Opening up for business

As the economy opens up in the four step roadmap outlined by the government on the 22nd February, we can see potential turbulence for balance sheets across the UK.

Step 1: 29th March - schools open, sports facilities opening up, shops starting to restock

Step 2: 12th April - outdoor hospitality stocking up for reopening, domestic travel restarting

Step 3: 17th May - hospitality sector opening up, trading across the economy resumes

Step 4: 21st June - events restarting and trading ramps up to full capacity.

At each of these steps, expenses will precede revenues in almost all businesses so the working capital cycle for businesses is likely to tighten up on balance sheets already stressed from a year of revenue drops.

Combined with the £60bn furlough scheme likely to taper, £70bn government loan scheme finalising and tightening supplier limits Capital Advisory is going to be important to many of your clients.

As we can see it’s the retail, hospitality and events sectors which will likely need continued support through times.

Set up your portfolio, ready for April

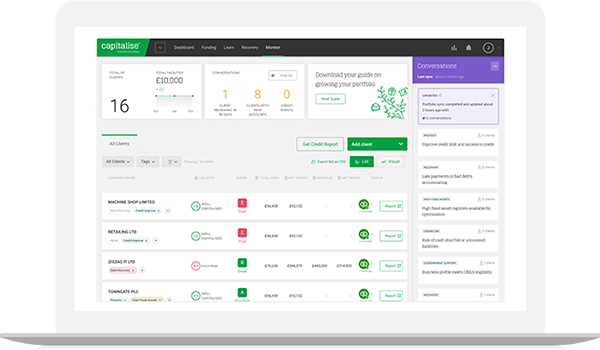

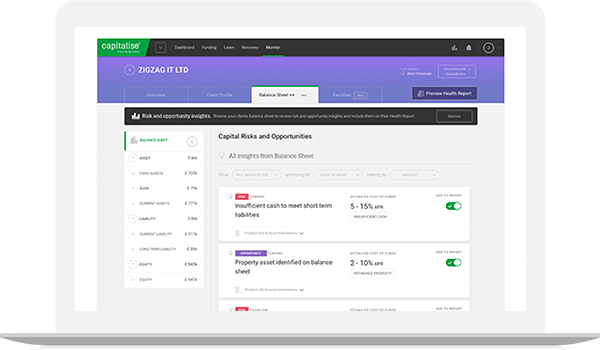

Each of our Starter, Partner and Pro plans include our client portfolio tool, Monitor. Using this you’ll be able to see your clients, their current cash position and trajectory.

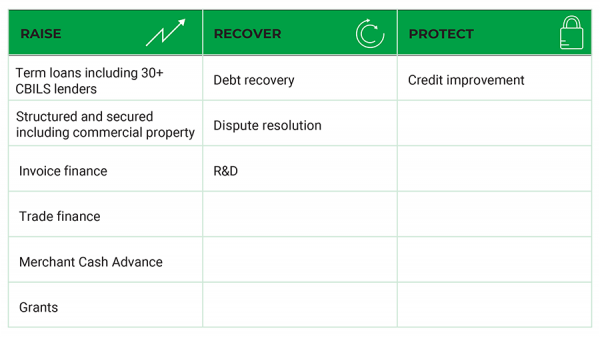

By connecting your client portfolio up by 31st March you can have access to 10 different ways to boost the capital position for your client.

These allow your firm to raise, recover and protect capital for your clients.

Seeing your client portfolio, clearly and quickly

If you like to see how to use our Capital Advisory platform to catch up on our webinar, Triaging and next best actions with CBILS/BBL repayments with iwoca.

To date Capitalise has had £750 million of approved offers through our Capital Advisory platform. The majority of this has been outside of government support so we’re getting prepared for a resumption of fully underwritten lending.

United Kingdom

United Kingdom  South Africa

South Africa