are not heading into financial trouble

Spot any legal notices such as County Court Judgements against businesses to ensure they are not heading into financial trouble

View suggested credit limits to help you make informed decisions about the credit terms you offer

View suggested credit limits to help you make informed decisions about the credit terms you offer

Know your customer or supplier’s current trading status

Know your customer or supplier’s current trading status

View their publicly-filed accounts

View their publicly-filed accounts

Check key company data like incorporation date and registered address

Check key company data like incorporation date and registered address

See when directors were appointed

See when directors were appointed

Download their company credit report to keep on file

Download their company credit report to keep on file

Archive companies you were previously monitoring credit risks

Archive companies you were previously monitoring credit risks

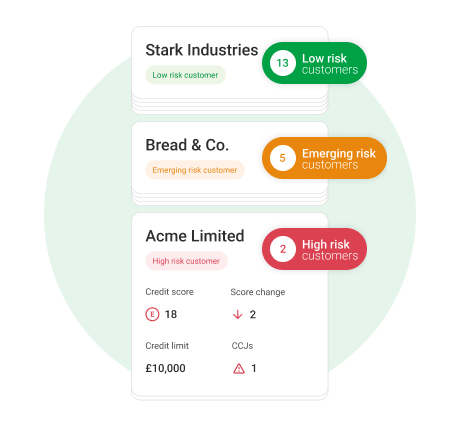

Understand the financial position of the businesses you deal with, before you start working with them.

Reduce risk to your business with regular updates on your client's payment performance and credit position, in one place.

Make sure your business is protected. Add this crucial first step to your workflow so you can make informed decisions about who you work with.

Know the credit score of the businesses you work with

Get alerts on changes to their creditworthiness

Monitor your client's payment performance

Get a business credit score consultation with a specialist

Get your business credit score professionally reviewed by Experian and see if you can boost it.

Track your business credit score, get started for free.

Get matched with the right lenders for your business with a single search.

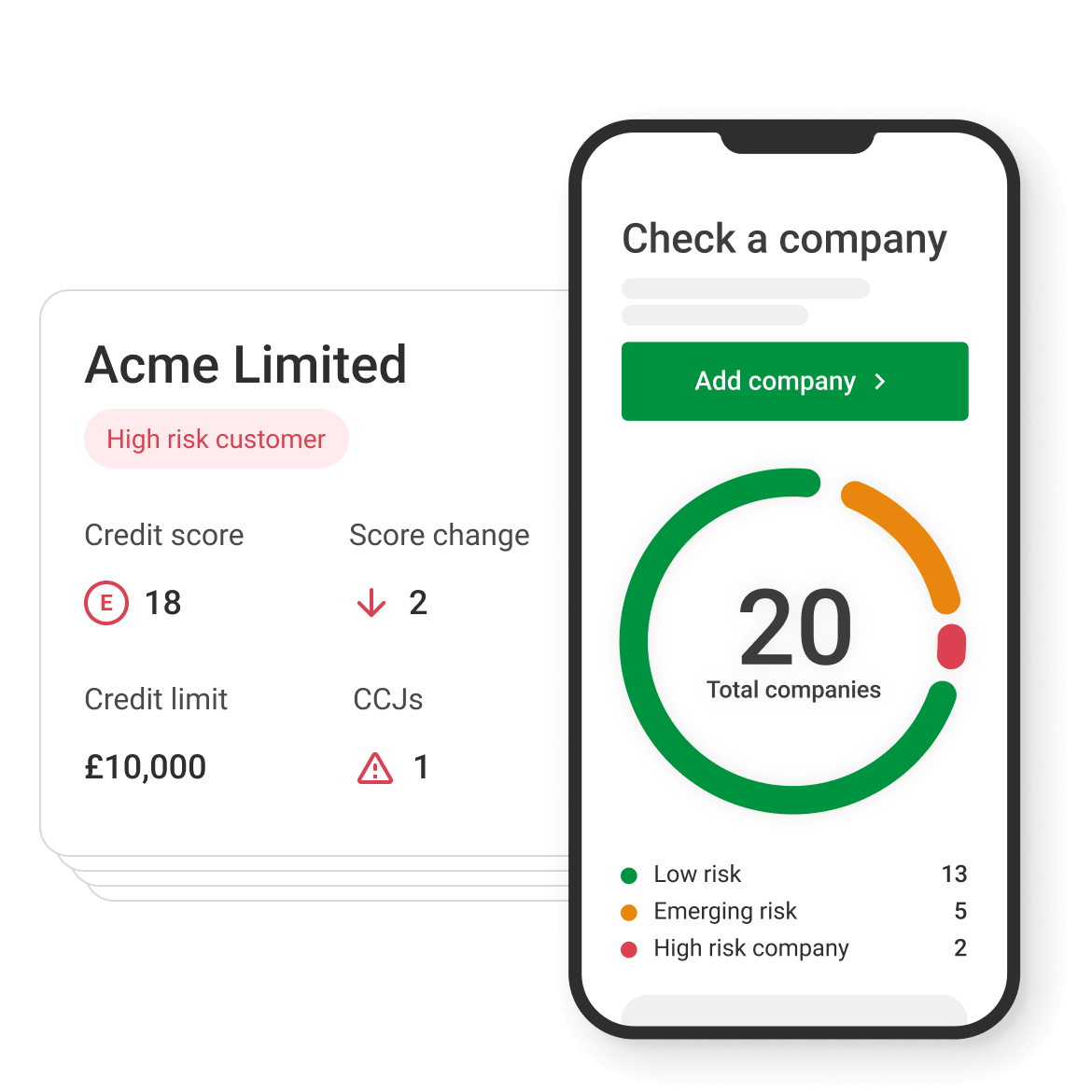

Free to sign-up and no credit card required. Check the risks of 20 companies and upgrade for full Experian reports.

Checking a company’s credit score is easy with Capitalise for Business. Simply head to the "Check a company" tab of your account, tell us which company you want to check and we’ll add that company to your list. Click on the company to view their profile or download their credit profile as a PDF. Company checks like this are anonymous.

If you have a free Capitalise for Business plan, you can check if there are credit risks present without paying a penny. By upgrading to a Pro plan, you’ll unlock the full Experian credit profiles of up to 10 customers –as well as a wide range of extra features and benefits – for a monthly subscription of just £24/month (excl VAT). For larger firms, you can acess up to 100 customer credit checks for £59/month with our Enterprise plan.

You can find information about the financial health of the companies you work with to understand whether it’s a risk to work with them. For example, if there’s a chance that they won’t be able to settle invoices. The financial health factors you’ll have access to include:

With Capitalise for Business Pro, you can check your exact business credit score any time you like just by logging into your account (as part of your detailed credit profile). You’ll also get a notification any time your credit score changes. If you have a free Capitalise for Business account, you’ll always know what range your credit score is in. We’ll also tell you whether lenders consider your score low, average or high risk and how that compares to other businesses in your industry.

When you check and monitor a company through Capitalise for Business, you’ll see:

It’s useful to know the credit scores of companies you work with because it tells you a lot about their financial health. If a customer has a high credit score, for example, their finances are in good shape. You’ll know how much credit you can comfortably offer them and feel more confident in their ability to settle invoices.

No, you don’t need permission to credit check another company. Credit checks through Capitalise for Business are anonymous and leave no trace. We partner with Experian to access credit data on your behalf. This means that the rating of the company you check won’t be affected and your business won’t be linked to the credit check.