Why storytelling?

Advertisers and brand consultants have used stories for years, recognising their power to touch humans deeply and bring easy recall. Paul Smith, author of bestselling book “Lead with a story” tells us that “Whether you are trying to communicate a vision, sell an idea, or inspire commitment, storytelling is a powerful business tool that can mean the difference between mediocre results and phenomenal success”

Our brain is wired to remember stories as scientists believe that the human mind processes stories rather than logic.

As advisers to businesses, storytelling brings greater understanding to the endless data available to them which can educate and inspire clients, helping you create long lasting relationships.

How to structure the story - the peak

Just like any drama, book or film that you’ve experienced, you’ll recognise that the best stories follow a similar pattern.

If we use this same approach, we can structure our business communications in a powerful way.

We’re proud to be focused on helping thousands of advisers to raise, recover and protect their clients' capital. Download our Capital Advisory guide for more information.

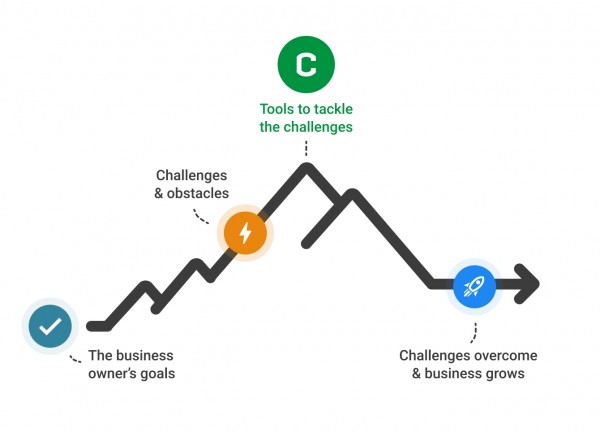

In your work with your clients, you can guide them through their own ‘story’ so it evolves in the same way.

It’s important to understand and remind them of their business and personal goals, clearly set out their current challenges and then provide them with possible solutions.

The reason this resonates with clients is because it’s a narrative they recognise:

-

The starting point which is connected to a real human need, so make sure you really dig into their personal goals so they can vocalise them and understand them in their own mind

-

The obstacles which are challenging

-

And finally showing them the intended new world at the end of the process, a happier place. This cannot be the same as the start, otherwise all that effort would be pointless. We need goals and to aspire to something better.

You can find out more about defining and understanding goals in the Capitalise Learn Mastery Course, Module 1, Lesson 4 “Defining the outcome and then the journey” which is available to all subscribers.

You can also bring in other stories, other clients’ successes which they could aspire to achieve. They will always remember these stories you tell them!

The happy ending

As we come to the end it’s important for you to structure your story and plan when speaking to clients to help build a stronger relationship. If they understand the how, what and when with the ever growing access to data then this will allow you to implement an efficient capital advisory service. Our platform can provide the data in an easy-to-digest form through our Monitor and Capital Report tools.

Read more about “Leveraging data and tailoring client advice” by downloading our guide here.

United Kingdom

United Kingdom  South Africa

South Africa