Save time by seeing the impact of all your business bank accounts, in one place. See what lenders and banks see when judging your affordability.

See how your accounts affect your credit profile.

Use smart reporting to spot late or rejected payments, inactive business bank accounts and risks to your business credit score.

Track your company borrowing

Spot risks from your accounts early

Boost business credit score

Save time and get the visibility you need by having all your account performance information in one place. Get actionable insights improving your credit profile:

Business accounts with low activity

Late payments on borrowing or credit

Turnover trends from multiple accounts

Track the days spent in your overdraft

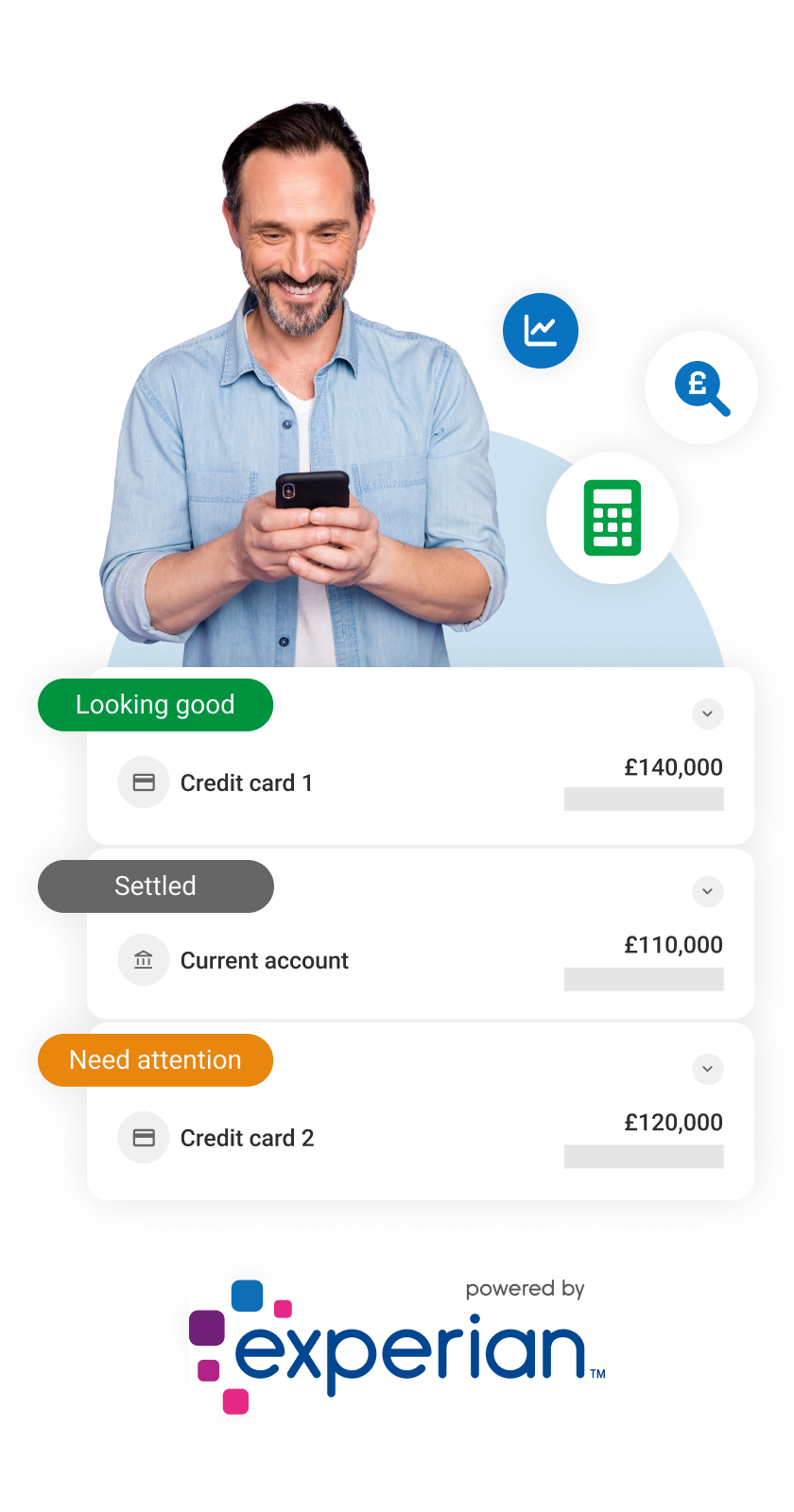

Your data powered by Experian

Cash and Capital works with Experian to give you the data you need to run your business more efficiently. The feature tracks the payment performance of all your business credit accounts using data from Experian, to identify any risks before they become an issue. All in one place.

This is the data lenders and banks use to view your businesses' affordability. We’ve got it so you can get the same visibility and gain greater control over your business finance.

Find out more in the FAQs.

Get your business credit score professionally reviewed by Experian and see if you can boost it.

Reduce risk to your business by running company credit checks on customers, suppliers and competitors

Get matched with the right lenders for your business with a single search.

CAIS and CATO are the names of two shared databases that belong to Experian, our credit partner at Capitalise. These databases hold specific kinds of information that banks and lenders look at about your business. To help them decide whether they can offer your business funding, for example.

CAIS stands for Credit Account Information Sharing. Put simply, CAIS is information about any credit commitments your business has – and how well you’re keeping up with them. For instance, are you regularly making loan repayments in full and on time? Lenders share credit account information about their customers with Experian in exchange for access to Experian’s whole CAIS database. They can look at CAIS data from as recently as 15 days ago.

CATO (Current Account Turnover) is a view of all your transactions across every bank account linked to your business. It’s a way for banks and lenders to understand your cashflow by looking at money coming in and going out of your business accounts. Similar to CAIS, banks share current account information with Experian in exchange for being able to look at Experian’s whole CATO database. This is also available up until the last 15 days.

If you have a few accounts linked to your business, you might find that you barely use one of them or that one of the accounts you no longer use is empty. Having very little activity on an account, or a zero balance, can have a negative impact on your business credit score. And having a lower credit score will impact your ability to access affordable funding. You might also have less success in negotiating credit terms with suppliers or winning new customers. You can improve your credit score by closing any accounts that you no longer need and using one main business account for all balances and activity.

Any debt your business has will be taken into account by a rating agency when they calculate your business credit score. But that doesn’t necessarily mean that all debt will have a very negative impact.

If you have a reasonable amount of debt like a modest business loan and your repayments are up to date, this is unlikely to have much of an impact on your credit score. On the other hand, having a large amount of debt split over several different sources can result in a lower score. For example, an overdraft and a credit card as well as a short-term loan. You can improve your score by consolidating your debt into a single business loan that you pay off consistently and on time.

You may also find that your credit score is lower if your business has failed to pay back debts, or paid them back late, in the past. Of course the flipside of this is that a track record of consistently repaying any good debt your business accumulates within the agreed period of time can have a positive impact on your credit score.

Failed payments could be an indication that your cashflow is under pressure. It may sound obvious but essentially there’s not enough money coming into your business to cover the amount of money that needs to go out.

A track record of failed payments on your business bank account can have a negative impact on your business credit score. With a lower score, accessing funding tends to be more difficult. Suppliers may also be less likely to offer your business credit terms. That’s why it’s so important to keep on top of your business bank accounts – so you’ll know if a payment is likely to fail and you can act quickly if one already has. Capitalise for Business makes this easy with a view of all your business bank accounts in one place as well as instant alerts on failed payments and other risks.

There are a few solutions you could consider to help avoid failed payments. If regular payments go off your business account at the same time every month, try to align these with any regular payments coming in. Make sure that you leave enough time for incoming funds to clear in your account so that they’re available when you need them to cover payments.Consider the way you invoice customers and whether this is affecting your cashflow. Agree payment terms upfront and don’t be afraid to chase payments as soon as they’re overdue. Have an organised process in place to ensure that your invoices are sent out promptly and without any errors.

Ideally you want to pay back any money your business borrows consistently and within the agreed timeframe. Doing this will boost your credit score and make it easier to access more funding if and when you need it. But of course, things don’t always go to plan and there may come a time when you pay late. For example, if one of your customers takes longer than expected to settle an invoice, you might not be able to make a loan repayment while you wait to get paid.

Fortunately, banks and lenders look at your CAIS data (how well you keep up with credit commitments) over time. That means they can see where a late payment was an isolated incident rather than a habit of regularly paying late.

Your business may be less likely to be approved for funding if you’re already having trouble paying off an existing loan, or a track record of consistently paying late. However, if you’ve run into one or two delays but are mostly and recently keeping up with your commitments, it probably won’t have much impact on your access to funding.

We’ve partnered with Experian, not only to get CAIS and CATO data about your business, but also to make that data available to you. With a complete view of all the information banks and lenders look at about your business, we can match you with the funding that you’re most likely to be approved for. When you share this view, you can see where you can make improvements to access business funding more easily and at better rates.