As a business owner, there may be times when unforeseen circumstances arise, leading to potential financial disputes. If this leads to a County Court Judgment (CCJ), it can feel very daunting. Here’s what you need to know about CCJs and how you can manage the impact.

What is a CCJ?

A CCJ is a legal ruling issued by a county court in the United Kingdom. It occurs when a creditor takes legal action against a debtor who has failed to repay a debt. Once a CCJ is issued, it becomes a matter of public record and can have far-reaching consequences for your business.

Who will see a CCJ registered against your business?

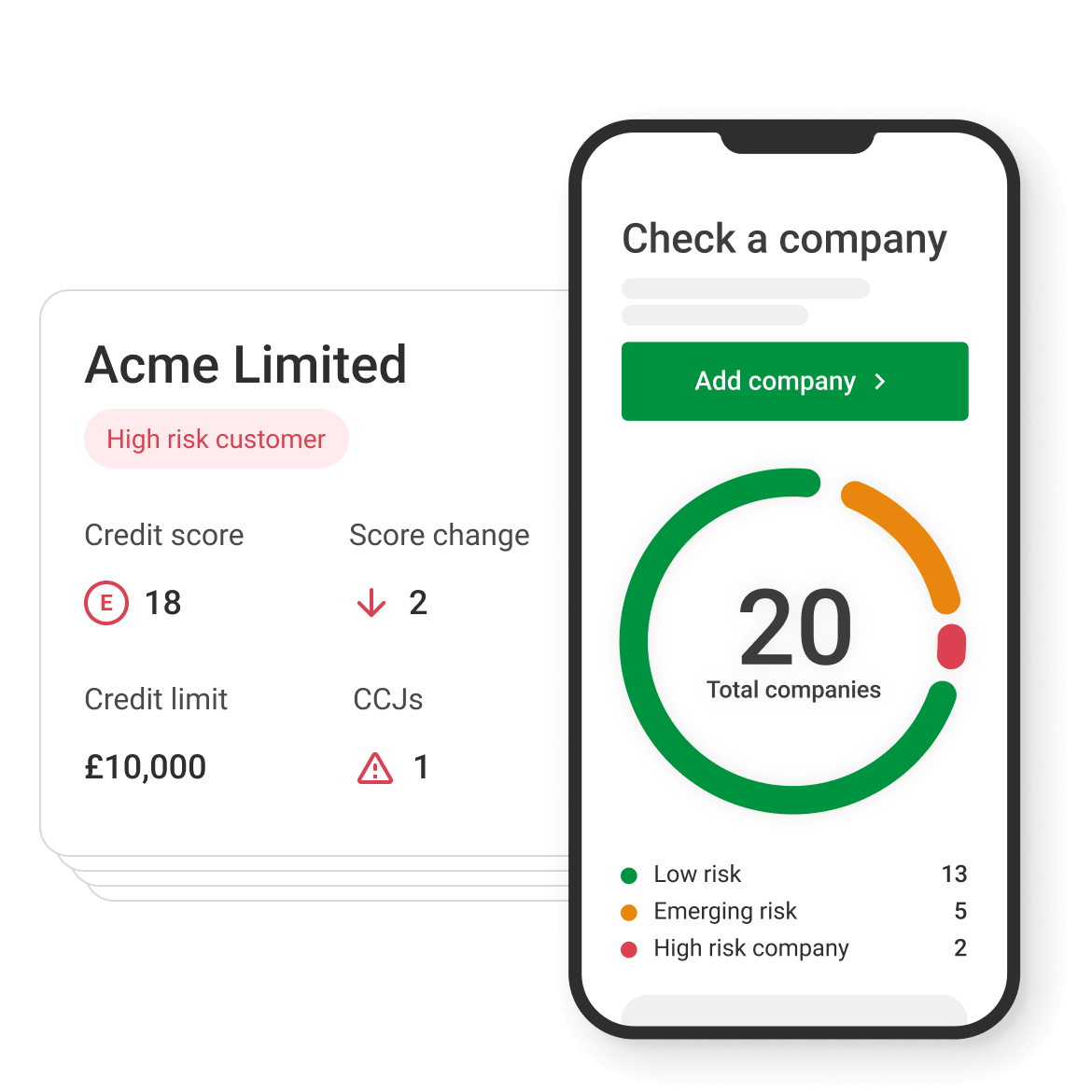

A CCJ is visible to anyone who runs a credit check on your business. This includes potential lenders, suppliers, partners, and even customers

How will a CCJ impact your business?

Your business credit score

When a CCJ is registered against your business you can expect your business credit score to fall dramatically. This legal judgement acts as a major red flag on your business’s credit profile, clearly signalling to banks, lenders, and potential partners that your business has faced serious payment difficulties. If you don't resolve the CCJ within 30 days, this mark remains on your credit report for six years.

Top Tip: Make it a routine to check your business credit score periodically. This way, you can catch any issues, like a CCJ, early and address them promptly.

Limited options for business loans

Having a CCJ against your business can make securing business loans more challenging. Banks and other lenders often view a business with a CCJ as a high-risk borrower. This perception could limit your options significantly as you might find that fewer lenders are willing to consider your loan applications. If you do get approved for a loan, you're likely to face higher interest rates and shorter repayment terms, which can result in larger monthly payments.

Supplier and trade relations

Just as lenders, suppliers and potential business partners may be cautious about entering into agreements with a company that has a CCJ. They might fear that financial instability could jeopardise your ability to uphold your obligations to them. This could affect your It ability to negotiate favourable terms, establish new partnerships, or maintain existing ones.

Reputation and customer trust

How customers see your business matters. A CCJ is public information, and if your customers find out, it could make them question your reliability and professionalism. This kind of reputational damage could in the worst case lead to a decline in customer trust and, ultimately, sales.

Can you still get a business loan with a CCJ?

While a CCJ complicates financing, securing a loan isn’t impossible. Lenders might consider secured finance options where high-value assets can offset the risk. Demonstrating that the CCJ has been settled (i.e., marked as "satisfied") can also help in securing financing, albeit possibly at higher interest rates.

How long will the CCJ impact your business credit score for?

A CCJ will impact your business credit score for six years if left unresolved. However, paying the debt in full and ensuring the CCJ is marked as "satisfied" can mitigate some negative effects.

How to navigate the CCJ process

Here are some steps you can take if your business has a CCJ:

Respond promptly

If you receive a CCJ, respond quickly and engage in the legal process. Ignoring or delaying can worsen the situation. Seek legal advice if necessary to understand your rights and options.

Payment options

Address the CCJ by paying the debt in full, negotiating a settlement, or setting up a repayment plan. Engaging with the creditor demonstrates your commitment to resolving the issue.

CCJ satisfaction

Once you have paid the debt, ensure the CCJ is marked as "satisfied" in public records. This shows potential lenders, suppliers, and partners that you have met your obligations.

You can check your business credit profile to confirm the CCJ has been satisfied.

Tips to rebuild after a CCJ

Here are some tips to help you rebuild your credit profile and reputation after a CCJ to try and mitigate the risks:

1. Improve your credit history

Focus on building your business credit score over time by consistently paying bills on time, reducing debts, and managing cash flow effectively.

2. Maintain transparent communication

Be open with your suppliers, partners, and customers about your efforts to resolve the CCJ and your strategies to avoid future issues.

3. Prove your reliability

Showcase your business’s dependability by consistently delivering quality products or services, meeting deadlines, and honouring agreements.

While a CCJ can have significant implications for your business, it does not mean the end of the road. By understanding the impact and taking proactive measures to rebuild your business's reputation and financial stability, you can mitigate the effects.

United Kingdom

United Kingdom  South Africa

South Africa