We all know the importance of keeping your business in a positive cashflow position. But with rising inflation and higher costs on the horizon, staying in a good cash position is becoming a challenge. So, what can you do to reduce the risks and ride out the current economic downturn?

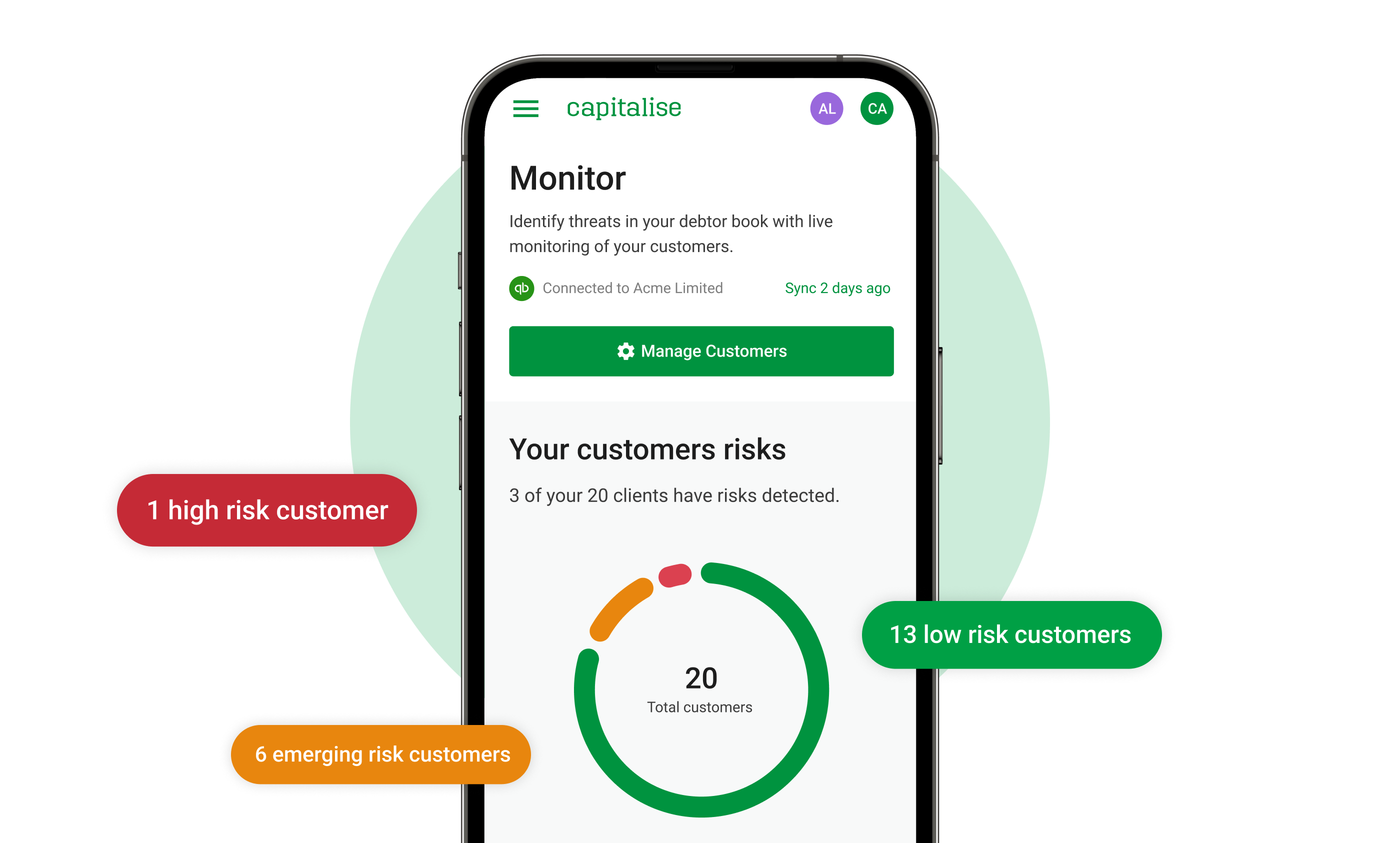

One answer is to have a better understanding of the credit and payment risks in your supply chain. With better real-time information, you can take action fast to protect your cashflow.

Knowing who you’re working with

When you have a good understanding of who you’re working with, that will ultimately improve your cashflow. That might not seem immediately obvious. But when you have a deeper understanding of your customers and suppliers, you’ll find that it’s easier to spot the slow payments and potential financial worries that are undermining your cashflow.

Nobody has a completely accurate crystal ball for forecasting the financial road that lies ahead. But the more information you have at your fingertips, the easier it gets to spot the pitfalls in your path.

For example:

-

Customers may be late with their payments – with money increasingly tight, both for consumers and businesses, there’s the ever-present threat of late payments and bad debt. If your customers simply can’t pay your bill, that’s bad news for your cash position.

-

Suppliers may be late with their deliveries and services – prices are rising and supply chain issues are affecting a number of sectors. Because of this, many businesses are finding it hard to service their existing clients. If your supplier is struggling financially, there’s a strong possibility that they won’t be able to supply your agreed orders.

-

New customers might not be 100% financially stable – winning a new customer is good news. But what if this customer is going through a cash drought and can’t actually afford to pay you? You want to be as certain as you can be that any new business is actually going to generate more revenue.

Keeping tabs on your customers and suppliers

Running a fit and healthy business will be top of your agenda as a leader. But how much time do you spend thinking about the financial health of the businesses in your supply chain?

Knowing the financial health of customers and suppliers used to be a tricky metric to gauge. Usually, you’d only have access to their statutory accounts – historic information that could well be completely out of date. But with advances in financial technology, you can now access detailed information about another company’s finances.

You can check the companies you work with to predict whether:

-

Customer invoices are likely to be paid (and on time)

-

Supplier orders are going to be fulfilled as expected

-

You can offer credit terms with confidence

United Kingdom

United Kingdom  South Africa

South Africa