Since the FRC's Revised Ethical Standard was published in late 2019, auditors have been required to become more conscious of the non-audit services which they can offer their clients and how to charge for them.

The overarching principles of integrity, objectivity and independence prevent an audit firm from offering management accounts services or having any influence where it may be perceived that they are supporting directors with management decisions. There are further specific requirements for those audits of public interest assurance engagements (or PIEs) of which the definition has become broader.

Larger regional or medium sized accountancy firms may have a small number of PIE audits, but the majority of audits will not be. For these non-PIE clients, differentiating your offering as an auditor is becoming more difficult, especially as the price at which an audit can be carried out means fees are inevitably increasing.

In this blog, we’ll walk you through how you can offer new services to support your audit work, whilst remaining within the regulations.

Planning your audit work

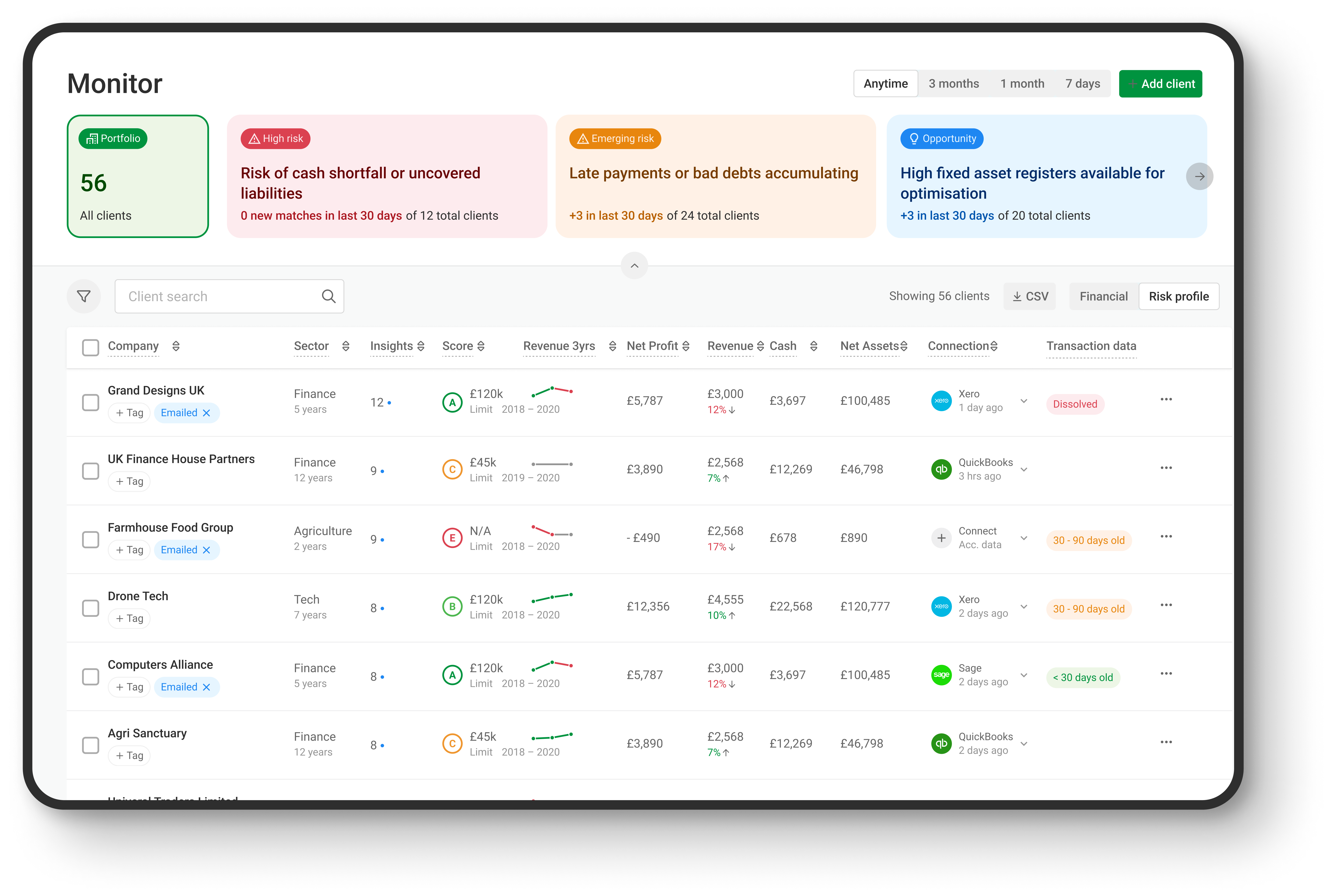

Capitalise for Accountants includes access to our award-winning technology and the Monitor dashboard which includes public data from Companies House and Experian.

Access to this information allows you to:

- View an historical overview of the business including the high level revenue, profitability and balance sheet data, especially useful for a new client to the firm

- Review your clients’ credit rating and recent payment performance trend to consider any going concern risks

- Check for any Monitor insights around liquidity such as ‘Insufficient cash to meet short term liabilities’ which may also raise going concern issues

If the business has a Capitalise for Business subscription, there is the option to use this tool to view the credit scores of the customers they are tracking and identify any potential bad debt risks.