A business thinking about the future will inevitably need to consider how to get there - from product development to how to “go to market” and, crucially also how much all of this will cost.

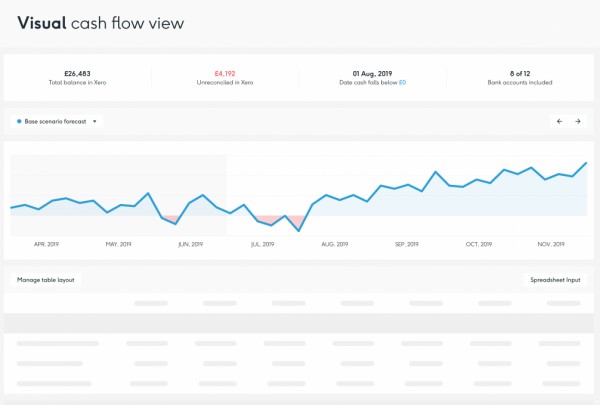

Image source: Float app

We use cookies to give you the best online experience. For more information review our cookie policy.

Explore more

insights

Explore more

insights

A business thinking about the future will inevitably need to consider how to get there - from product development to how to “go to market” and, crucially also how much all of this will cost.

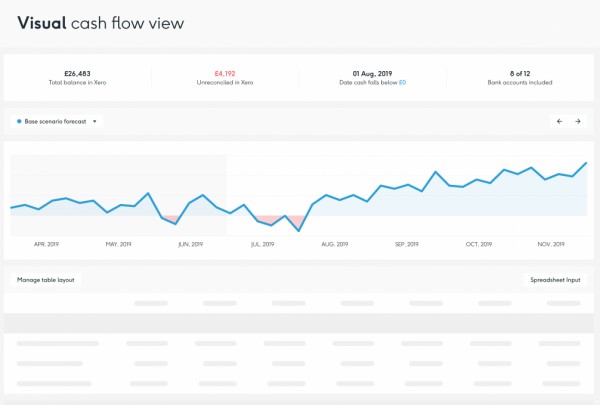

Image source: Float app

Whether they do this on the back of an envelope, in Google Sheets/Excel or in a robust cash flow building tool such as Float, Spotlight or Futrli Predict, at some point the scenario will need to meet reality.

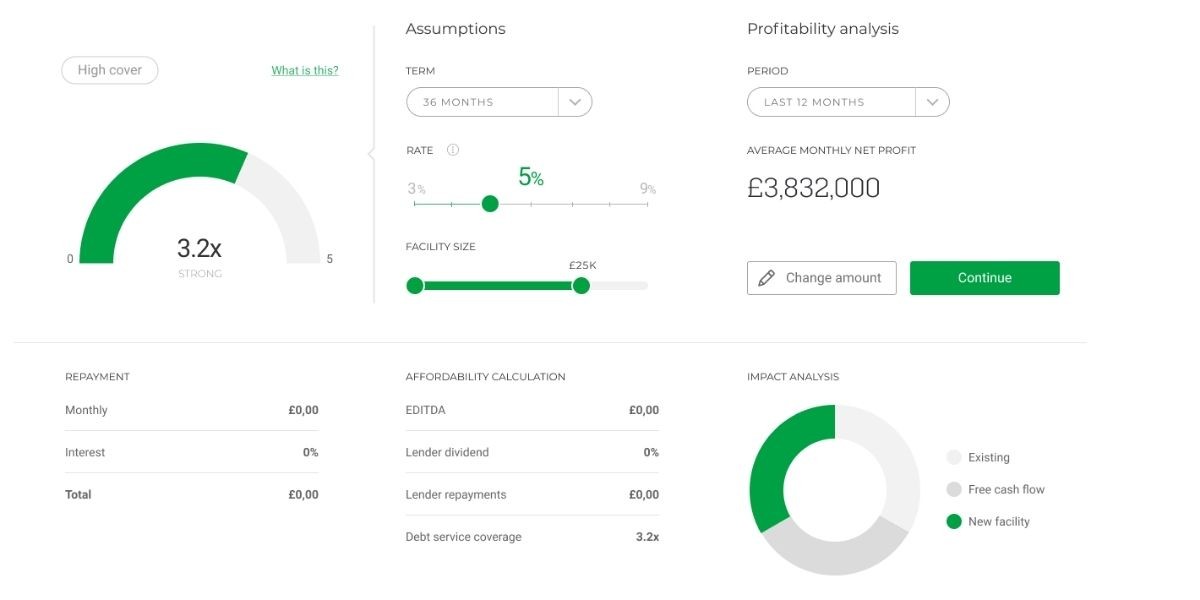

Our capital advisory platform is connected with over 100+ lenders and we’ve handled tens of thousands of offers. With that knowledge we’ve introduced our Estimated Serviceability component integrated into the funding search journey.

Whether Xero, QuickBooks or Sage cloud accounts has plenty of useful history to start to build a picture of a client’s affordability - so we’ve extended our usage of it to affordability calculations.

Steps:

Estimated Serviceability in action...

Five ways affordability can affect your client

If you'd like to find out more about capital advisory, funding, debt recovery and/or Capitalise, we're running regular web sessions, UK market briefings, motivational presentations by thought leaders outside the accounting realm and more.

Ollie is Co-founder and Chief Product Officer for Capitalise. He is a serial tech start-up product lead and has worked alongside VCs, technologists, service design experts & business minds to build market leading digital products in start-ups to multi-nationals.

Have insights about the accounting community sent straight to your inbox. Sign up to our newsletter.