Expanding a business can be difficult and often requires careful planning, strategic investments, and adequate financing.

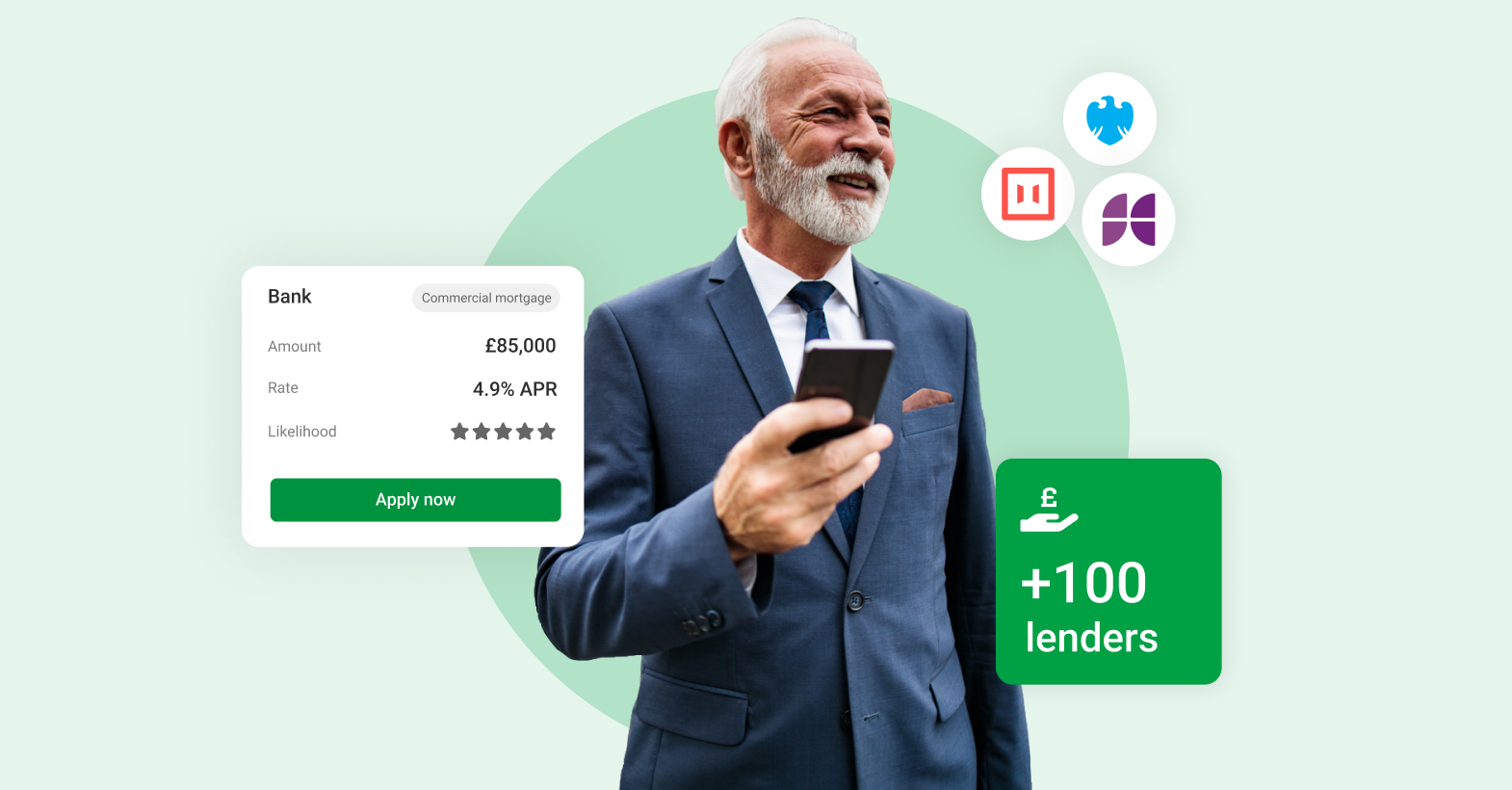

One way to fund business expansion is through a commercial mortgage. A commercial mortgage provides businesses with the necessary capital to acquire or develop commercial properties, helping them to grow, increase revenue, and achieve long-term success.

See how a commercial mortgage can be a game-changer for your business expansion goals.

Access to Capital

A commercial mortgage can help your business expand as it provides you with access to capital. Whether you need funds to purchase a new property, or expand an existing one, a commercial mortgage offers the financial resources. Unlike short-term business loans, commercial mortgages typically have longer repayment terms, allowing businesses to repay the loan over an extended period, easing the burden on your cashflow.

Property Acquisition

Commercial mortgages can be used by a business to acquire new properties. This could be an office space, a warehouse, or industrial facility. Whichever property you’re looking to purchase, a commercial mortgage allows you to add to your property portfolio. By investing in commercial property, you can build equity over time and benefit from the property's appreciation, strengthening your business’ financial position.

Construction and Development

If your expansion plans involve constructing or developing a new property, a commercial mortgage can help cover the costs of land acquisition, construction, permits, and other expenses. This enables your businesses to pursue ambitious projects that can help grow your business.

New business revenue

Expanding your business with a commercial mortgage can create additional revenue streams through rental payments from tenants and lease agreements. Owning the property can also provide opportunities for cost savings, such as avoiding rising rental costs.

Increased business turnover

A commercial mortgage can grow your business’ turnover by providing you with the resources needed to expand your physical footprint, attract more customers, and offer additional products or services.

With the strategic use of a commercial mortgage, you can expand your business and take it to new heights of success.

See what you could be eligible for, compare commercial mortgage lenders today.

United Kingdom

United Kingdom  South Africa

South Africa