Reduced costs and risks

Investing in new equipment using asset finance is an effective way to fund your purchases as well as reduce the risk that can come with ownership.

More and more SMEs are using asset finance to invest in business growth. Asset finance is a form of business funding that can enable a business to purchase or refinance business equipment, spreading the cost over an agreed period of time. It is effectively a loan to buy or lease equipment, which can enable you to move your business forward.

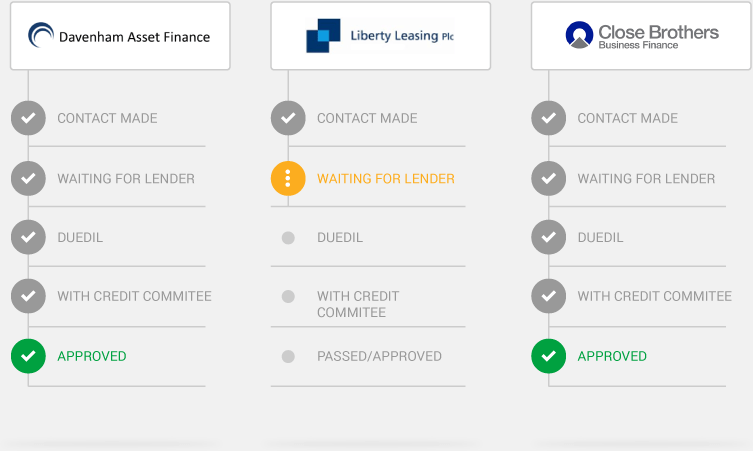

Asset finance helps businesses finance exactly what they need and has considerable tax saving benefits. Capitalise has partnered with lenders who specialise in asset finance, making it easy for you to find lenders most likely to give you an offer.

At Capitalise, we work with specialist lenders who have a proven track record supporting similar businesses within your sector.

GET THE RESOURCES YOU NEED WITHOUT TYING UP CASH FLOW

Sourcing finance can be a struggle for most businesses, especially in times of economic uncertainty. When traditional sources dry up, alternative solutions, such as asset finance, can offer a cost effective, and flexible method of purchasing business assets. Asset finance is a particularly well suited option for SMEs looking to invest in growth. Use Capitalise to find, compare and select lenders who specialise in asset finance.

Almost any asset can be financed ranging from office equipment to machinery or vehicles used for your business. The lenders we work with specialise in the following areas:

It allows you to use your business capital to expand and make profit for your business. With leasing, you pay for your new business equipment in the same way as you pay your employees. This allows you to save your usable capital and makes budgeting for new purchases easier.

It is possible to join a new lease agreement with your existing lease and determine a new fixed end period. Otherwise your existing lease can be partly settled, providing a flexible way of upgrading without rolling forward debt.

Banks will often fund equipment and machinery; however, they typically provide only short-term and long-term funding - not medium term. Many companies choose to use asset funding to protect their working capital. Cash flow is crucial to every business, so it may be wise to leave headroom for other bank facilities in the future.

The cost of renting or leasing an asset is deductible as a business expense, so this can reduce your overall tax bill. If you expect to own the asset at the end of the lease or hire purchase period, this is considered a supply of goods for VAT purposes and you will have to pay VAT on the entire value at the start of the contract. If you will not become the owner of the asset at the end of the lease or hire purchase contract, this is a supply of services for VAT purposes, so VAT will be payable periodically.

You can claim capital allowances for assets bought through hire purchase as well as assets supplied through long-term lease. You can't claim capital allowances with shorter leases (i.e., less than five years and sometimes less than seven), but the leasing company can, so you should benefit indirectly through lower rental charges. Also, because it's a trading expense, you can usually deduct the full rental costs from your taxable income.