CREATING A FUNDING TEAM IN YOUR FIRM

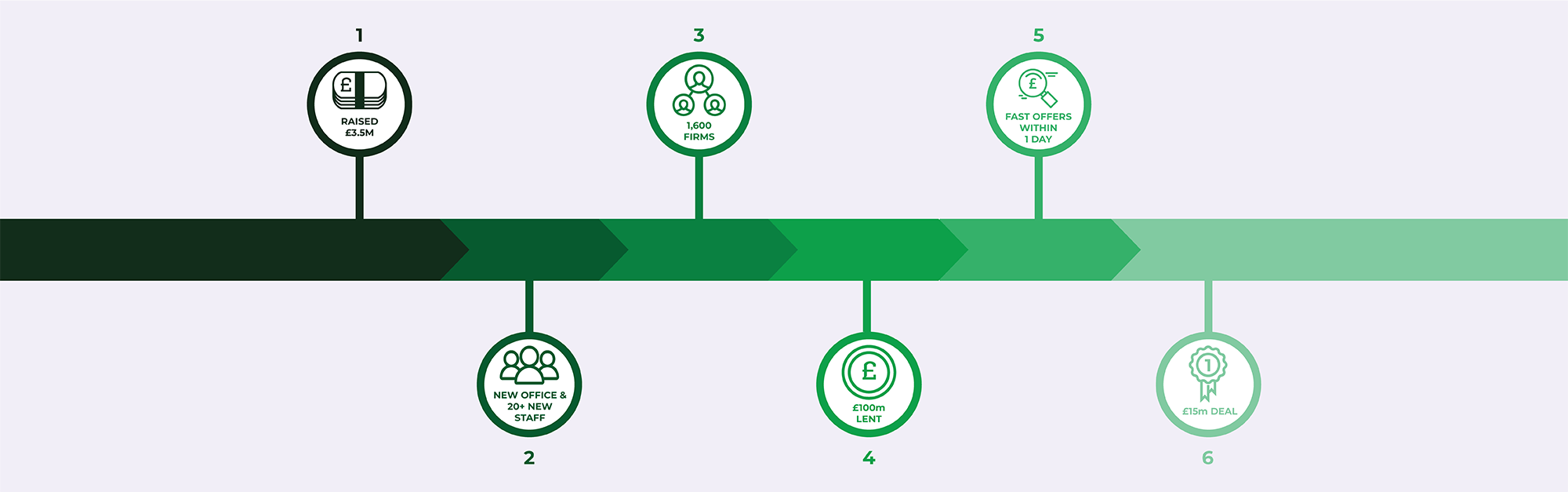

We kicked off the new year by reflecting on the organisational structure we saw work when rolling out a funding team.

By focusing on selecting a champion and a funding team, we found that firms benefited from creating process and structure around Capitalise.

We released workflows to create teams and manage permissions. Assigning responsibility and reporting were significant parts of getting funding functioning as a service line.

SHARING OUR PLAYBOOK WITH OUR CUSTOMERS

Setting up the team wasn’t the only piece of the puzzle and so we brought together our learning of setting up teams and created a Playbook.

Our playbook has 30 plays, and firms that follow these plays experience over 50% more successful outcomes and 250% more success in rolling the service out to their clients and have trained 250 accountants UK wide.

SHAREABLE BUSINESS FINANCE GUIDES

We realise that sometimes having good content to share with your clients is an important part of getting interest in your new service line.

We started with two client whitepapers, designed to be shared with your clients.

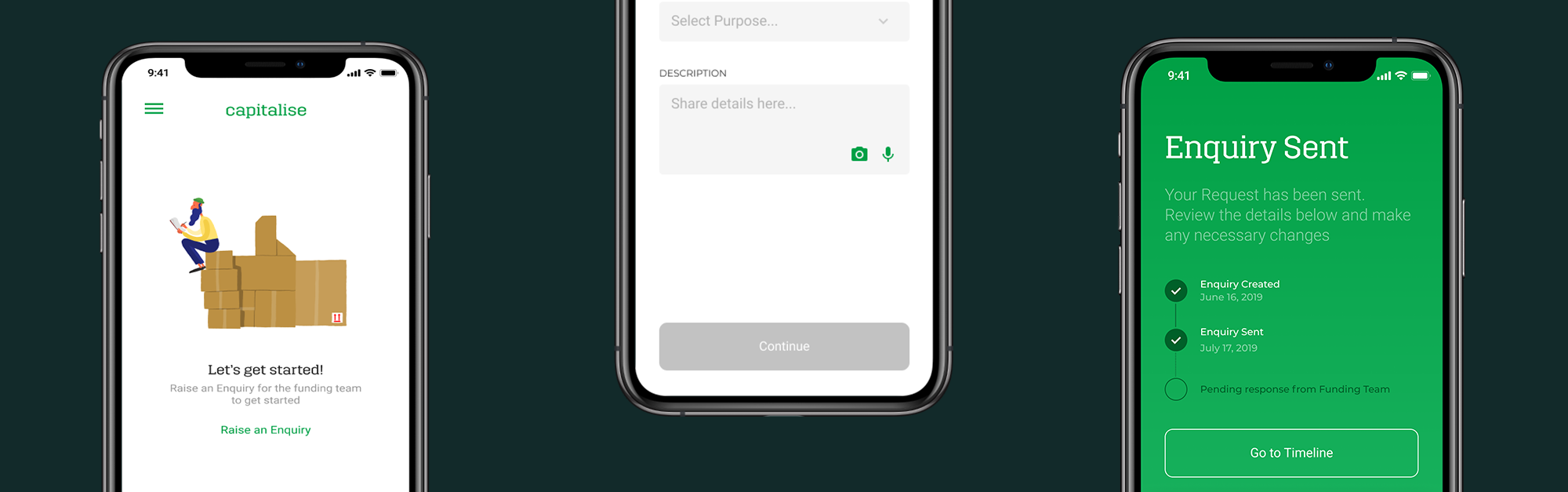

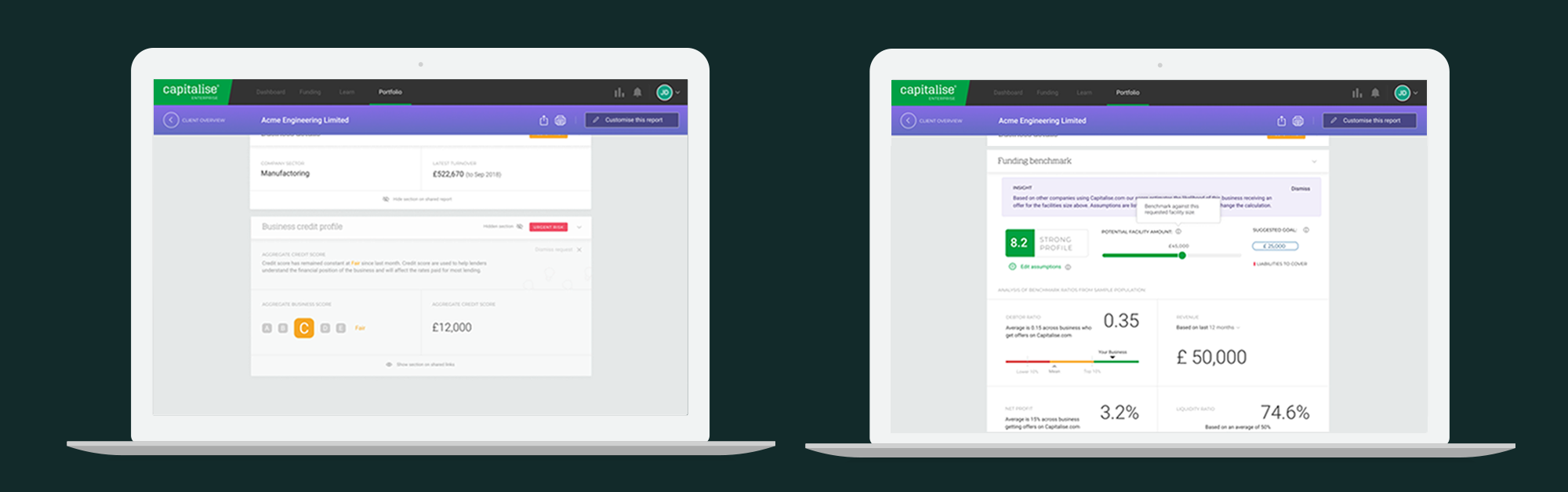

Exciting tools coming to identify clients who need your help

Building a service line can’t just be a skill; it’s also about the workflow inside your firm to take it to market. In 2019, we’ve created two tools which are both in beta. Our Capitalise.com Adviser app and Monitor, for portfolio analysis and health reports, are available to subscribed customers.