Commercial mortgages offer a way for a business to access capital to purchase or refinance retail properties.

Whether you’re considering purchasing your own convenience shop, a new cafe, or a book shop, a commercial mortgage can help you cover the costs of the purchase and invest in any renovations.

Understanding Commercial Mortgages for Retail Properties

A commercial mortgage, or business mortgage, is a loan obtained by a business to finance the purchase or refinance of a commercial property.

When it comes to retail properties, such as shopping centres or standalone stores, commercial mortgages play a vital role in providing the necessary funds for purchasing, renovating, or expanding.

How commercial mortgages for retail property could grow your business

- Commercial mortgages allow businesses to secure the funds needed to acquire or expand their retail space. By obtaining a commercial mortgage, you could seize opportunities for growth that would otherwise be out of reach.

- If you purchase your operating premises with a commercial mortgage it can save your business additional costs from increasing rental payments.

- Commercial mortgages enable retail businesses to invest in prime locations, purchase larger properties, or undertake extensive renovations. This can enhance market position and profitability.

- Unlike short-term loans, commercial mortgages for retail properties typically come with longer repayment terms, which can extend up to 20 or 30 years. This extended timeline allows for manageable monthly payments, reducing financial strain on a business.

- Retail properties have the potential to appreciate in value over time. By securing a commercial mortgage, businesses not only gain ownership of an income-generating property, but also benefit from potential equity growth. This proves opportunities for future refinancing, or leveraging the property for additional investments.

- Owning the retail property through a commercial mortgage offers businesses greater control and flexibility over operations. You could make modifications to the property as needed, customise the space to align with your brand, and potentially sublet portions of the property to generate additional revenue streams.

- As your retail business grows, you may find the need to expand or open additional locations to reach new markets. Commercial mortgages can provide the necessary funds to support these expansion plans.

Can I get a commercial mortgage without retail experience?

It is possible to get a commercial mortgage for a retail property without having prior retail experience. While experience in the retail industry can be beneficial and may help lenders assess the viability of your business, it's not always a requirement. Lenders primarily evaluate the financial aspects of your business, such as creditworthiness, cashflow, and the property's potential value. They will consider factors such as your business plan, financial projections, and collateral to determine the risk associated with the commercial mortgage.

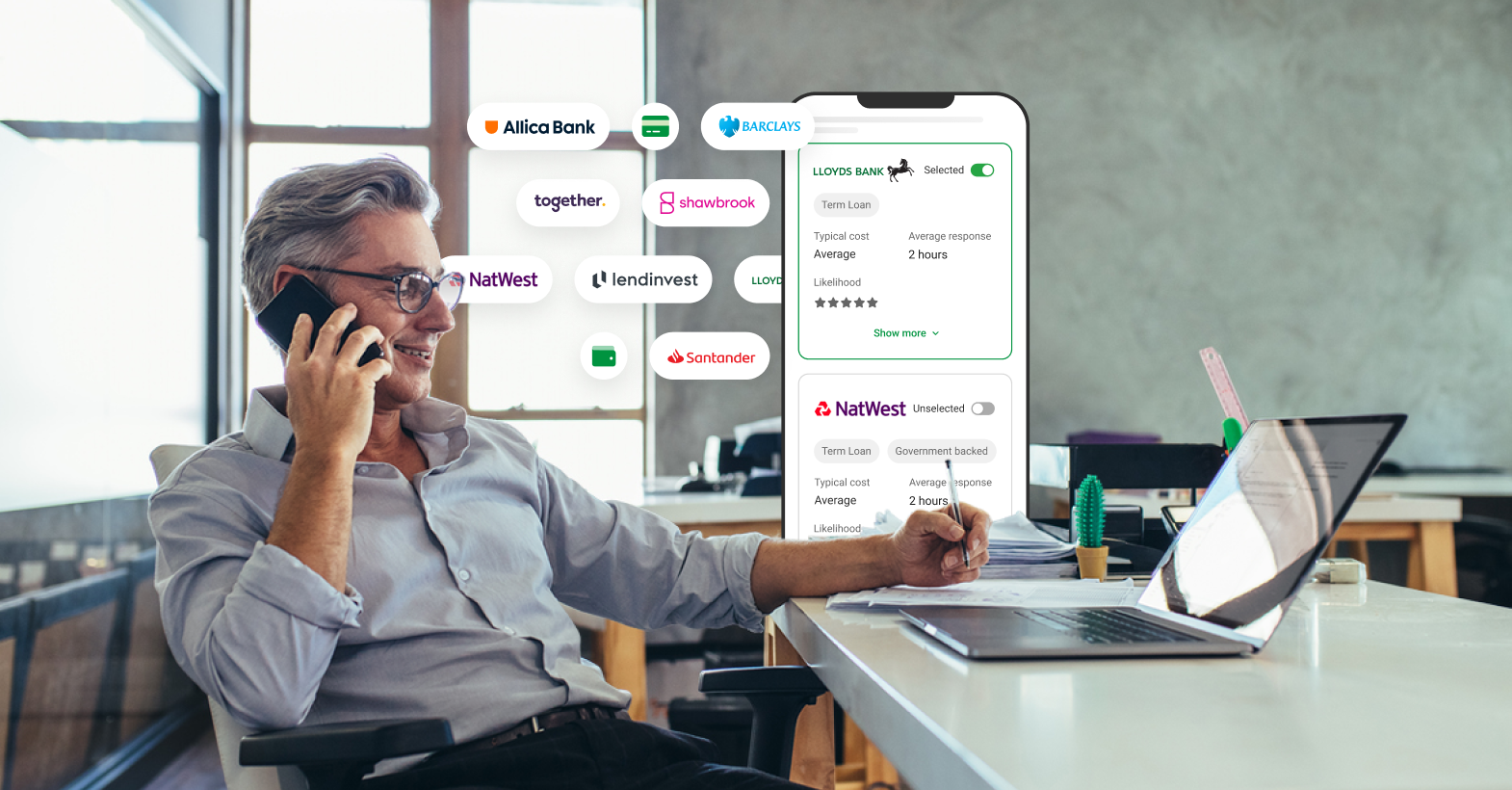

You should work with lenders who specialise in commercial mortgages and understand the unique needs of retail properties to increase your chances of securing financing.

At Capitalise, we work with a panel of lenders that specialise in commercial mortgages. You can speak with a funding specialist who will guide you through the process to find the right commercial mortgage for your retail property.

Find your commercial mortgage.

United Kingdom

United Kingdom  South Africa

South Africa