Since 2016, we’ve been helping small businesses access capital and protect their balance sheets.

Starting from the realisation of the bank branches closing (”Bank Manager is Dead” in 2019) to the Weekly COVID Updates and to “Leave No Business Behind”.

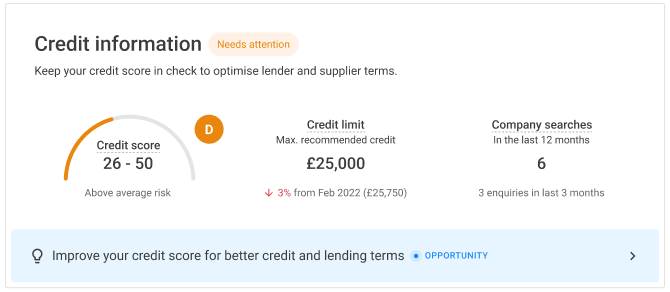

Most recently, we partnered with Experian to bring you the Credit Review Service, helping to protect credit scores.

There's been a fair share of challenges for small business, but we’ve always responded to their needs.

Being efficient while helping clients

Many accounting firms helping their clients with business challenges have found offering this support has been more difficult in the face of a virtually impossible labour market and margin pressures.

Funding remains a top challenge for small business and with higher interest rates this challenge is ever greater.

But how can your firm help your clients at this time of need without spending more time? We’ve got five pointers on how we are finding firms are doing funding advisory well.

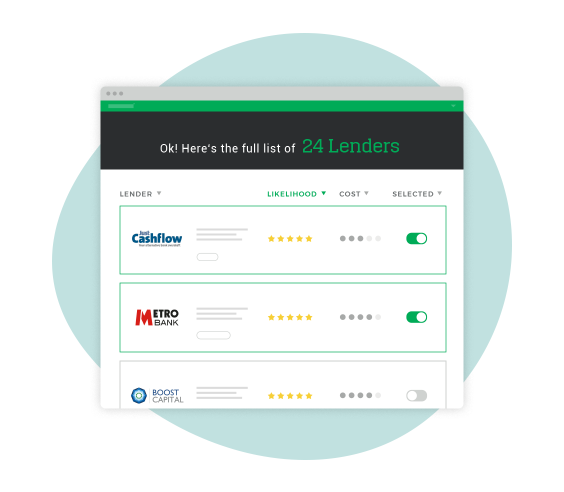

Over half of lending in 2022 was done by alternative and challenger lenders. This has led to a need for advice and discovery services for small businesses to find the right lender

For accounting firms pursuing a strategy of getting closer to clients, adding additional services and differentiating their practice, funding is likely to be a key component of charting clients to better financial health.

Five tips on doing Funding Advisory properly

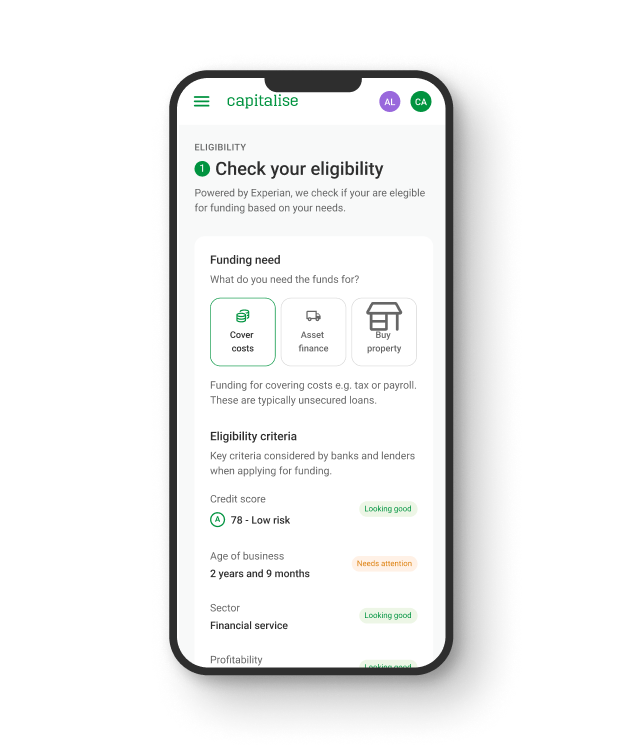

Tip 1: Partner with an end to end platform

Managing a £10m MBO, restructure or mezzanine finance requires a significant amount of consultation and support.

However for firms who either don’t have a corporate finance team or want their CF team to support smaller transactions a platform brings a huge amount of efficiency to the process.

By partnering with a platform which is end to end this bring simplicity to your firm, easy onboarding and high conversion. This means higher recovery of time costs plus team development.