Rises in inflation and interest rates have been high on the news agenda in recent weeks. UK inflation is at its highest rate for 10 years, with the UK Consumer Prices Index rising by a record 4.2% in the year to October, according to official data. That's the biggest jump in the index since November 2011 and has led to many commentators predicting a rise in interest rates to combat this rise in inflation. Traders are already pricing in three interest rate rises in 2022 according to Bloomberg, but what would a rise in interest rates mean for SME lending?

Higher interest rates encourage saving and slow down consumer spending, curbing inflation. But rising interest rates will have a significant and detrimental impact on the property market, and this could have become a significant problem for clients with property portfolios.

So, what can you do to help minimise the negative impact for affected clients? And how could refinancing be an important part of the solution when it comes to mortgage prices?

The problem of high interest rates for property owners and developers

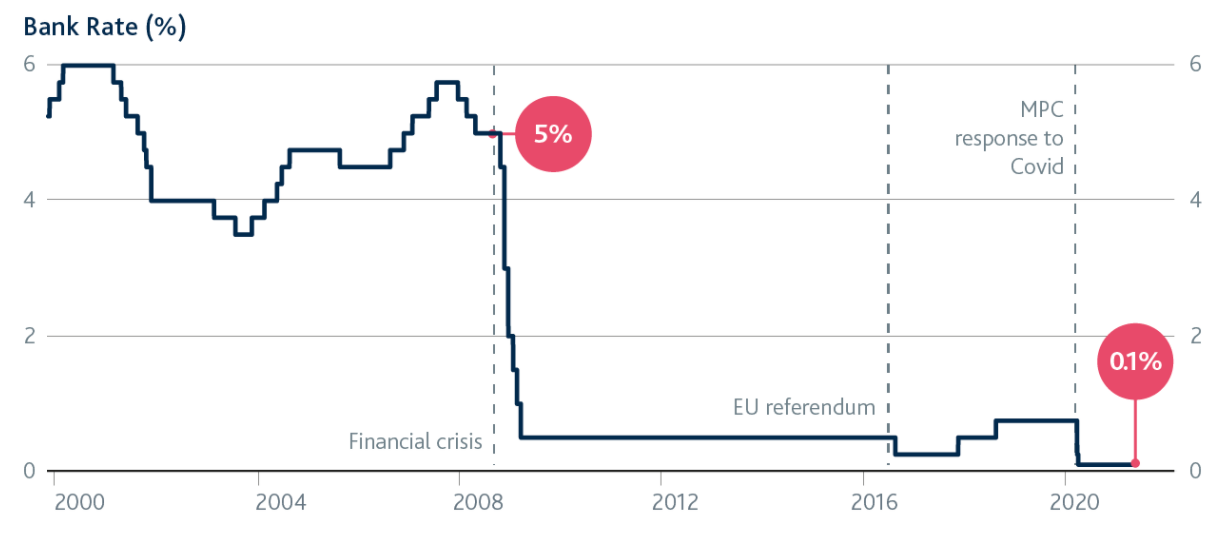

The Bank of England has maintained interest rates at the historically low figure of 0.1% for some time now, in an effort to overcome the severe financial impact of the Covid pandemic.

Chart courtesy of The Bank of England’s Monetary Policy Report - May 2021

So far, though, the bank has resisted pressure to react to the UK’s rising inflation rate. But with inflation continuing to spiral upwards, it may well be that the bank has no choice but to increase interest rates in the coming months and into 2022.

If interest rates DO rise, how is this likely to affect your client’s commercial property? The impacts are complex but, on the whole, it’s a mix of negative and positive outcomes.

For example:

-

Lending for variable or new facilities will become more expensive as interest rates rise, making it more difficult to raise the required funds for large property acquisitions or commercial developments etc.

-

Mortgage costs may increase if a fixed-rate product ends, raising property costs and making it impractical and unaffordable for some businesses to maintain their current property portfolios.

-

However, on the flipside, rising interest rates could potentially result in higher yields and lower vacancy rates for existing commercial properties.

Where clients have property interests, it’s important for you to factor these interest rate increases into your planning conversations, and to look at the longer-term impacts.

Overcoming the problem of high interest rates

Where you have business clients that are also property owners, these clients are likely to see their mortgage costs rising. If these costs become prohibitive, this could begin to cause serious cash-flow issues. So it’s important to think about potential solutions to the problem.

Options may include:

-

Refinancing the property – renegotiating the existing finance relationship is a good starting point. By searching for facilities that cut down the main mortgage costs, it may be possible to make the property a more affordable and profitable asset for the business.

-

Borrowing extra cash – if refinancing isn’t an option, taking out external finance to cover the additional mortgage costs may be an option. Any lending could potentially be secured against the existing property assets, if security is required. Of course, the business needs to be able to withstand these extra costs and ensure that their use of the property is maximised to bring greater profits.

-

Selling the property and cutting their losses – in a worst case scenario, where refinancing and additional funding are not options, the answer may be to sell the property and to find alternative premises, either at a lower cost or rented.

Helping your offer the best possible property finance options

Property finance is one of our key offerings at Capitalise, so we’ve been watching the dialogue around interest rates with interest. While we can’t change the prevailing economic conditions, we can make it easier for you to offer help to your property owning clients.

Key benefits we can offer include:

-

Monitor: the easy way to check for property finance red flags – Monitor is our client intelligence software tool. Using the real-time dashboard in Monitor, you can quickly identify which clients are likely to be most affected by interest rate increases, and what their underlying financial health may be at present. Monitor can search for clients with property on the balance sheet and show you which businesses have facilities with particular lenders. Based on this up-to-date client information, you can then get ahead of the crowd when it comes to starting conversations and finding resolutions.

-

Access to property finance lenders and specialists – we have a network of 100+ different lenders in the Capitalise Marketplace, including a number of specialist property finance providers. With access to such a large network, locating the most appropriate mortgages and financial products is easier to do. And with simple, straightforward access to finance, your clients have more options.

-

Our Secured & Structured Finance team to help negotiate the best rates – our team have years of hands-on experience with the property finance market and can help you and your clients secure the best possible deals, with the least amount of hassle. We work closely with you to complete the finance applications and act as the main point of contact between your client and their chosen lender or lenders, in the case of a syndication.

Talk to us about upping your property finance game in 2022

With rising inflation and inflation rates likely to create a host of challenges in 2022, there’s an excellent opportunity here to become your clients’ property finance saviour. We can help you expand your property finance capabilities, and provide the true value-add advice that your clients expect from their trusted adviser in difficult times.

Book in a chat with our Secured & Structured Finance team to find out the options available to you, and how we can help you expand the property finance side of your services.

Email us: alice.garvey@capitalise.com

United Kingdom

United Kingdom  South Africa

South Africa