Reduce Your Monthly Bills

For many businesses currently renting their premises, the spiralling costs of property rental is now becoming a key driver behind making a full purchase.

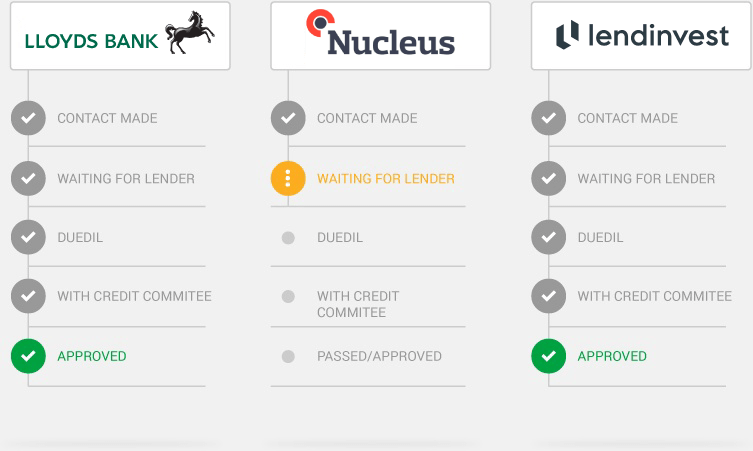

With Capitalise, you can access a range of competitive commercial mortgage rates which can help to drive down the amount your business spends each month on its premises, whilst gradually working towards full ownership.