Take on advisory roles previously performed by bank managers

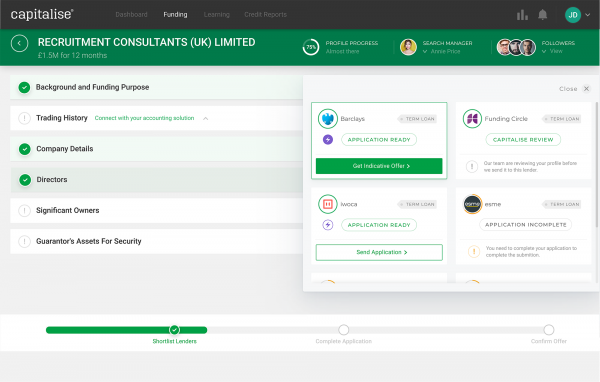

Today we announce the launch of our Instant Offers Marketplace, with Barclays and iwoca the first of our panel of lenders to go live. But what does this mean? Accountants will now be able to receive instant decisions on funding applications for their clients. A win for accountants who choose to support clients with funding. Accountants can now offer a service superior to any bank, broker, online service whilst the business owner is no longer forced to compromise on choice or speed.

Lenders and advisers alike recognise that, with an estimated 50,000 bank managers leaving the market since the 1990s, business owners are increasingly turning to you, their accountant, for support navigating the financial market. Using Open Banking APIs, our platform compares thousands of lending products, without a universal API for the B2B market, advisers had previously waited several days before being able to pass a recommendation to their client.

Instant Offers means that, once Capitalise has analysed relevant business data and assessed a company as eligible, advisers will receive an instant quote from Barclays and iwoca. In doing so, Instant Offers solves a key challenge for businesses, driven by the behaviour of business owners themselves. Faced with a cash flow issue, they spend just one hour researching providers, with 80 percent approaching only one lender. Receiving a real-time response will therefore help businesses understand their suitability for financial support and overcome challenges quickly, in a format that suits them.

United Kingdom

United Kingdom  South Africa

South Africa