Our Get Fit For Business report found that 31% of business leaders want to learn how to improve their credit in 2022. But why is boosting your business credit score so important?

Your credit score is a rating of your creditworthiness as a business. A low credit score can have a profound impact on the perceived fitness of your business. But a high credit score makes it easier to access trade credit, agree contracts with new suppliers and partner with lenders etc.

So, what elements could be dragging your credit score down?

What makes a good credit score?

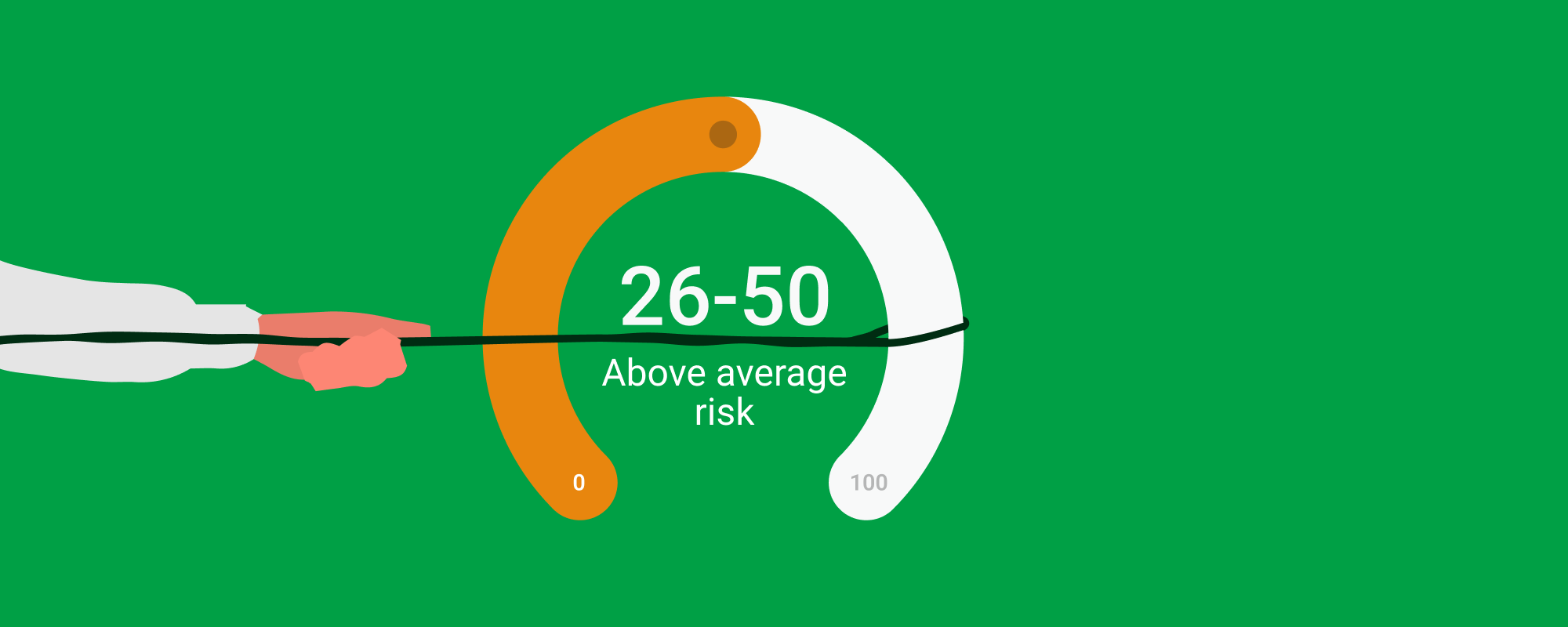

Checking your current business credit score is a good starting point. There’s no absolute cut-off for what makes a ‘good’ credit score. But, generally speaking, any score below 50 on the Commercial Delphi scale is high risk. And anything from 80 upwards is low risk. The lower your risk, the greater the stability of your financial position. That’s good news when approaching investors, working with new suppliers or planning your growth.

So, if your current business credit score is 50 or below, what could be causing this negative financial impact? And what can you do to reverse your fortunes?

Key elements that adversely affect your credit score

If you know the cause of your high risk-rating, you can start doing something to improve it. Let’s take a look at the common areas that can hold back your business credit score.

Common causes can include:

-

Missed or late payments against loans/credit cards – missing scheduled payments when repaying existing loans or credit doesn’t paint a rosy picture of your creditworthiness. Pay on time to improve your payment history. And make sure you have the cash in the bank to cover these payments by staying on top of your cashflow.

-

County Court Judgments and insolvency – being served with a County Court Judgement (CCJ) is a clear red flag to other businesses. Any sign of CCJs or insolvency shows that you’re high-risk when it comes to settling your bills. Remember, CCJs remain on your record for six years, so try to avoid them if at all possible.

-

Filing your accounts late – one of your core responsibilities as a limited company director is to file your statutory company accounts with Companies House. If you file late, that’s likely to mean a penalty fine and a negative impact on your credit score. Work closely with your accountant and get those accounts submitted on time, every time.

-

Having high levels of debt – a healthy balance sheet should have a strong ratio of assets (things you own, like cash) to liabilities (things you owe, like debts). When the business has a high level of debt, this can affect how other businesses view your financial stability. Try to keep debt to a manageable level and work closely with your FD and accounting advisers to manage your ongoing liabilities.

-

Making several applications for credit at one time – if you ask multiple potential lenders to credit check your business, your score will get worse. Work with Capitalise to find the best providers and products before you make an application. And create a proper budget and funding strategy prior to applying for finance.

Removing the negatives from your credit score

Credit Improvement helps you boost your overall business credit score. With a high score and low-risk rating, you set the best financial foundations for a fit and healthy business.

We partner with credit improvement specialists who can take your score from high risk to low risk in a matter of weeks. We’ll review your current credit history, financial accounts and payment background to look for the negative impacts. Then we’ll work with you to correct any errors. Improve your creditworthiness. And get your score updated with the credit agencies.

Get in touch for a chat about the benefits of Credit Improvement with Capitalise.

Call us on 020 3696 9700 or email us at support@capitalise.com

United Kingdom

United Kingdom  South Africa

South Africa